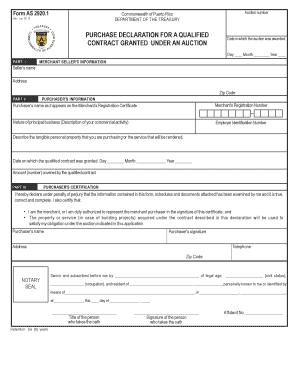

As 2920 1 Rev 26 Jun 15 as 2920 1 Rev 26 Jun 15 Hacienda Gobierno Form

Understanding the Puerto Rico Tax Certificate

The Puerto Rico tax certificate serves as an official document issued by the Hacienda (Department of Treasury) that verifies an individual's or entity's tax status. This certificate is essential for various transactions, including applying for tax exemptions or confirming compliance with tax obligations. The tax certificate may include details such as the taxpayer's identification number, the type of taxes paid, and the validity period of the certificate. Understanding its components can help taxpayers ensure they are using the correct form for their needs.

Steps to Obtain the Puerto Rico Tax Certificate

To obtain the Puerto Rico tax certificate, follow these steps:

- Gather necessary documents, including your tax identification number and proof of tax payments.

- Visit the official Hacienda website or your local Hacienda office.

- Complete the required application form, ensuring all information is accurate.

- Submit the application along with any required documentation, either online or in person.

- Wait for processing, which may take several days depending on the volume of requests.

Once processed, you will receive your tax certificate, which can be printed or saved electronically.

Legal Uses of the Puerto Rico Tax Certificate

The Puerto Rico tax certificate is legally recognized for various purposes. It is often required for:

- Applying for tax exemptions, such as the Puerto Rico sales tax exemption certificate.

- Confirming tax compliance when engaging in business transactions.

- Filing for tax refunds or credits.

- Establishing eligibility for certain government programs or grants.

Using the certificate appropriately can help individuals and businesses navigate tax obligations effectively.

Eligibility Criteria for the Puerto Rico Tax Certificate

Eligibility for obtaining a Puerto Rico tax certificate typically includes the following criteria:

- Having a valid tax identification number issued by the Hacienda.

- Being in good standing with the Hacienda, meaning all taxes owed are paid.

- Providing accurate and complete information in the application form.

Meeting these criteria is crucial for a successful application and to avoid delays in receiving the certificate.

Common Scenarios for Using the Puerto Rico Tax Certificate

Various scenarios may necessitate the use of a Puerto Rico tax certificate, including:

- Business owners seeking to apply for a resale certificate to purchase goods without paying sales tax.

- Individuals applying for tax exemptions on hotel stays or other services.

- Entities looking to demonstrate tax compliance for bidding on government contracts.

Understanding these scenarios can help taxpayers leverage the certificate effectively in their financial dealings.

Required Documents for Application

When applying for a Puerto Rico tax certificate, the following documents are typically required:

- Tax identification number documentation.

- Proof of tax payments, such as receipts or statements.

- Completed application form, available from the Hacienda.

Having these documents ready can streamline the application process and ensure compliance with all requirements.

Quick guide on how to complete as 2920 1 rev 26 jun 15 as 2920 1 rev 26 jun 15 hacienda gobierno

Finalize AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, permitting you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly, without any hold-ups. Handle AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

Steps to modify and electronically sign AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno with ease

- Locate AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno and select Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno to guarantee clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the as 2920 1 rev 26 jun 15 as 2920 1 rev 26 jun 15 hacienda gobierno

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Puerto Rico tax certificate pictures?

Puerto Rico tax certificate pictures refer to the visual representation of tax certificates issued by the government of Puerto Rico. These images are important for documenting tax compliance and are often required for various business transactions.

-

How can airSlate SignNow help with Puerto Rico tax certificate pictures?

airSlate SignNow allows users to easily upload, save, and share Puerto Rico tax certificate pictures securely. This streamlines the process of managing important documentation, ensuring compliance and reducing the risk of misplacement.

-

Is there a fee for using airSlate SignNow for Puerto Rico tax certificate pictures?

airSlate SignNow offers a cost-effective solution with a range of pricing plans to fit different business needs. Users can access features for handling Puerto Rico tax certificate pictures at an affordable rate, including a free trial to explore its functionalities.

-

Can I integrate my existing systems with airSlate SignNow for Puerto Rico tax certificate pictures?

Yes, airSlate SignNow provides integration options with various platforms and software. This enables businesses to easily incorporate their processes for managing Puerto Rico tax certificate pictures into existing workflows, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Puerto Rico tax certificate pictures?

Using airSlate SignNow for Puerto Rico tax certificate pictures offers several benefits, including enhanced security and ease of access. With features like electronic signatures and cloud storage, businesses can ensure their documents are safely stored and easily retrievable.

-

How secure are my Puerto Rico tax certificate pictures in airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and secure cloud storage to protect your Puerto Rico tax certificate pictures from unauthorized access and data bsignNowes.

-

Can I edit Puerto Rico tax certificate pictures using airSlate SignNow?

While airSlate SignNow primarily focuses on document signing and management, users can annotate and add notes to Puerto Rico tax certificate pictures for clarity. This feature helps facilitate communication and understanding among parties involved in a transaction.

Get more for AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno

- Limited liability operating agreement dlp equity fund ii llc form

- Fully disclosed clearing agreement of pershing llc secgov form

- Appendix i department of justice form

- Guam residential lease agreement free legal form

- Checklist for sequential activities form

- Personal history statement greenville tx form

- I represent concerning injuries form

- Our file no form

Find out other AS 2920 1 Rev 26 Jun 15 AS 2920 1 Rev 26 Jun 15 Hacienda Gobierno

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application