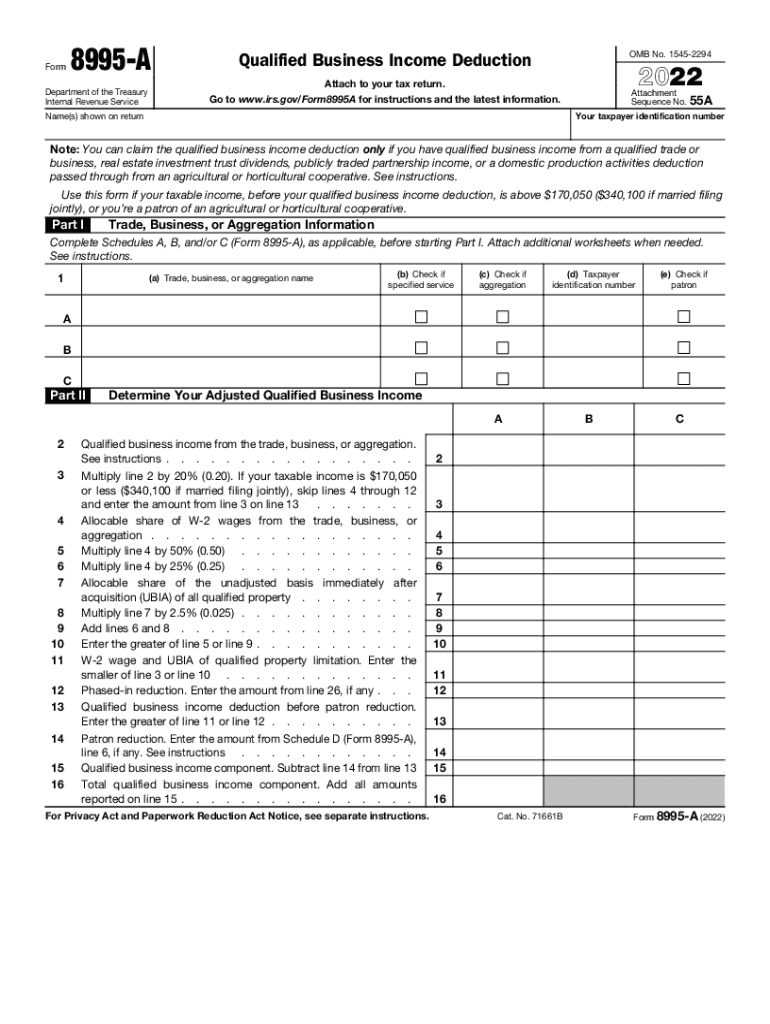

Form 8995 a Qualified Business Income Deduction 2022

What is the Form 8995 A Qualified Business Income Deduction

The IRS 8995 A form is used to claim the qualified business income deduction, which allows eligible taxpayers to deduct a portion of their qualified business income from their taxable income. This deduction is available to individuals, partnerships, S corporations, and some trusts and estates. The deduction is designed to reduce the tax burden on small businesses and self-employed individuals, thereby encouraging entrepreneurship and investment in the economy.

How to use the Form 8995 A Qualified Business Income Deduction

To use the IRS 8995 A form, taxpayers must first determine their eligibility based on their business type and income level. Once eligibility is confirmed, the form must be filled out accurately, detailing the qualified business income and any relevant deductions. It is essential to gather all necessary documentation, such as income statements and expense records, to support the figures reported on the form. After completing the form, it should be submitted with the taxpayer's annual tax return.

Steps to complete the Form 8995 A Qualified Business Income Deduction

Completing the IRS 8995 A form involves several key steps:

- Gather all relevant financial documents, including income and expense reports.

- Determine your qualified business income and any allowable deductions.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your tax return by the designated deadline.

Legal use of the Form 8995 A Qualified Business Income Deduction

The IRS 8995 A form must be used in compliance with federal tax laws. Taxpayers should ensure that they meet the eligibility criteria and accurately report their income and deductions. Misuse of the form, such as claiming deductions for ineligible income or providing false information, can result in penalties and interest on unpaid taxes. It is advisable to consult with a tax professional if there are uncertainties regarding the legal use of the form.

Eligibility Criteria

To qualify for the deduction using the IRS 8995 A form, taxpayers must meet specific eligibility criteria. Generally, the taxpayer must have qualified business income from a qualified trade or business. The deduction is subject to limitations based on the taxpayer's total taxable income. For example, higher-income individuals may face restrictions on the amount they can deduct. It is important to review the IRS guidelines to ensure compliance with these criteria.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 8995 A form align with the standard tax return deadlines. Typically, individual taxpayers must submit their tax returns by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties. Keeping track of these important dates is essential for maintaining compliance with tax regulations.

Quick guide on how to complete 2022 form 8995 a qualified business income deduction

Complete Form 8995 A Qualified Business Income Deduction easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Form 8995 A Qualified Business Income Deduction on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and electronically sign Form 8995 A Qualified Business Income Deduction effortlessly

- Locate Form 8995 A Qualified Business Income Deduction and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using specific tools that airSlate SignNow offers.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8995 A Qualified Business Income Deduction to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8995 a qualified business income deduction

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 8995 a qualified business income deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 8995 A form and who needs it?

The IRS 8995 A form is used to calculate the qualified business income deduction under Section 199A. Taxpayers with qualified business income from pass-through entities typically need this form to determine their deduction amount.

-

How can airSlate SignNow assist in handling IRS 8995 A forms?

airSlate SignNow provides a streamlined process for sending and eSigning IRS 8995 A forms. With its user-friendly interface, businesses can easily manage and store their tax documents securely while ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for IRS 8995 A forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs. By choosing the right plan, you can efficiently manage the eSigning process for IRS 8995 A forms without breaking the bank.

-

What features does airSlate SignNow offer for IRS 8995 A form management?

Key features of airSlate SignNow include customizable templates, secure storage, and report tracking. These functionalities ensure that your IRS 8995 A forms are processed efficiently and securely, enhancing your workflow.

-

Does airSlate SignNow provide integrations for preparing IRS 8995 A forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to prepare and manage IRS 8995 A forms. This integration streamlines the process and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for IRS 8995 A forms?

Using airSlate SignNow for IRS 8995 A forms offers numerous benefits, including time savings, improved accuracy, and enhanced security. This means you can focus on your business while ensuring compliance with tax regulations.

-

Can I use airSlate SignNow for bulk sending of IRS 8995 A forms?

Absolutely! airSlate SignNow allows users to send IRS 8995 A forms in bulk, making it a perfect solution for businesses with multiple clients or employees. Streamlining this process saves time and reduces administrative overhead.

Get more for Form 8995 A Qualified Business Income Deduction

- Sample written editorial for an educational program form

- Condominium form association

- With covenant form

- Warranty customer form

- Deed condo form

- Roommate agreement form

- Condominium purchase agreement form

- Buy sell or stock purchase agreement covering common stock in closely held corporation with option to fund purchase through form

Find out other Form 8995 A Qualified Business Income Deduction

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online