Delaware State Tax Filing Tax USA 2022-2026

Understanding the Delaware Individual Income Tax Form

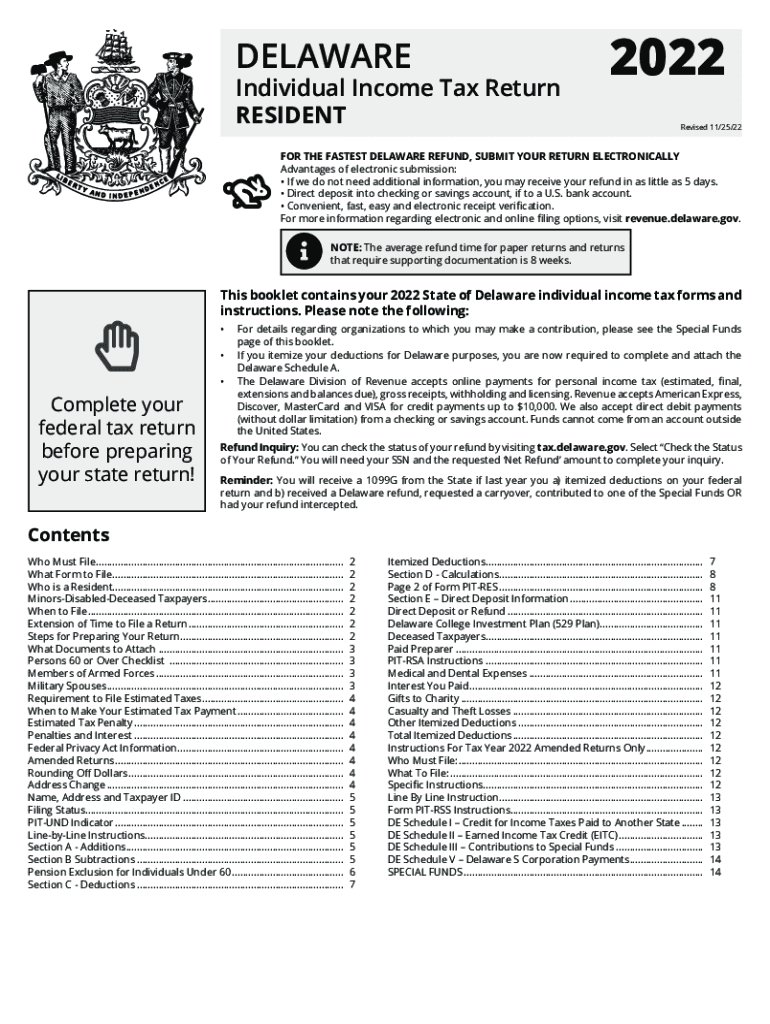

The Delaware individual income tax form, commonly referred to as Form 200, is essential for residents to report their income and calculate their tax obligations. This form is designed for individuals who earn income within the state, including wages, salaries, and other forms of compensation. It is important to accurately complete this form to ensure compliance with state tax laws and to avoid penalties.

Steps to Complete the Delaware Individual Income Tax Form

Filling out the Delaware individual income tax form involves several key steps:

- Gather Required Information: Collect all necessary documents, such as W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income, including wages, interest, and dividends.

- Calculate Deductions: Determine if you qualify for any deductions, such as standard or itemized deductions.

- Determine Tax Liability: Use the provided tax tables to calculate your tax based on your taxable income.

- Sign and Date the Form: Ensure that you sign and date the form before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Delaware individual income tax form. Typically, the deadline for submitting your Form 200 is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need more time to file, you can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

The Delaware individual income tax form can be submitted through various methods:

- Online: Residents can file their taxes electronically using approved e-filing software.

- By Mail: Completed forms can be mailed to the Delaware Division of Revenue. Ensure you use the correct address based on whether you are expecting a refund or need to make a payment.

- In-Person: Taxpayers may also submit their forms in person at designated state offices, though this option may require an appointment.

Required Documents for Filing

To successfully complete the Delaware individual income tax form, you will need several key documents:

- W-2 Forms: These forms report your annual wages and the taxes withheld.

- 1099 Forms: If you received income from freelance work or other sources, these forms are necessary.

- Receipts for Deductions: Keep records of any deductible expenses, such as medical bills or charitable contributions.

Legal Use of the Delaware Individual Income Tax Form

The Delaware individual income tax form is a legally binding document. When completed and signed, it serves as your official declaration of income and tax liability to the state. It is important to ensure that all information provided is accurate and truthful, as discrepancies can lead to audits or penalties. Utilizing a reliable electronic signature tool can enhance the legal standing of your submission, ensuring compliance with state laws.

Quick guide on how to complete delaware state tax filing free tax usa

Prepare Delaware State Tax Filing Tax USA effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, enabling you to access the correct form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Delaware State Tax Filing Tax USA on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest way to modify and eSign Delaware State Tax Filing Tax USA with ease

- Find Delaware State Tax Filing Tax USA and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which only takes a few seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Delaware State Tax Filing Tax USA while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware state tax filing free tax usa

Create this form in 5 minutes!

How to create an eSignature for the delaware state tax filing free tax usa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware individual income tax form?

The Delaware individual income tax form is a document used by residents to report their personal income to the state of Delaware. This form is essential for calculating the taxes owed and ensuring compliance with state tax regulations. Completing the Delaware individual income tax form accurately is crucial for avoiding penalties.

-

How can I access the Delaware individual income tax form?

You can easily access the Delaware individual income tax form through the official Delaware Division of Revenue website. Additionally, airSlate SignNow offers a convenient solution to electronically manage your tax documents, including eSigning the Delaware individual income tax form securely and efficiently.

-

What are the benefits of using airSlate SignNow for the Delaware individual income tax form?

Using airSlate SignNow for the Delaware individual income tax form streamlines the signing process with its user-friendly interface. This solution allows for quick eSignatures, organizes your required tax documents, and enhances security, making your tax filing experience hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Delaware individual income tax form?

Yes, there is a membership fee for using airSlate SignNow's services. However, the pricing is competitive and offers various plans that cater to individual needs, thus providing excellent value when preparing and signing the Delaware individual income tax form.

-

How does airSlate SignNow ensure the security of my Delaware individual income tax form?

airSlate SignNow takes security seriously, incorporating industry-standard encryption protocols to protect your documents, including the Delaware individual income tax form. Robust authentication methods ensure that only authorized users can access and sign your tax documents securely.

-

Can I integrate airSlate SignNow with other tax preparation software while filing my Delaware individual income tax form?

Absolutely! airSlate SignNow offers a variety of integrations with popular tax preparation software, allowing users to easily manage their Delaware individual income tax form alongside other financial documents. This integration simplifies the workflow and maximizes efficiency during the tax filing process.

-

What features does airSlate SignNow provide for managing the Delaware individual income tax form?

airSlate SignNow provides several features for managing the Delaware individual income tax form, including eSigning, templates for recurring use, and document tracking. These features enhance your ability to organize and complete your tax documents efficiently, saving you valuable time.

Get more for Delaware State Tax Filing Tax USA

- Rhode island tenant 497325121 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497325122 form

- Letter from landlord to tenant as notice to tenant to inform landlord of tenants knowledge of condition causing damage to 497325123

- Rhode island law form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497325125 form

- Letter from tenant to landlord about insufficient notice of rent increase rhode island form

- Rhode island letter increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase rhode island form

Find out other Delaware State Tax Filing Tax USA

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed