Form 8995 a Qualified Business Income Deduction 2023

Understanding the Form 8995 A Qualified Business Income Deduction

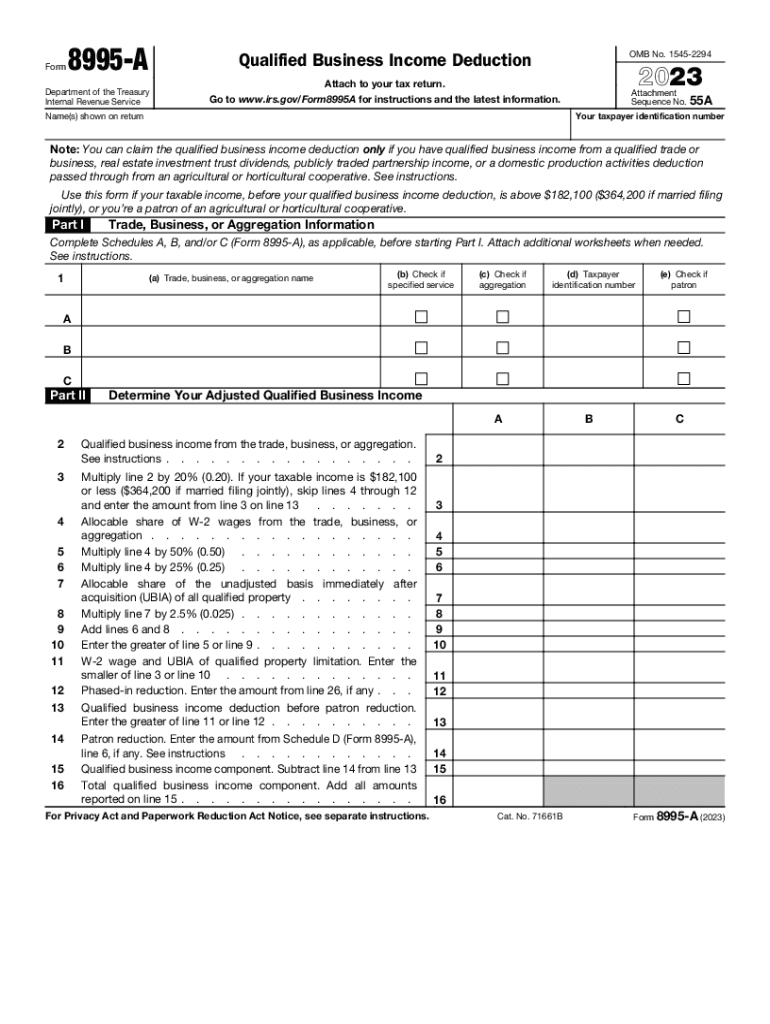

The IRS Form 8995 A is specifically designed for taxpayers who qualify for the Qualified Business Income (QBI) deduction. This deduction allows eligible business owners to deduct a portion of their income from qualified businesses, which can significantly reduce their taxable income. The form is primarily used by individuals, including sole proprietors, partnerships, and S corporations, who earn income from pass-through entities. Understanding the nuances of this form is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

Steps to Complete the Form 8995 A Qualified Business Income Deduction

Completing the Form 8995 A involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation regarding your business income and expenses. Next, accurately report your qualified business income, which includes income from eligible trades or businesses. You will also need to calculate your QBI deduction based on the applicable percentage, which is typically twenty percent of your qualified business income. Finally, review the form for any errors before submitting it with your tax return.

Eligibility Criteria for the Form 8995 A Qualified Business Income Deduction

To qualify for the QBI deduction using Form 8995 A, taxpayers must meet specific eligibility criteria. The income must be derived from a qualified trade or business, which generally excludes certain professions such as health, law, and consulting when income exceeds specific thresholds. Additionally, taxpayers must have taxable income below certain limits to fully benefit from the deduction. Understanding these criteria is crucial for determining eligibility and ensuring the correct application of the deduction.

Required Documents for Filing Form 8995 A

When preparing to file Form 8995 A, it is essential to gather all required documents to support your claims. This includes records of business income, such as profit and loss statements, and any relevant documentation of expenses that can affect your QBI calculation. Additionally, having your previous tax returns on hand can help ensure consistency and accuracy in reporting. Proper documentation is vital for substantiating your deductions in case of an audit.

IRS Guidelines for Form 8995 A

The IRS provides specific guidelines for completing and submitting Form 8995 A. These guidelines outline the necessary calculations for determining the QBI deduction, as well as instructions on how to report the form with your annual tax return. It is important to follow these guidelines closely to avoid errors that could lead to penalties or delays in processing your return. Regularly reviewing IRS updates regarding the form can also help ensure compliance with any changes in tax law.

Filing Deadlines for Form 8995 A

Form 8995 A must be filed along with your annual tax return, typically due on April fifteenth for most individual taxpayers. If you require additional time, you may file for an extension, but it is essential to ensure that the form is submitted by the extended deadline. Keeping track of these important dates is crucial for maintaining compliance and avoiding late filing penalties.

Quick guide on how to complete form 8995 a qualified business income deduction

Complete Form 8995 A Qualified Business Income Deduction seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8995 A Qualified Business Income Deduction from any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form 8995 A Qualified Business Income Deduction effortlessly

- Obtain Form 8995 A Qualified Business Income Deduction and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Form 8995 A Qualified Business Income Deduction to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8995 a qualified business income deduction

Create this form in 5 minutes!

How to create an eSignature for the form 8995 a qualified business income deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 8995 A form?

The IRS 8995 A form is used to calculate the Qualified Business Income deduction, which can signNowly reduce taxable income. Understanding this form is essential for small business owners to maximize their tax benefits effectively.

-

How can airSlate SignNow assist with IRS 8995 A submissions?

airSlate SignNow simplifies the signing and submission process for IRS 8995 A forms by providing an intuitive eSignature platform. This can help ensure that your submissions are completed quickly and securely, aiding your business in staying compliant.

-

What features does airSlate SignNow offer for handling IRS 8995 A?

With airSlate SignNow, you can easily create, send, and eSign the IRS 8995 A form with features like template creation, reminders, and automated workflows. These features streamline the document management process, making it easier for businesses to focus on their operations.

-

Is airSlate SignNow cost-effective for small businesses dealing with IRS 8995 A?

Yes, airSlate SignNow offers competitive pricing that is particularly beneficial for small businesses managing IRS 8995 A forms. The subscription plans are designed to fit various budgets while providing all essential features for efficient document management.

-

Can I integrate airSlate SignNow with other accounting software for IRS 8995 A?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting and tax software, allowing for easy management of IRS 8995 A and other essential documents. This integration helps streamline your workflow, saving you time and reducing errors.

-

What are the benefits of eSigning IRS 8995 A with airSlate SignNow?

Using airSlate SignNow to eSign your IRS 8995 A forms brings convenience, speed, and security to the process. Digital signatures are legally binding and allow for quicker turnaround times, ensuring you meet important tax deadlines.

-

How secure is airSlate SignNow for IRS 8995 A document handling?

airSlate SignNow prioritizes the security of your documents, including the IRS 8995 A forms, by implementing robust encryption and compliance standards. This commitment helps safeguard sensitive financial information from unauthorized access.

Get more for Form 8995 A Qualified Business Income Deduction

- Maine judgment form

- Small estate affidavit for estates not more than 40000 maine form

- Sworn closing statement by representative small estates maine form

- Maine landlord tenant eviction unlawful detainer forms package maine

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497310971 form

- Maine annual form

- Notices resolutions simple stock ledger and certificate maine form

- Minutes organizational meeting 497310974 form

Find out other Form 8995 A Qualified Business Income Deduction

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document