Wilmington Delaware Tax Return 2020

What is the Wilmington Delaware Tax Return

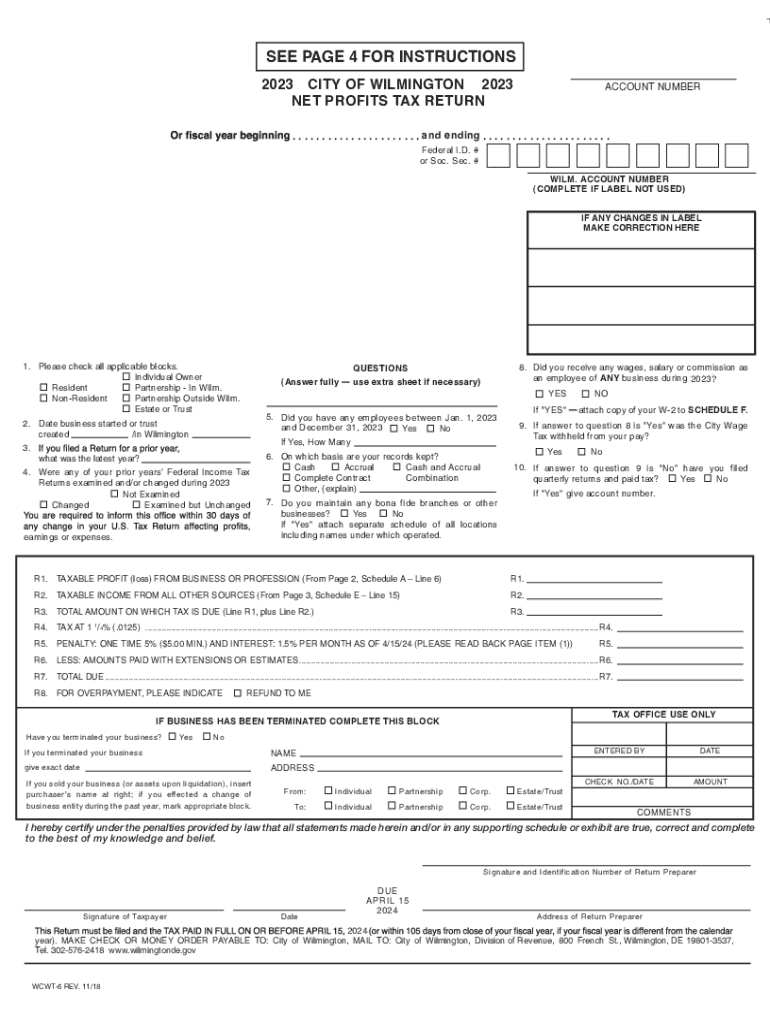

The Wilmington Delaware Tax Return, specifically the city of Wilmington WCWT 1 form, is a document required for businesses operating within the city to report their net profits. This form is essential for compliance with local tax regulations, ensuring that businesses contribute appropriately to the city's revenue. The return is part of the Wilmington net profits tax system, which applies to various business entities, including corporations and partnerships.

Steps to complete the Wilmington Delaware Tax Return

Filling out the Wilmington Delaware Tax Return involves several key steps:

- Gather necessary financial documents, including profit and loss statements, balance sheets, and prior tax returns.

- Calculate your net profits by subtracting allowable deductions from your total income.

- Complete the WCWT 1 form by entering your business information, net profits, and any applicable deductions.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form by the designated deadline, either online or via mail.

Required Documents

To accurately complete the Wilmington Delaware Tax Return, you will need several documents:

- Profit and loss statements for the reporting period.

- Balance sheets that reflect the financial position of your business.

- Previous tax returns for reference and consistency.

- Any additional documentation supporting deductions claimed on the form.

Form Submission Methods

The city of Wilmington offers multiple methods for submitting the WCWT 1 form. You can file the form online through the official city tax portal, which provides a streamlined process for electronic submissions. Alternatively, you may choose to print the form and mail it to the designated tax office. In-person submissions are also accepted during business hours at the city tax office, allowing for direct assistance if needed.

Penalties for Non-Compliance

Failing to file the Wilmington Delaware Tax Return or submitting it late can result in significant penalties. Businesses may face fines based on the amount of tax owed, along with interest on any unpaid taxes. It is crucial to adhere to filing deadlines to avoid these penalties and ensure compliance with local tax laws.

Eligibility Criteria

Eligibility to file the Wilmington Delaware Tax Return typically includes any business entity that generates net profits within the city limits. This includes sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each entity must accurately report its profits and comply with local tax regulations to maintain good standing with the city.

Quick guide on how to complete wilmington delaware tax return

Effortlessly Prepare Wilmington Delaware Tax Return on Any Gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed documents since you can easily access the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Wilmington Delaware Tax Return on any device with airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

How to Modify and Electronically Sign Wilmington Delaware Tax Return with Ease

- Obtain Wilmington Delaware Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from a device of your choice. Edit and electronically sign Wilmington Delaware Tax Return and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wilmington delaware tax return

Create this form in 5 minutes!

How to create an eSignature for the wilmington delaware tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Wilmington WCWT 1 form?

The city of Wilmington WCWT 1 form is a document required for businesses operating in Wilmington to comply with local regulations. It streamlines the submission process for businesses and helps to ensure timely responses from local authorities.

-

How can airSlate SignNow help me manage the city of Wilmington WCWT 1 form?

airSlate SignNow provides a user-friendly interface to electronically sign and submit the city of Wilmington WCWT 1 form. With our platform, you can easily track the status of your document and ensure that it is completed and filed correctly.

-

What features does airSlate SignNow offer for the city of Wilmington WCWT 1 form?

With airSlate SignNow, you can utilize features such as customizable templates, secure cloud storage, and real-time notifications for the city of Wilmington WCWT 1 form. These features help improve efficiency and reduce the risk of errors during the filing process.

-

Is airSlate SignNow cost-effective for handling the city of Wilmington WCWT 1 form?

Yes, airSlate SignNow offers competitive pricing plans designed to be cost-effective for businesses of all sizes. By choosing our solution for managing the city of Wilmington WCWT 1 form, you save time and reduce costs related to paper processing and manual signatures.

-

Can I integrate airSlate SignNow with other tools for the city of Wilmington WCWT 1 form?

Absolutely! airSlate SignNow seamlessly integrates with various platforms such as Google Drive, Dropbox, and others. This capability allows you to easily manage the city of Wilmington WCWT 1 form alongside your other business tools.

-

What are the benefits of using airSlate SignNow for legal documents like the city of Wilmington WCWT 1 form?

Using airSlate SignNow for legal documents ensures that you adhere to compliance standards required for forms like the city of Wilmington WCWT 1 form. Additionally, it provides a secure environment for document handling, signNowly reducing the risk of unauthorized access.

-

How secure is airSlate SignNow when dealing with the city of Wilmington WCWT 1 form?

Security is a priority at airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your documents, including the city of Wilmington WCWT 1 form, ensuring that they are safe during transmission and storage.

Get more for Wilmington Delaware Tax Return

- Chapter 13 plans us bankruptcy court western district form

- 60 days after this agreement is filed with the court whichever is later by notifying the creditor that the agreement is form

- You may rescind cancel this agreement at any time before the bankruptcy court enters a discharge order or within form

- I certify that the event or act described in this document has occurred or been performed

- Real estate purchase and sale agreement 38953055 form

- Washington being of sound and disposing mind and memory do hereby make publish and declare this to form

- I certify that i know or have satisfactory evidence that name of person form

- Trial proceedings washington state courts form

Find out other Wilmington Delaware Tax Return

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation