D 403 2017

What is the D-403?

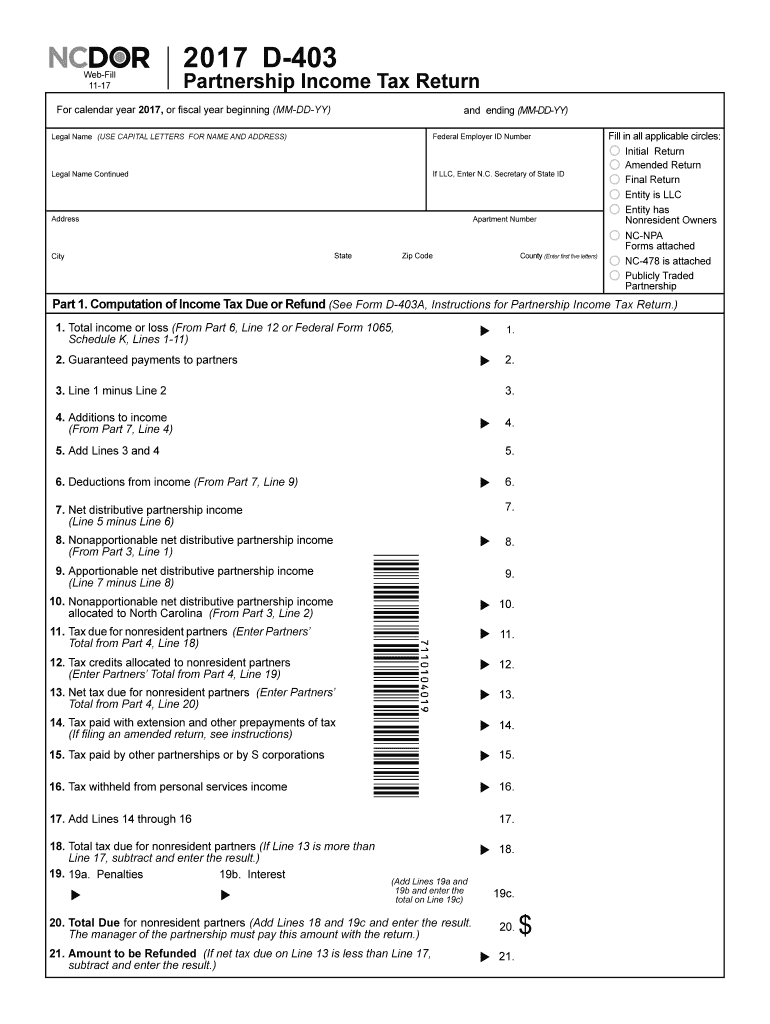

The D-403 form, specifically the 2017 D-403, is a tax document utilized in North Carolina for reporting partnership income. This form is essential for partnerships to accurately disclose their financial activities to the state. It captures vital information regarding income, deductions, and credits that are pertinent to the partnership's tax obligations. Understanding the D-403 is crucial for ensuring compliance with state tax regulations.

How to use the D-403

Using the 2017 D-403 involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to the partnership, including income statements, expense reports, and any applicable deductions. Next, fill out the form, ensuring that all sections are completed accurately. Once the form is filled, it should be reviewed for accuracy before submission. The D-403 can be submitted electronically or via mail, depending on the preference of the partnership.

Steps to complete the D-403

Completing the 2017 D-403 requires a systematic approach:

- Gather all financial documents related to the partnership.

- Fill in the partnership's identifying information, including name and address.

- Report all income received by the partnership during the tax year.

- Detail any deductions the partnership is eligible for, ensuring compliance with state tax laws.

- Review the completed form for accuracy and completeness.

- Submit the form either online or by mailing it to the appropriate state tax office.

Legal use of the D-403

The 2017 D-403 must be used in accordance with North Carolina tax laws. It is legally binding and serves as an official record of the partnership's income and deductions. Accurate completion and timely submission are essential to avoid penalties. The form is designed to meet the requirements set forth by the North Carolina Department of Revenue, ensuring that partnerships fulfill their tax obligations responsibly.

Filing Deadlines / Important Dates

Partnerships must be aware of specific deadlines when filing the 2017 D-403. Generally, the form is due on the 15th day of the fourth month following the end of the tax year. For partnerships operating on a calendar year, this typically means an April deadline. It is important to stay informed of any changes in deadlines or additional extensions that may apply to ensure timely filing.

Required Documents

To complete the 2017 D-403, certain documents are necessary:

- Income statements detailing all earnings of the partnership.

- Expense reports that outline all deductible costs.

- Any supporting documentation for credits or deductions claimed.

- Partnership agreement, if applicable, to clarify ownership and profit-sharing arrangements.

Who Issues the Form

The 2017 D-403 is issued by the North Carolina Department of Revenue. This agency is responsible for administering tax laws and ensuring compliance among businesses operating within the state. The form is part of the state's effort to streamline tax reporting for partnerships and facilitate accurate tax collection.

Quick guide on how to complete nc k 1 fillable 2017 2019 form

A Comprehensive Guide to Preparing Your D 403

If you are unsure about how to produce and submit your D 403, here is a concise set of instructions to simplify the tax declaration process.

First, you simply need to create your airSlate SignNow account to transform the way you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures, as well as revisit and amend answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow these steps to complete your D 403 in just a few minutes:

- Create your account and start editing PDFs within minutes.

- Utilize our catalog to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your D 403 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to apply your legally-binding electronic signature (if needed).

- Examine your document and correct any errors.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically using airSlate SignNow. Keep in mind that filing by mail may lead to increased errors and delayed refunds. Additionally, before e-filing your taxes, verify the submission rules on the IRS website for your state.

Create this form in 5 minutes or less

Find and fill out the correct nc k 1 fillable 2017 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the nc k 1 fillable 2017 2019 form

How to make an eSignature for your Nc K 1 Fillable 2017 2019 Form online

How to make an electronic signature for the Nc K 1 Fillable 2017 2019 Form in Google Chrome

How to make an eSignature for putting it on the Nc K 1 Fillable 2017 2019 Form in Gmail

How to make an electronic signature for the Nc K 1 Fillable 2017 2019 Form from your mobile device

How to generate an eSignature for the Nc K 1 Fillable 2017 2019 Form on iOS

How to create an electronic signature for the Nc K 1 Fillable 2017 2019 Form on Android

People also ask

-

What is the 2017 d 403 document type?

The 2017 d 403 refers to a specific form used within various industries for compliance and record-keeping. Understanding its requirements and how it can be effectively managed is crucial for businesses operating in regulated sectors. airSlate SignNow offers tools to streamline the eSigning process for the 2017 d 403.

-

How does airSlate SignNow simplify the eSigning of the 2017 d 403?

airSlate SignNow provides an easy-to-use platform that allows users to upload, edit, and send the 2017 d 403 document for electronic signatures. With drag-and-drop functionality, you can quickly assemble the document and invite signers, ensuring compliance and efficiency. This means no more printed papers and faster turnaround times.

-

What are the pricing options for using airSlate SignNow for the 2017 d 403?

airSlate SignNow offers flexible pricing plans suitable for individual and enterprise needs when handling the 2017 d 403. You can choose a subscription that provides your business with cost-effective access to features tailored for managing important documents. Check our website for detailed pricing plans and potential discounts.

-

Can airSlate SignNow integrate with other software for the 2017 d 403?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance its functionality for managing the 2017 d 403. Whether you use CRM systems or cloud storage platforms, our integrations ensure a smooth workflow and better document handling. You can easily connect your existing tools to optimize efficiency.

-

What security measures are in place for signing the 2017 d 403?

airSlate SignNow prioritizes security for all documents, including the 2017 d 403, by utilizing advanced encryption and authentication methods. We comply with industry standards to protect your sensitive data during the eSigning process. You can trust that your documents are secure and legally binding.

-

Are there mobile features for managing the 2017 d 403?

Absolutely! airSlate SignNow offers mobile capabilities, allowing you to manage and sign the 2017 d 403 on the go. The mobile app is user-friendly and ensures you can access, edit, and send documents quickly from your smartphone or tablet. This flexibility enhances productivity and convenience.

-

How can airSlate SignNow benefit my business when using the 2017 d 403?

By utilizing airSlate SignNow for the 2017 d 403, your business can reduce turnaround times, improve efficiency, and maintain compliance. The platform provides an organized way to handle documents digitally, which allows for better tracking and management. This results in cost savings and enhanced operational effectiveness.

Get more for D 403

Find out other D 403

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free