Solved 2848 Power of Attorney and Declaration of 2020

What is the New Hampshire DP 2848 Power of Attorney and Declaration of

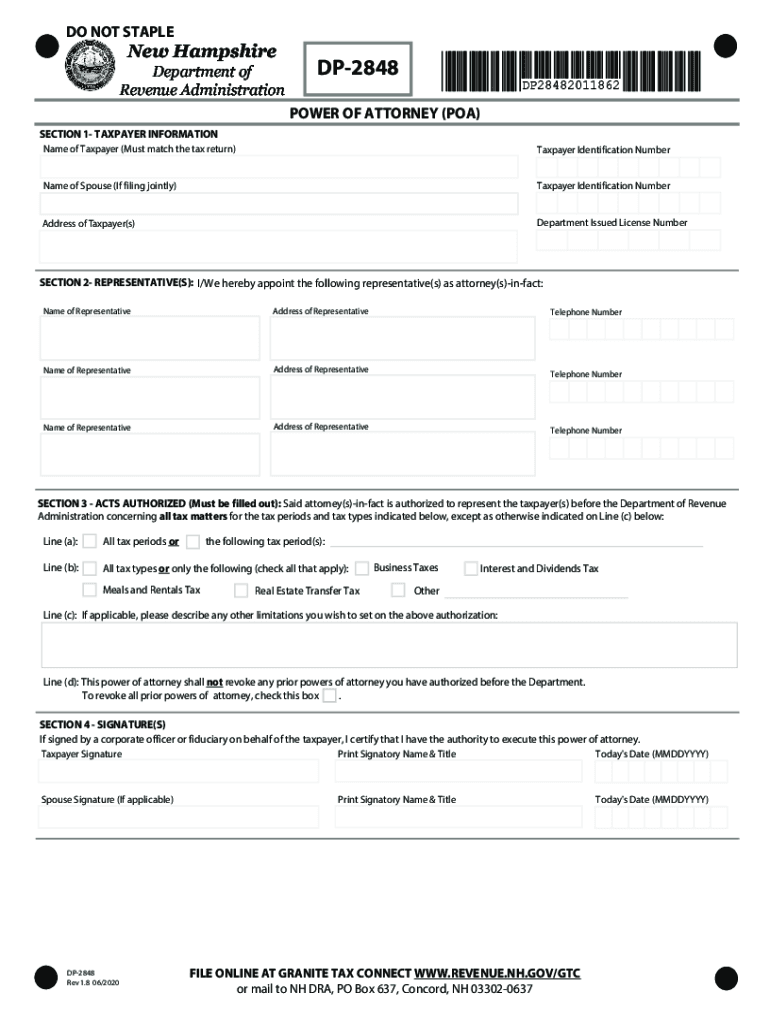

The New Hampshire DP 2848 form is a Power of Attorney document that allows individuals to designate another person to act on their behalf in specific tax matters. This form is particularly relevant for those dealing with the New Hampshire Department of Revenue Administration. By completing the DP 2848, you grant authority to the appointed representative to handle tax-related issues, including filing returns and communicating with the department regarding your tax status.

Steps to Complete the New Hampshire DP 2848

Completing the New Hampshire DP 2848 involves several important steps:

- Begin by downloading the DP 2848 form from the New Hampshire Department of Revenue Administration website.

- Fill in your personal information, including your name, address, and Social Security number.

- Designate the individual you wish to appoint as your representative by providing their name and contact details.

- Specify the tax matters for which you are granting authority, ensuring clarity on the scope of the representation.

- Sign and date the form to validate your consent.

- Submit the completed form to the New Hampshire Department of Revenue Administration, either online or by mail.

Legal Use of the New Hampshire DP 2848

The New Hampshire DP 2848 is legally binding as long as it is filled out correctly and submitted in accordance with state regulations. It is essential that the form is signed by the principal, as this signature authenticates the document. The appointed representative can then act on behalf of the principal in tax matters, ensuring compliance with state laws and facilitating smoother interactions with the Department of Revenue Administration.

Filing Deadlines / Important Dates

When using the New Hampshire DP 2848, it is important to be aware of any relevant deadlines. Typically, the form should be submitted well in advance of any tax filing deadlines to ensure that your representative can act on your behalf in a timely manner. Keeping track of important tax dates, such as the filing deadline for your tax return, will help ensure compliance and avoid any penalties.

Examples of Using the New Hampshire DP 2848

The New Hampshire DP 2848 can be utilized in various scenarios, including:

- When an individual is unable to manage their tax affairs due to health issues.

- For business owners who wish to appoint an accountant or tax professional to handle their tax filings.

- In situations where an individual is out of the state and needs someone to represent them in tax matters.

Who Issues the New Hampshire DP 2848 Form

The New Hampshire DP 2848 form is issued by the New Hampshire Department of Revenue Administration. This department is responsible for overseeing tax compliance and administration within the state. If you have questions about the form or its use, you can contact the department directly for assistance.

Quick guide on how to complete solved 2848 power of attorney and declaration of

Complete Solved 2848 Power Of Attorney And Declaration Of effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Solved 2848 Power Of Attorney And Declaration Of on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Solved 2848 Power Of Attorney And Declaration Of effortlessly

- Obtain Solved 2848 Power Of Attorney And Declaration Of and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for this task.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device. Edit and eSign Solved 2848 Power Of Attorney And Declaration Of and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct solved 2848 power of attorney and declaration of

Create this form in 5 minutes!

How to create an eSignature for the solved 2848 power of attorney and declaration of

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the New Hampshire DP 2848 form?

The New Hampshire DP 2848 form is a power of attorney document that allows you to authorize someone to act on your behalf regarding tax matters with the New Hampshire Department of Revenue Administration. Using airSlate SignNow, you can easily fill out and eSign the form securely online, ensuring that your authorization is processed swiftly.

-

How can I use airSlate SignNow for the New Hampshire DP 2848?

You can use airSlate SignNow to create, edit, and eSign the New Hampshire DP 2848 form online. The platform provides an intuitive interface that simplifies the process, allowing you to complete your documents efficiently while maintaining compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the New Hampshire DP 2848?

While airSlate SignNow offers various pricing plans, you can start with a free trial to assess its features for the New Hampshire DP 2848. After the trial, subscription costs depend on the level of features you need, making it a cost-effective solution for businesses and individuals.

-

What features does airSlate SignNow provide for managing the New Hampshire DP 2848?

airSlate SignNow offers features such as document templates, eSignature, custom workflows, and real-time tracking for the New Hampshire DP 2848. These tools streamline the signing process, making it easy for users to manage and track their documents throughout the signing journey.

-

Can I integrate airSlate SignNow with other software when working on the New Hampshire DP 2848?

Yes, airSlate SignNow supports integrations with popular business applications, allowing you to enhance your workflow while managing the New Hampshire DP 2848 form. Whether you use CRM tools or cloud storage solutions, these integrations help you keep all your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for the New Hampshire DP 2848?

Using airSlate SignNow for the New Hampshire DP 2848 offers numerous benefits, including increased efficiency, reduced errors, and faster processing times. The platform ensures that your documents are securely stored and compliant with New Hampshire's regulations, giving you peace of mind.

-

How secure is the submission of the New Hampshire DP 2848 via airSlate SignNow?

Security is a top priority for airSlate SignNow. When submitting the New Hampshire DP 2848, your information is protected using advanced encryption protocols, ensuring that all sensitive data remains confidential and secure throughout the signing process.

Get more for Solved 2848 Power Of Attorney And Declaration Of

- Reg 1 o form

- Wyn glencross pressure care article word doc waterlow form rtf doc

- Printable control logs for urine pregnancy form

- Pa 118 form

- Accountability worksheets for adults pdf form

- Correlation vs causation worksheet pdf form

- Im new middletown christian church form

- Penn foster transcript request form penn foster

Find out other Solved 2848 Power Of Attorney And Declaration Of

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online