Tax Alaska 2016

What is the Tax Alaska

The Tax Alaska form is a specific document used for reporting income and calculating tax obligations for residents and businesses operating in Alaska. It is essential for ensuring compliance with state tax laws and regulations. This form helps taxpayers accurately report their earnings, deductions, and credits, allowing for the correct calculation of any taxes owed or refunds due.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather all necessary documents, including income statements, W-2s, and any relevant receipts for deductions.

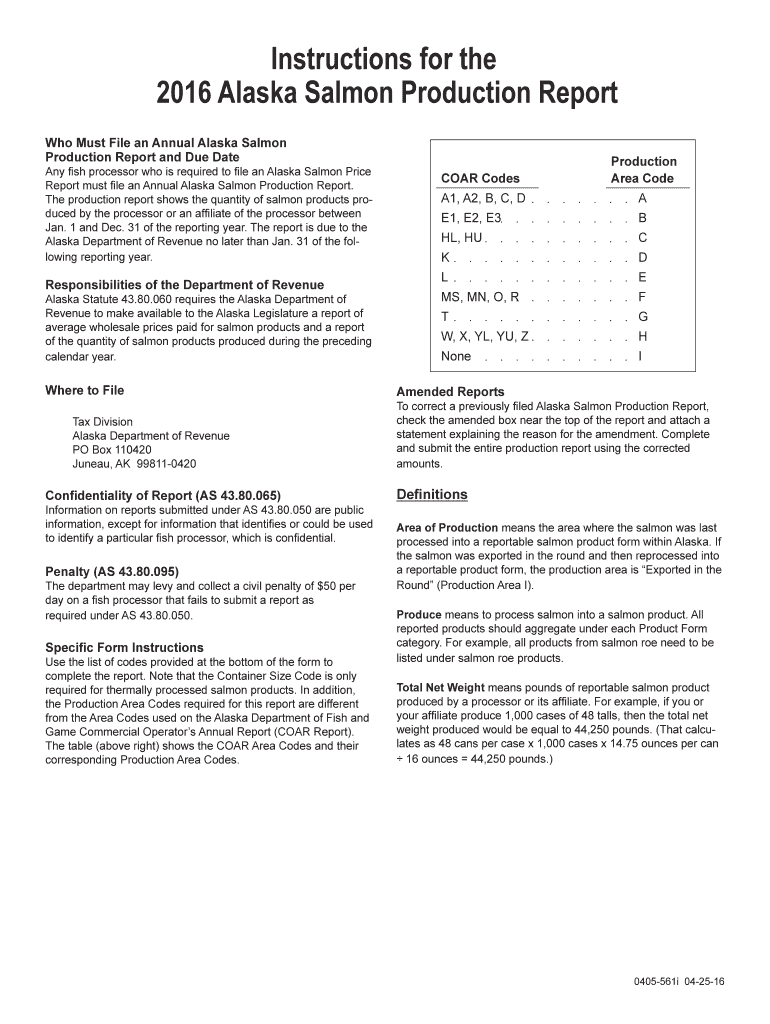

- Carefully read the instructions provided with the form to understand the requirements and any specific state guidelines.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the preferred method, whether online, by mail, or in person.

Legal use of the Tax Alaska

The Tax Alaska form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must adhere to the following:

- Provide accurate and truthful information on the form.

- Sign and date the form to certify its authenticity.

- Submit the form within the designated filing deadlines to avoid penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance with state tax laws. The Tax Alaska form typically has specific due dates, which may vary based on the taxpayer's situation. Key dates include:

- Annual filing deadline for individual taxpayers, usually April 15.

- Extended filing deadlines for those who apply for an extension.

- Quarterly estimated tax payment deadlines for self-employed individuals.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide resources and guidance for completing the form and understanding tax obligations.

Required Documents

To complete the Tax Alaska form accurately, certain documents are necessary. These typically include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income, such as freelance work or interest.

- Receipts for deductible expenses, including medical costs and business expenses.

Quick guide on how to complete tax alaska 6967165

Effortlessly Manage Tax Alaska on Any Device

Online document administration has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Tax Alaska on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric tasks today.

How to Modify and Electronically Sign Tax Alaska with Ease

- Locate Tax Alaska and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Choose your delivery method for the form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form navigation, and errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Tax Alaska and ensure outstanding communication at every step of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967165

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967165

How to generate an eSignature for your Tax Alaska 6967165 online

How to make an electronic signature for the Tax Alaska 6967165 in Chrome

How to make an electronic signature for putting it on the Tax Alaska 6967165 in Gmail

How to generate an eSignature for the Tax Alaska 6967165 straight from your mobile device

How to generate an eSignature for the Tax Alaska 6967165 on iOS

How to create an electronic signature for the Tax Alaska 6967165 on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Tax Alaska?

airSlate SignNow is a powerful eSignature solution that enables businesses in Alaska to streamline their document signing processes. It is especially beneficial for managing tax documents, ensuring compliance with state regulations, and facilitating faster transactions. By utilizing airSlate SignNow, Alaskan businesses can easily handle their Tax Alaska requirements efficiently.

-

How can airSlate SignNow help with managing Tax Alaska documents?

With airSlate SignNow, businesses can create, send, and eSign Tax Alaska documents securely online. The platform allows users to categorize and track their tax-related paperwork with ease, making the entire process transparent and organized. This simplifies compliance and saves valuable time for businesses operating in Alaska.

-

Is airSlate SignNow cost-effective for handling Tax Alaska needs?

Yes, airSlate SignNow offers a cost-effective pricing model that suits businesses of all sizes managing Tax Alaska requirements. With various plans tailored to different needs, users can choose a package that fits their budget while still benefiting from essential eSignature features. This ensures that handling tax documentation is both affordable and efficient.

-

What features does airSlate SignNow provide for Tax Alaska processing?

airSlate SignNow provides various features that are particularly useful for processing Tax Alaska documents. These include customizable templates for tax forms, automated workflows for document routing, and secure storage for all your important files. With these tools, managing your tax processes becomes seamless and hassle-free.

-

Can airSlate SignNow integrate with other software for Tax Alaska management?

Absolutely! airSlate SignNow offers integrations with popular applications that businesses rely on for Tax Alaska management, such as accounting and document storage software. This ensures that your eSigning process fits smoothly into your existing workflows, enhancing efficiency and accuracy when handling tax documentation.

-

What are the benefits of using airSlate SignNow for Tax Alaska?

Utilizing airSlate SignNow for Tax Alaska documentation leads to numerous benefits including increased efficiency, reduced paperwork, and improved security. Businesses can streamline their signing process, ensuring compliance with state regulations while achieving faster turnaround times. Overall, this results in a more productive and organized approach to tax management.

-

How secure is airSlate SignNow for handling sensitive Tax Alaska documents?

airSlate SignNow is designed with security as a top priority, making it safe for handling sensitive Tax Alaska documents. The platform employs encryption and advanced security protocols to protect your information during transmission and storage. This ensures that businesses can manage their tax requirements without worrying about data bsignNowes or unauthorized access.

Get more for Tax Alaska

- Mississippi 4 h report form msucares

- Mississippi patient self determination act form

- Miix user agreement mississippi state department of health msdh state ms form

- Peace officer standards amp training mississippi department of public form

- Mspb grievance form mississippi state personnel board mspb ms

- Broker reactivation form mississippi real estate commission mrec ms

- Affidavit for reppossessed motor vehicle form

- Mississippi public utility regulatory tax gross revenue report dor ms form

Find out other Tax Alaska

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement