NC DoR D 403 Form 2022

What is the NC DoR D 403 Form

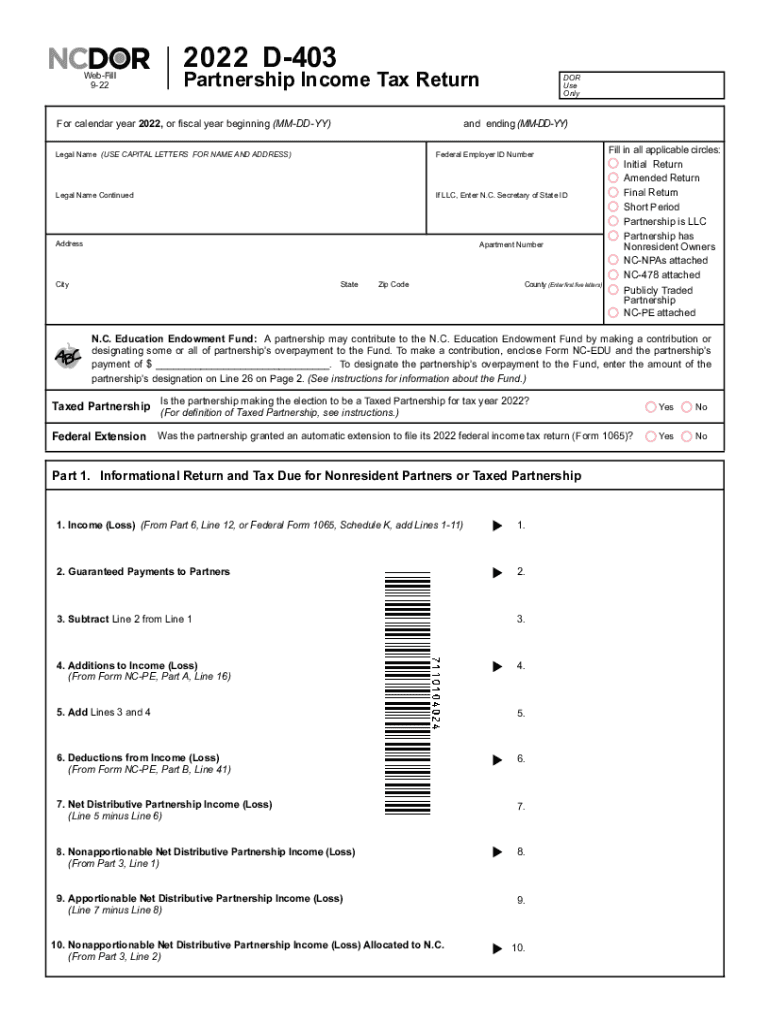

The NC DoR D 403 Form, also known as the North Carolina Partnership Return, is a tax document used by partnerships operating within the state. This form is essential for reporting income, deductions, and credits from the partnership's activities. It is filed with the North Carolina Department of Revenue (DoR) and is crucial for ensuring compliance with state tax laws. The information provided on this form helps determine the tax obligations of the partnership and its partners.

Steps to complete the NC DoR D 403 Form

Completing the NC DoR D 403 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form with accurate information regarding the partnership’s income, deductions, and credits. It is important to ensure that each partner’s share of income and deductions is correctly reported. After completing the form, review it for any errors or omissions before submitting it to the North Carolina DoR.

Legal use of the NC DoR D 403 Form

The legal use of the NC DoR D 403 Form is governed by state tax regulations. This form must be filed annually by partnerships to report their financial activities and fulfill their tax obligations. Proper use of the form ensures that partnerships remain compliant with North Carolina tax laws, thus avoiding potential penalties or legal issues. It is essential for partnerships to understand the legal implications of their filings and maintain accurate records to support their reported figures.

Filing Deadlines / Important Dates

Filing deadlines for the NC DoR D 403 Form are critical for compliance. Typically, partnerships must file this form by the fifteenth day of the fourth month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is important for partnerships to be aware of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Required Documents

To successfully complete the NC DoR D 403 Form, partnerships need to gather several required documents. These include financial statements, income records, and documentation of any deductions or credits claimed. Additionally, each partner may need to provide their individual tax identification numbers and details regarding their share of the partnership’s income. Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The NC DoR D 403 Form can be submitted through various methods to accommodate different preferences. Partnerships may choose to file the form online using the North Carolina Department of Revenue’s e-filing system, which offers a convenient and secure option. Alternatively, the form can be mailed to the appropriate address provided by the DoR. In-person submissions are also accepted at designated locations. Each method has its own processing times and requirements, so partnerships should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the NC DoR D 403 Form can result in significant penalties. Partnerships that do not file on time may face late fees and interest on any unpaid taxes. Additionally, non-compliance can lead to audits and further scrutiny from tax authorities. It is crucial for partnerships to adhere to filing deadlines and ensure that all information submitted is accurate to avoid these potential consequences.

Quick guide on how to complete nc dor d 403 form

Complete NC DoR D 403 Form effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle NC DoR D 403 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign NC DoR D 403 Form seamlessly

- Obtain NC DoR D 403 Form and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from the device of your choice. Edit and eSign NC DoR D 403 Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc dor d 403 form

Create this form in 5 minutes!

How to create an eSignature for the nc dor d 403 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the d 400 instructions for using airSlate SignNow?

The d 400 instructions guide users on how to access and utilize the key features of airSlate SignNow effectively. These instructions can help you navigate the platform, enabling smooth document signing and management. By following the d 400 instructions, you can streamline your workflow and enhance productivity.

-

How does airSlate SignNow ensure the security of my documents during the signing process?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication protocols as outlined in the d 400 instructions. This ensures that all documents remain confidential and protected from unauthorized access. Following the d 400 instructions will help you understand the security measures in place.

-

What are the pricing options available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, which are detailed in the d 400 instructions. Each plan includes different features, allowing businesses to choose according to their budget and requirements. For the latest pricing details, refer to the d 400 instructions on the website.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with popular applications, enhancing its functionality as specified in the d 400 instructions. These integrations allow for improved workflow automation and document management. Consult the d 400 instructions for a complete list of compatible applications.

-

What features should I look for in airSlate SignNow?

Key features to look for in airSlate SignNow include document templates, automated reminders, and in-person signing options, which are highlighted in the d 400 instructions. These features help streamline the signing process and increase efficiency. The d 400 instructions provide a comprehensive overview of all available features.

-

How does eSigning with airSlate SignNow benefit my business?

Using airSlate SignNow for eSigning offers numerous benefits, including faster turnaround times and reduced paper waste, as explained in the d 400 instructions. These advantages contribute to improved operational efficiency and sustainability. The d 400 instructions also detail how these benefits can positively impact your business.

-

Is training available for new users of airSlate SignNow?

Yes, airSlate SignNow provides training resources and support as outlined in the d 400 instructions to help new users get started effectively. These resources are designed to facilitate a quick learning curve, ensuring you can use the platform confidently. The d 400 instructions include links to training materials and support services.

Get more for NC DoR D 403 Form

Find out other NC DoR D 403 Form

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed