Personal Income Tax Forms and Instructions Delaware 2020

Understanding Delaware Individual Income Tax Forms

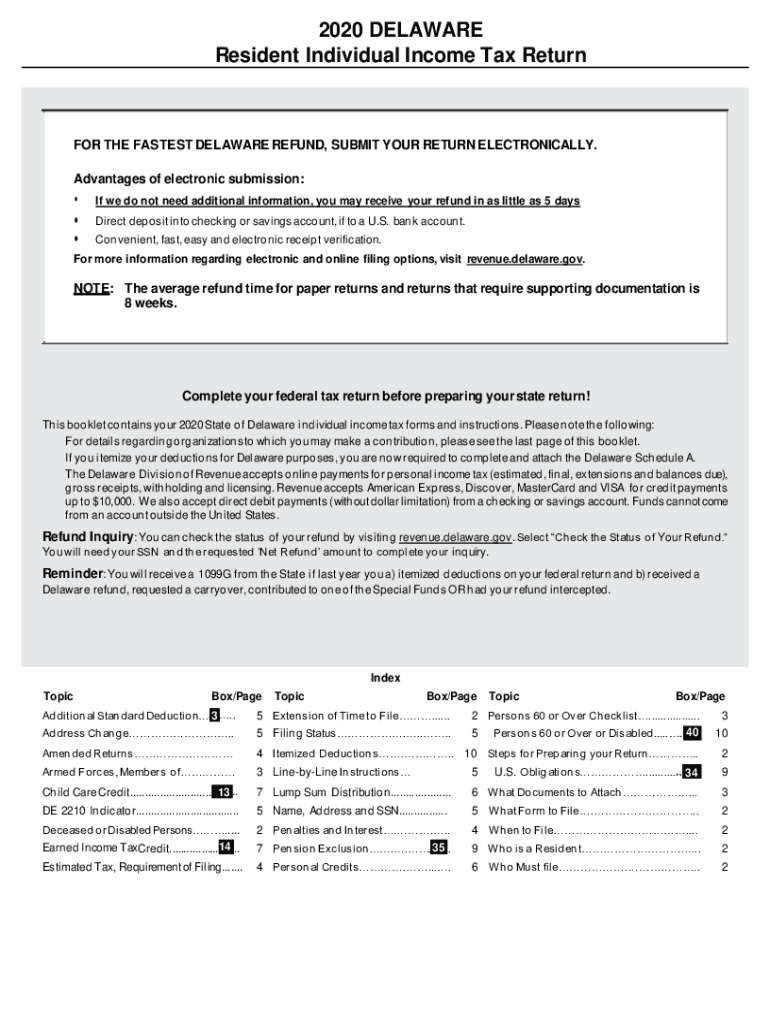

The Delaware individual income tax form, known as the Delaware Form 200, is essential for residents to report their income and calculate their tax obligations. This form is specifically designed for individuals who earn income in Delaware, including wages, salaries, and other sources of income. It is crucial for taxpayers to understand the various components of this form, including income categories, deductions, and credits available to them. Proper completion of the Delaware individual income tax return ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete the Delaware Individual Income Tax Form

Completing the Delaware Form 200 involves several steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income from all sources, followed by any applicable deductions, such as personal exemptions or standard deductions. Finally, calculate your tax liability based on the provided tax tables and include any credits you may qualify for. Review the completed form for accuracy before submission.

Required Documents for Filing Delaware Individual Income Tax

When preparing to file your Delaware individual income tax return, it is important to have the following documents on hand:

- W-2 forms from employers showing wages earned

- 1099 forms for additional income sources, such as freelance work

- Records of any other income, including interest and dividends

- Documentation for deductions, such as mortgage interest statements

- Proof of any tax credits you plan to claim

Having these documents ready will streamline the filing process and help ensure that your return is accurate.

Filing Deadlines for Delaware Individual Income Tax

Taxpayers must be aware of the filing deadlines for the Delaware individual income tax return to avoid penalties. Typically, the deadline for filing the Delaware Form 200 is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file your return early to allow time for any potential issues that may arise. Additionally, if you owe taxes, payment is due by the same deadline to avoid interest and penalties.

Legal Use of the Delaware Individual Income Tax Form

The Delaware Form 200 is legally binding when completed and submitted according to state regulations. To ensure its legality, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reliable eSignature platform can enhance the security and validity of your submission.

Who Issues the Delaware Individual Income Tax Form

The Delaware Division of Revenue is responsible for issuing the individual income tax form and overseeing tax collection in the state. This division provides resources and guidance for taxpayers, including instructions on how to complete the form and information on filing requirements. Taxpayers can access the form and related materials through the Division of Revenue's official website or other designated channels.

Quick guide on how to complete personal income tax forms and instructions delaware

Easily Prepare Personal Income Tax Forms And Instructions Delaware on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Personal Income Tax Forms And Instructions Delaware on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign Personal Income Tax Forms And Instructions Delaware effortlessly

- Find Personal Income Tax Forms And Instructions Delaware and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and hit the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Personal Income Tax Forms And Instructions Delaware and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal income tax forms and instructions delaware

Create this form in 5 minutes!

How to create an eSignature for the personal income tax forms and instructions delaware

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Delaware individual income tax?

Delaware individual income tax is a state tax levied on the income earned by residents and non-residents who work in Delaware. It varies based on income levels and is crucial for individuals to understand for accurate tax filings. Knowing how airSlate SignNow can streamline document signing can simplify the tax process.

-

How can airSlate SignNow help with Delaware individual income tax documents?

airSlate SignNow provides a user-friendly platform to manage and eSign your Delaware individual income tax documents securely. By enabling quick document processing and signature collection, it ensures you meet tax deadlines without hassle. This is especially beneficial during the busy tax season.

-

What are the pricing options for airSlate SignNow related to tax documents?

airSlate SignNow offers competitive pricing plans that accommodate various business needs, making it cost-effective for handling Delaware individual income tax documents. The plans include options for individual users and larger teams, ensuring flexibility. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers a range of features for tax-related documents, such as customizable templates, secure eSigning, and document tracking. These features ensure that your Delaware individual income tax papers are completed efficiently and securely. Cloud storage also allows easy access to your documents anytime.

-

How does airSlate SignNow ensure document security for tax purposes?

airSlate SignNow employs advanced security protocols, including encryption and secure cloud storage, to protect your Delaware individual income tax documents. This means that sensitive financial information is safeguarded throughout the signing process. Trusting airSlate SignNow for your documents ensures compliance with regulatory standards.

-

Can I integrate airSlate SignNow with accounting software for Delaware individual income tax?

Yes, airSlate SignNow integrates seamlessly with numerous accounting software platforms, enabling a streamlined workflow for processing Delaware individual income tax documents. This integration allows you to manage tax-related tasks from a single interface, enhancing efficiency and reducing errors. It's perfect for businesses looking to simplify their tax processes.

-

Is airSlate SignNow suitable for small businesses handling individual income tax?

Absolutely! airSlate SignNow is designed with small businesses in mind, providing affordable solutions for managing Delaware individual income tax documents. Its intuitive interface makes it easy for teams with limited resources to handle eSigning and document management effectively. Small businesses can benefit greatly from these features to optimize their operations.

Get more for Personal Income Tax Forms And Instructions Delaware

Find out other Personal Income Tax Forms And Instructions Delaware

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile