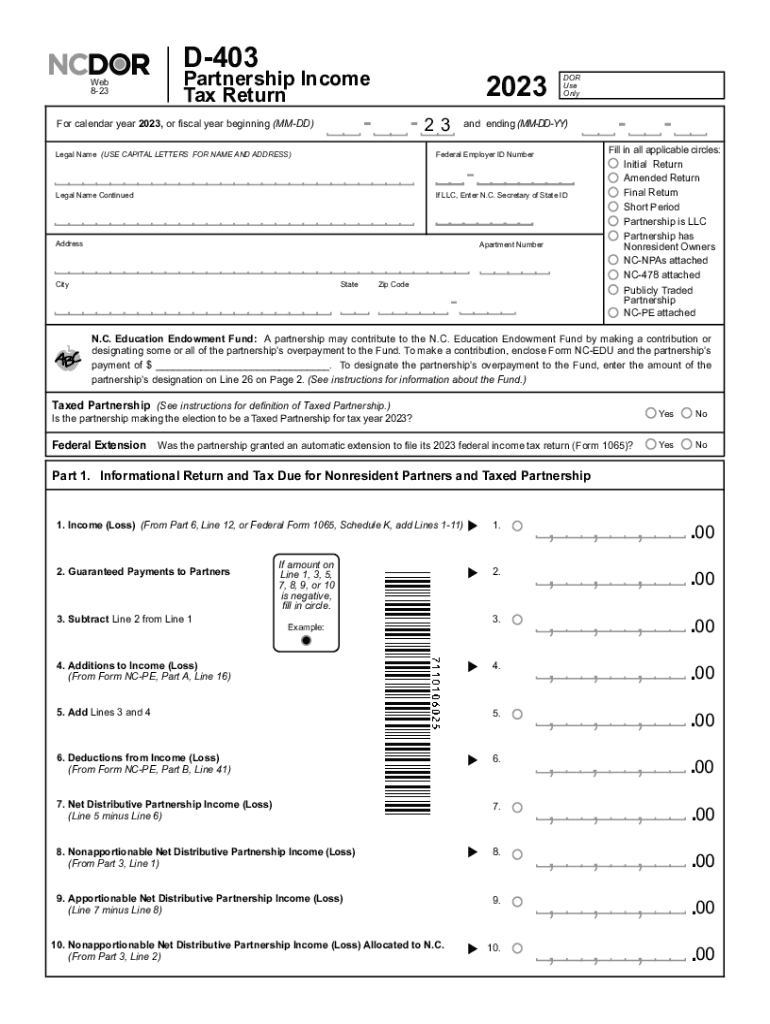

Web 8 23 D 403 Partnership Income Tax Return 2023

What is the NC 403 Tax Partnership Income Tax Return?

The NC 403 Tax form, also known as the North Carolina Partnership Income Tax Return, is a crucial document for partnerships operating within the state. This form is used to report the income, deductions, gains, and losses of a partnership. It ensures that partnerships comply with state tax regulations and accurately reflect their financial activities for the tax year. The NC 403 is specifically designed for partnerships, including limited partnerships and general partnerships, that are required to file taxes in North Carolina.

Steps to Complete the NC 403 Tax Partnership Income Tax Return

Completing the NC 403 Tax form involves several important steps:

- Gather financial information: Collect all necessary financial records, including income statements, expense reports, and any other relevant documents.

- Complete the form: Fill out the NC 403 form accurately, ensuring that all income, deductions, and credits are reported correctly.

- Attach supporting documents: Include any required schedules or additional forms, such as the NC K-1, which details each partner's share of income and deductions.

- Review for accuracy: Double-check all entries for errors or omissions to avoid potential issues with the state tax authority.

- Submit the form: File the completed NC 403 form by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

It is essential for partnerships to be aware of filing deadlines to avoid penalties. The NC 403 Tax form is typically due on the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. If additional time is needed, partnerships may file for an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents for the NC 403 Tax Return

To successfully complete the NC 403 Tax form, partnerships need to gather several key documents:

- Income statements: Documentation of all income earned by the partnership during the tax year.

- Expense records: Detailed records of all business-related expenses that can be deducted.

- Partner information: Each partner's details, including their share of income and deductions, typically reported on the NC K-1 form.

- Prior year tax returns: Previous tax returns can provide a reference for completing the current year's form.

Legal Use of the NC 403 Tax Partnership Income Tax Return

The NC 403 Tax form must be used in accordance with North Carolina tax laws. Partnerships are legally obligated to file this return if they meet certain criteria, such as having income sourced from North Carolina or conducting business within the state. Failure to file the NC 403 can result in penalties, including fines and interest on unpaid taxes. It is advisable for partnerships to consult with a tax professional to ensure compliance with all legal requirements.

Who Issues the NC 403 Tax Form?

The NC 403 Tax form is issued by the North Carolina Department of Revenue. This state agency is responsible for administering tax laws and ensuring that partnerships comply with state tax regulations. The Department of Revenue provides resources, including instructions and guidelines, to assist partnerships in accurately completing and filing the NC 403 form. Partnerships can access these resources through the official state website or by contacting the department directly for assistance.

Quick guide on how to complete web 8 23 d 403 partnership income tax return

Complete Web 8 23 D 403 Partnership Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents quickly without any holdups. Manage Web 8 23 D 403 Partnership Income Tax Return on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Web 8 23 D 403 Partnership Income Tax Return with ease

- Locate Web 8 23 D 403 Partnership Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just moments and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your revisions.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Modify and eSign Web 8 23 D 403 Partnership Income Tax Return and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct web 8 23 d 403 partnership income tax return

Create this form in 5 minutes!

How to create an eSignature for the web 8 23 d 403 partnership income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nc 403 tax and how does it affect my eSigning process?

The nc 403 tax refers to specific tax regulations that apply to certain transactions, including those facilitated through eSigning platforms like airSlate SignNow. Understanding how the nc 403 tax impacts your agreements is crucial for compliance. By using an eSigning solution, you can streamline your document signing while ensuring you adhere to relevant tax obligations.

-

How does airSlate SignNow simplify managing nc 403 tax documents?

airSlate SignNow provides an intuitive platform for creating, sending, and signing documents related to the nc 403 tax. The platform allows you to easily integrate tax-related documents into your workflow, ensuring that all signers are compliant. With audit trails and secure storage, managing your nc 403 tax documents has never been easier.

-

What are the pricing options for airSlate SignNow related to nc 403 tax eSigning?

airSlate SignNow offers various pricing plans that cater to different business needs, including those that manage nc 403 tax documents. Each plan provides access to essential features that help streamline the signing process while remaining cost-effective. You can choose a plan that best suits your business's volume of documents and specific needs regarding the nc 403 tax.

-

Can I integrate airSlate SignNow with other software to manage nc 403 tax documents?

Yes, airSlate SignNow integrates seamlessly with many popular tools, making it easier to manage nc 403 tax-related documents across platforms. This integration capability allows you to automate workflows and ensure that your tax documentation is handled efficiently. Whether using CRM, accounting, or project management software, you can enhance your nc 403 tax processes.

-

What benefits does using airSlate SignNow offer for businesses dealing with nc 403 tax?

Using airSlate SignNow provides several benefits for businesses dealing with nc 403 tax, including improved efficiency and compliance. The platform's electronic signature capability ensures that all documents are signed promptly, reducing delays associated with traditional methods. Additionally, it helps maintain an organized record of transactions, simplifying tax audits or reviews.

-

Is airSlate SignNow secure for handling nc 403 tax documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all nc 403 tax documents are protected through robust encryption and secure storage solutions. You can trust that sensitive information related to tax documents will remain confidential and safe from unauthorized access. Compliance with industry standards further bolsters the security measures in place.

-

How do I get started with airSlate SignNow for nc 403 tax document management?

Getting started with airSlate SignNow for managing nc 403 tax documents is straightforward. Simply sign up for an account, choose a suitable pricing plan, and begin uploading your documents. The user-friendly interface and comprehensive support resources will guide you through the setup, allowing you to focus on managing your nc 403 tax documentation efficiently.

Get more for Web 8 23 D 403 Partnership Income Tax Return

- Construction selection sheet form

- Confidential information form

- Studio rental form the rock center for dance

- Editable rent roll form

- Century 21 form

- Cooperative apartment deposit receipt and contract for sale form

- San bernardino county housing authority waiting list form

- 72 hour agreement advantagefilescom form

Find out other Web 8 23 D 403 Partnership Income Tax Return

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter