Flagstar Form 4506

What is the Flagstar Form 4506

The Flagstar Form 4506 is a document used primarily to request a copy of your tax return from the Internal Revenue Service (IRS). This form is essential for individuals or businesses needing to verify income for various purposes, such as applying for loans, mortgages, or other financial services. The form allows taxpayers to obtain their tax transcripts directly from the IRS, which can be crucial for financial institutions when assessing eligibility for credit or loans.

How to use the Flagstar Form 4506

To use the Flagstar Form 4506, you must fill out the form accurately, providing all required information, including your name, Social Security number, and the tax years for which you are requesting transcripts. After completing the form, it can be submitted to the IRS either online or via mail. It is important to ensure that all information is correct to avoid delays in processing your request.

Steps to complete the Flagstar Form 4506

Completing the Flagstar Form 4506 involves several key steps:

- Begin by downloading the form from the IRS website or obtaining a copy from Flagstar.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the tax years for which you are requesting transcripts.

- Sign and date the form to validate your request.

- Submit the completed form to the IRS through your preferred method, either online or by mailing it to the appropriate address.

Legal use of the Flagstar Form 4506

The Flagstar Form 4506 is legally recognized as a valid request for tax return information. It is important to use this form for legitimate purposes, such as securing loans or verifying income for tax-related matters. Misuse of the form can result in legal penalties, so it is essential to ensure that all requests comply with IRS regulations.

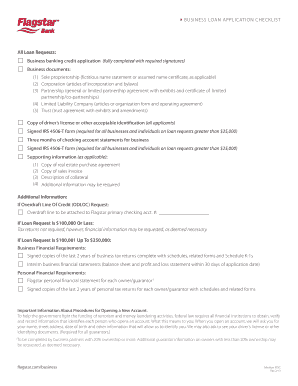

Required Documents

When submitting the Flagstar Form 4506, you may need to provide additional documentation to support your request. This can include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any relevant financial documents that may assist in verifying your identity or income.

Having these documents ready can expedite the processing of your request.

Form Submission Methods

The Flagstar Form 4506 can be submitted in several ways:

- Online: Use the IRS e-Services portal to submit your request electronically.

- By Mail: Print and send the completed form to the designated IRS address.

- In-Person: Visit a local IRS office to submit your request directly.

Choosing the right submission method can impact the speed at which you receive your tax transcripts.

Quick guide on how to complete flagstar form 4506

Effortlessly prepare Flagstar Form 4506 on any device

Digital document management has become increasingly favored among companies and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Flagstar Form 4506 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Flagstar Form 4506 effortlessly

- Find Flagstar Form 4506 and click Get Form to begin.

- Use the resources we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form: by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Flagstar Form 4506 to ensure excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flagstar form 4506

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the main function of airSlate SignNow?

The main function of airSlate SignNow is to empower businesses to send and electronically sign documents. With a cost-effective solution, you can streamline your document workflows quickly and efficiently by calling 833 806 2525 for support.

-

How does airSlate SignNow improve document management?

airSlate SignNow improves document management by providing a user-friendly platform that allows for seamless document creation, collaboration, and signing. If you have questions about features, call 833 806 2525 for immediate assistance.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers several pricing plans to cater to different business needs, including options for individuals, small teams, and larger enterprises. For detailed pricing information, signNow out to our team at 833 806 2525.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can easily integrate with various software applications such as CRM, productivity, and file storage tools. For specific integration capabilities, contact us at 833 806 2525.

-

What are the security features of airSlate SignNow?

airSlate SignNow prioritizes security with features like secure document encryption, two-factor authentication, and compliance with industry standards. For more information on how we protect your data, please call 833 806 2525.

-

How does airSlate SignNow benefit businesses?

airSlate SignNow benefits businesses by reducing turnaround times for contracts and forms while improving workflow efficiency. If you want to learn more about the benefits, feel free to signNow out to 833 806 2525.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to experience the platform's capabilities before committing. For start-up assistance during the trial, you can contact support at 833 806 2525.

Get more for Flagstar Form 4506

- Instructions for petition for order of form

- Reissuance temp ord for protectionnot of hearing form

- Order transferring dv case and set hearing form

- Temporary sexual assault protection order and notice of form

- Civil protection orders king county form

- Chapter 790 rcw sexual assault protection form

- Order modifying order for protection form

- Domestic violence protection order petition spokane county form

Find out other Flagstar Form 4506

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document