State Taxes Have a Minimal Impact on People's Interstate 2016

Understanding the Form Salmon Report

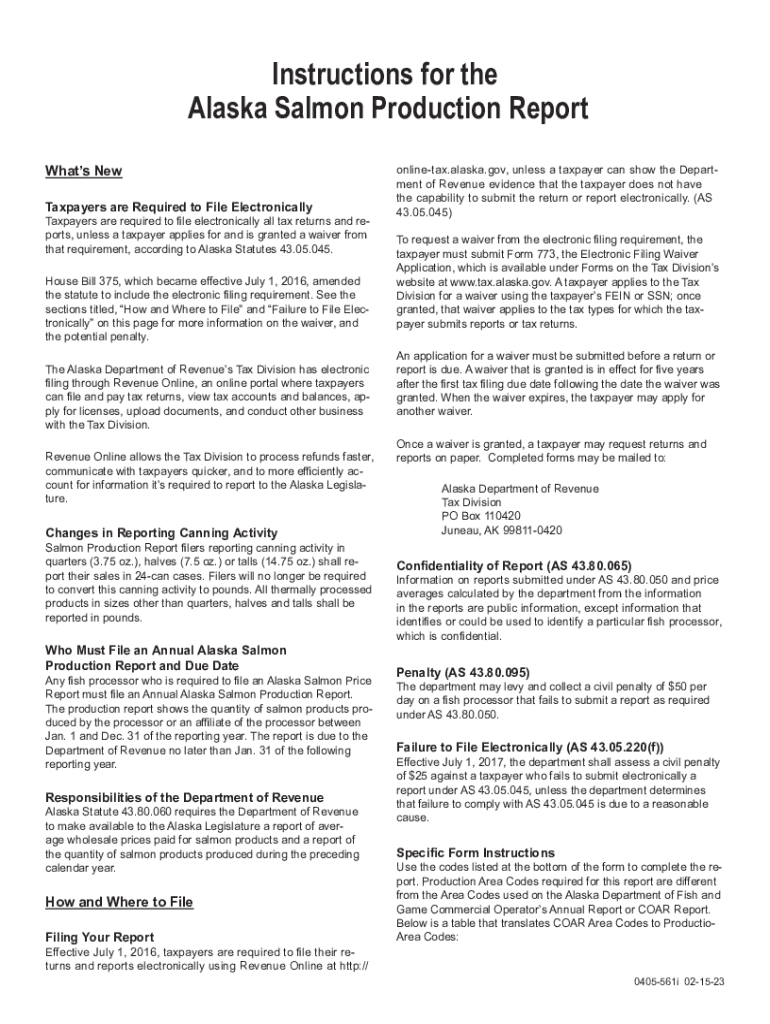

The form salmon report is a crucial document for individuals and businesses involved in salmon fishing in Alaska. This report provides essential data on the catch, including the number and type of salmon harvested. It is vital for regulatory compliance and helps in the management of salmon populations. Understanding the requirements and implications of this form is important for anyone participating in salmon fishing activities.

Steps to Complete the Form Salmon Report

Completing the form salmon report involves several key steps:

- Gather necessary information about your catch, including species, weight, and date of harvest.

- Ensure that you have the correct version of the form, as updates may occur annually.

- Fill out the form accurately, paying attention to all required fields to avoid delays.

- Review your entries for accuracy before submission to ensure compliance with state regulations.

Required Documents for Submission

To successfully submit the form salmon report, you may need the following documents:

- Proof of your fishing license, which verifies your eligibility to fish in Alaska.

- Any previous reports or records of your catch, which may assist in completing the current report.

- Documentation of any special permits if applicable, especially for specific fishing areas or species.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the form salmon report to avoid penalties. Generally, the report must be submitted by a specific date following the fishing season. Check the Alaska Department of Fish and Game website for the exact deadlines, as they can vary from year to year.

Legal Use of the Form Salmon Report

The form salmon report is legally required for all commercial and recreational fishers in Alaska. Failure to submit this report can result in fines and other penalties. It is important to understand the legal implications of this form and ensure that it is completed and submitted in accordance with state laws.

Examples of Using the Form Salmon Report

There are various scenarios in which the form salmon report is utilized:

- A commercial fishing operation must submit the report to demonstrate compliance with state regulations.

- A recreational angler may need to file the report to keep track of their catch for personal records or future reference.

- Research organizations may use aggregated data from these reports to study salmon populations and inform conservation efforts.

Quick guide on how to complete state taxes have a minimal impact on peoples interstate

Complete State Taxes Have A Minimal Impact On People's Interstate effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitution for conventional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without complications. Manage State Taxes Have A Minimal Impact On People's Interstate on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign State Taxes Have A Minimal Impact On People's Interstate with ease

- Obtain State Taxes Have A Minimal Impact On People's Interstate and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Modify and eSign State Taxes Have A Minimal Impact On People's Interstate and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state taxes have a minimal impact on peoples interstate

Create this form in 5 minutes!

How to create an eSignature for the state taxes have a minimal impact on peoples interstate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form salmon report and why do I need it?

A form salmon report is a structured document that helps you track and manage salmon-related data efficiently. Utilizing this report is essential for compliance, research, and effective decision-making in fisheries management. With airSlate SignNow, creating and managing your form salmon report becomes seamless and user-friendly.

-

How does airSlate SignNow help in creating a form salmon report?

airSlate SignNow offers intuitive templates and customization options to easily create your form salmon report. Its digital signing capabilities ensure that your reports can be executed quickly and securely, saving you time. This means you can focus on what truly matters—analyzing data and making informed decisions.

-

Is airSlate SignNow a cost-effective solution for managing form salmon reports?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By streamlining the process of creating and signing form salmon reports, it reduces administrative overhead and improves efficiency. You can enjoy robust features without breaking the bank.

-

What integrations does airSlate SignNow offer for form salmon reports?

airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage form salmon reports. These integrations include CRM systems and cloud storage services, making it easy to pull data and store reports securely. This interoperability ensures that your workflow remains uninterrupted and efficient.

-

Can I send a form salmon report for e-signature using airSlate SignNow?

Absolutely! airSlate SignNow allows you to send your form salmon report directly for e-signature. This feature not only speeds up the approval process but also adds a layer of security and authenticity to your documents. You can track the signature status in real-time for added convenience.

-

What are the key features of airSlate SignNow for managing form salmon reports?

Key features of airSlate SignNow include customizable templates, secure e-signatures, and automated workflows specifically designed for form salmon reports. These features simplify document management, improving collaboration among team members while ensuring compliance with regulations. You can access all functionalities through a user-friendly interface.

-

Is there customer support available if I encounter issues with my form salmon report?

Yes, airSlate SignNow provides excellent customer support for all its users. If you face any issues while creating or managing your form salmon reports, you can signNow out to their dedicated support team for assistance. They are committed to ensuring that you have a smooth experience with their platform.

Get more for State Taxes Have A Minimal Impact On People's Interstate

- Md standby form

- Affidavit survivor 497310380 form

- Maryland bankruptcy guide and forms package for chapters 7 or 13 maryland

- Bill of sale with warranty by individual seller maryland form

- Bill of sale with warranty for corporate seller maryland form

- Bill of sale without warranty by individual seller maryland form

- Bill of sale without warranty by corporate seller maryland form

- Summary of reaffirmation agreement maryland form

Find out other State Taxes Have A Minimal Impact On People's Interstate

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed