Forms Equity Trust Company

What is the Forms Equity Trust Company

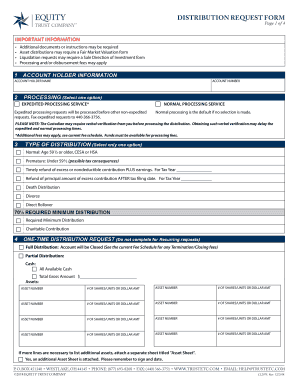

The Forms Equity Trust Company refers to a set of documents used to facilitate various financial transactions and account management processes within the framework of equity trusts. These forms are essential for individuals and businesses looking to manage their investments, retirement accounts, or other financial assets under the guidance of Equity Trust Company. They help streamline the process of establishing, maintaining, and reporting on trust accounts, ensuring compliance with regulatory requirements.

How to use the Forms Equity Trust Company

Using the Forms Equity Trust Company involves several steps. First, identify the specific form required for your transaction or account management needs. Each form serves a unique purpose, such as account setup, contribution, or distribution requests. Once the appropriate form is selected, complete it with accurate information, ensuring all required fields are filled out. After completing the form, submit it according to the specified submission methods, whether online, by mail, or in person. Keeping copies of submitted forms for your records is advisable.

Steps to complete the Forms Equity Trust Company

Completing the Forms Equity Trust Company requires careful attention to detail. Follow these steps:

- Identify the correct form based on your needs.

- Gather necessary information, such as personal identification and account details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form through the designated method.

By following these steps, you can ensure that your form is completed correctly and submitted in a timely manner.

Legal use of the Forms Equity Trust Company

The Forms Equity Trust Company must be used in compliance with applicable laws and regulations. These forms are designed to meet legal standards for financial transactions involving equity trusts. It is crucial to use these forms accurately to avoid legal complications, such as penalties for non-compliance. Understanding the legal implications of each form can help ensure that your transactions are valid and recognized by regulatory authorities.

Required Documents

When completing the Forms Equity Trust Company, certain documents may be required to support your application or transaction. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Social Security number or taxpayer identification number.

- Proof of address, such as a utility bill or bank statement.

- Any relevant financial statements or account information.

Ensuring you have all necessary documentation ready can help expedite the process and reduce the risk of delays.

Form Submission Methods

The Forms Equity Trust Company can typically be submitted through various methods to accommodate user preferences. Common submission methods include:

- Online submission via the Equity Trust Company website.

- Mailing the completed form to the designated address.

- In-person submission at an Equity Trust Company office.

Each method has its advantages, and users should choose the one that best suits their needs while ensuring timely processing of their forms.

Quick guide on how to complete forms equity trust company

Execute Forms Equity Trust Company effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents rapidly without delays. Manage Forms Equity Trust Company on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Forms Equity Trust Company with ease

- Locate Forms Equity Trust Company and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Modify and eSign Forms Equity Trust Company and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms equity trust company

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using Forms Equity Trust Company with airSlate SignNow?

Using Forms Equity Trust Company with airSlate SignNow streamlines document management, allowing for fast and secure eSigning. This integration enhances compliance and helps businesses save time and resources by automating workflows, resulting in a more efficient operational process.

-

How does the pricing for Forms Equity Trust Company integration work with airSlate SignNow?

The pricing for using Forms Equity Trust Company with airSlate SignNow is flexible, providing various plans to suit different business needs. Depending on the features required, businesses can choose from affordable monthly or annual subscriptions, ensuring that they get the best value for their investments.

-

Can I customize my Forms Equity Trust Company templates in airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize your Forms Equity Trust Company templates. You can add fields, adjust layouts, and incorporate branding elements to create personalized documents that align with your organizational identity.

-

What features are included in the Forms Equity Trust Company package with airSlate SignNow?

The Forms Equity Trust Company package with airSlate SignNow includes powerful features such as eSignature capabilities, document tracking, and secure cloud storage. These features not only enhance collaboration but also ensure that your documents are effective and legally binding.

-

What types of documents can I send using Forms Equity Trust Company?

You can send a variety of documents using Forms Equity Trust Company, including contracts, agreements, and onboarding forms. airSlate SignNow supports multiple document formats, allowing you to work seamlessly with any paperwork your business requires.

-

How can Forms Equity Trust Company integrate with other tools?

Forms Equity Trust Company can integrate with numerous third-party applications through airSlate SignNow. This helps businesses automate workflows and connect their entire operational ecosystem, improving productivity and collaboration across teams.

-

Is training available for using Forms Equity Trust Company with airSlate SignNow?

Yes, airSlate SignNow provides comprehensive training resources for users of Forms Equity Trust Company. These resources include tutorials, user guides, and customer support to ensure that your team can fully leverage the software capabilities.

Get more for Forms Equity Trust Company

- Order appointing guardian ad litem annual review of form

- Gn 4110 report and recommendation of guardian ad litem annual form

- Psychotropic medications report and recommendation of form

- Summary hearing form

- Summary hearing findings and order continuing order form

- Windsor family divisionvermont judiciary form

- In support of the claims made in my complaint i state the following facts to be true and correct to the best of form

- Affidavit in support of relief from abuse complaint for child notary form

Find out other Forms Equity Trust Company

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy