Nh Dra Form Dp2848 2017

What is the Nh Dra Form Dp2848

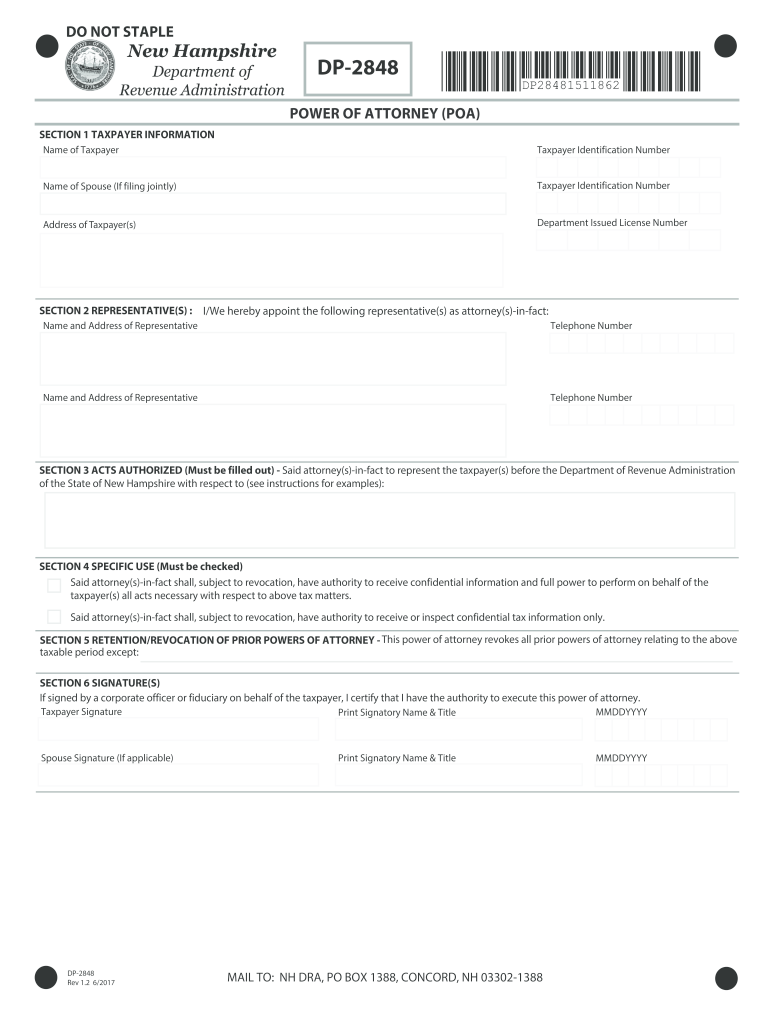

The Nh Dra Form Dp2848 is a specific tax form used in New Hampshire that authorizes a representative to act on behalf of a taxpayer in matters related to the Department of Revenue Administration. This form is essential for individuals or businesses who require assistance with tax filings or disputes. By completing this form, taxpayers grant permission for their designated representative to receive confidential tax information and communicate directly with the tax authorities.

How to use the Nh Dra Form Dp2848

Using the Nh Dra Form Dp2848 involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be found on the New Hampshire Department of Revenue Administration website. Next, fill in the required fields, including the taxpayer's information and the representative's details. After completing the form, review it for accuracy before signing. Finally, submit the form according to the instructions provided, ensuring that it reaches the appropriate department in a timely manner.

Steps to complete the Nh Dra Form Dp2848

Completing the Nh Dra Form Dp2848 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the New Hampshire Department of Revenue Administration.

- Fill in the taxpayer's name, address, and identification number accurately.

- Provide the representative's name, address, and contact information.

- Specify the scope of authority granted to the representative, including any limitations.

- Sign and date the form to validate it.

- Submit the completed form as instructed, either electronically or via mail.

Legal use of the Nh Dra Form Dp2848

The legal use of the Nh Dra Form Dp2848 is governed by state regulations that outline who can act as a representative and under what circumstances. This form must be completed accurately and submitted according to the guidelines set forth by the New Hampshire Department of Revenue Administration. It is important for taxpayers to understand that granting authority through this form does not absolve them of their tax obligations; rather, it allows a designated representative to assist in managing those responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the Nh Dra Form Dp2848 can vary depending on the specific tax situation and the timing of the tax year. It is crucial to submit the form before any relevant deadlines to ensure that the representative can act on behalf of the taxpayer effectively. Typically, the form should be filed well in advance of tax deadlines to allow sufficient time for processing. Taxpayers should consult the New Hampshire Department of Revenue Administration for the most current deadlines and any updates regarding changes in regulations.

Form Submission Methods (Online / Mail / In-Person)

The Nh Dra Form Dp2848 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the New Hampshire Department of Revenue Administration's electronic filing system, which offers a convenient and efficient option. Alternatively, the form can be mailed directly to the appropriate department or submitted in person at designated offices. Each method has its own processing times, so taxpayers should consider their needs when deciding how to submit the form.

Quick guide on how to complete nh dra form dp2848 2017

Your assistance manual on how to prepare your Nh Dra Form Dp2848

If you’re interested in learning how to generate and submit your Nh Dra Form Dp2848, here are some brief guidelines to facilitate tax processing.

To begin, you simply need to sign up for your airSlate SignNow account to alter how you handle documentation online. airSlate SignNow is an extremely user-friendly and efficient document solution that enables you to modify, produce, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures while returning to amend responses when necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to finalize your Nh Dra Form Dp2848 in just a few minutes:

- Establish your account and start working on PDFs immediately.

- Browse our catalog to find any IRS tax form; navigate through variants and schedules.

- Select Get form to access your Nh Dra Form Dp2848 in our editor.

- Complete the required editable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that submitting paper forms can lead to increased errors and slower refunds. Furthermore, before e-filing your taxes, review the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct nh dra form dp2848 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the nh dra form dp2848 2017

How to create an eSignature for the Nh Dra Form Dp2848 2017 in the online mode

How to create an electronic signature for the Nh Dra Form Dp2848 2017 in Chrome

How to make an eSignature for signing the Nh Dra Form Dp2848 2017 in Gmail

How to make an eSignature for the Nh Dra Form Dp2848 2017 right from your mobile device

How to create an electronic signature for the Nh Dra Form Dp2848 2017 on iOS

How to make an eSignature for the Nh Dra Form Dp2848 2017 on Android OS

People also ask

-

What is the NH Dra Form DP2848 and why is it important?

The NH Dra Form DP2848 is a crucial document used for granting power of attorney for tax matters in New Hampshire. This form allows taxpayers to authorize an individual to represent them before the IRS. Understanding how to properly fill out the NH Dra Form DP2848 can streamline tax processes and ensure compliance.

-

How can airSlate SignNow help with completing the NH Dra Form DP2848?

AirSlate SignNow simplifies the process of completing the NH Dra Form DP2848 by providing a user-friendly platform for electronic signatures and document management. With our intuitive tools, you can quickly fill out and eSign the form, ensuring it's valid and ready for submission without any hassle.

-

Is there a cost associated with using airSlate SignNow for the NH Dra Form DP2848?

Yes, airSlate SignNow offers affordable pricing plans to cater to various business needs. You can choose a plan that suits your requirements for managing documents like the NH Dra Form DP2848, with options for monthly or annual billing that provide flexibility and cost savings.

-

What features does airSlate SignNow offer for handling documents like the NH Dra Form DP2848?

AirSlate SignNow provides features such as easy document upload, customizable templates, and secure eSigning capabilities. These tools enhance your ability to manage the NH Dra Form DP2848 efficiently, ensuring that the signing process is fast, secure, and compliant with legal standards.

-

Can I integrate airSlate SignNow with other software for managing the NH Dra Form DP2848?

Absolutely! AirSlate SignNow seamlessly integrates with various business software, including CRM and document management systems. This integration allows you to streamline workflows related to the NH Dra Form DP2848, making it easier to manage your documents in one cohesive platform.

-

How secure is the signing process for the NH Dra Form DP2848 with airSlate SignNow?

The security of your documents, including the NH Dra Form DP2848, is paramount at airSlate SignNow. Our platform uses advanced encryption and multi-factor authentication to protect your data, ensuring that all transactions are secure and confidential.

-

What are the benefits of using airSlate SignNow for the NH Dra Form DP2848?

Using airSlate SignNow for the NH Dra Form DP2848 offers numerous benefits, including faster processing times and reduced paperwork. Additionally, the platform enhances collaboration by allowing multiple parties to sign and manage the document from anywhere, thus improving efficiency.

Get more for Nh Dra Form Dp2848

- Human papillomavirus hpv immunization consent form

- Start of service request thank you for joining metropcs form

- The treasure of lemon brown answer key pdf form

- Safelite solutions network phone number form

- Application to correct or change a michigan birth record form

- Consent form for euthanasia and care for remains pet care hospital

- Abc checklist version 1 form

- Sample attendance policy 2 absences per month doc form

Find out other Nh Dra Form Dp2848

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation