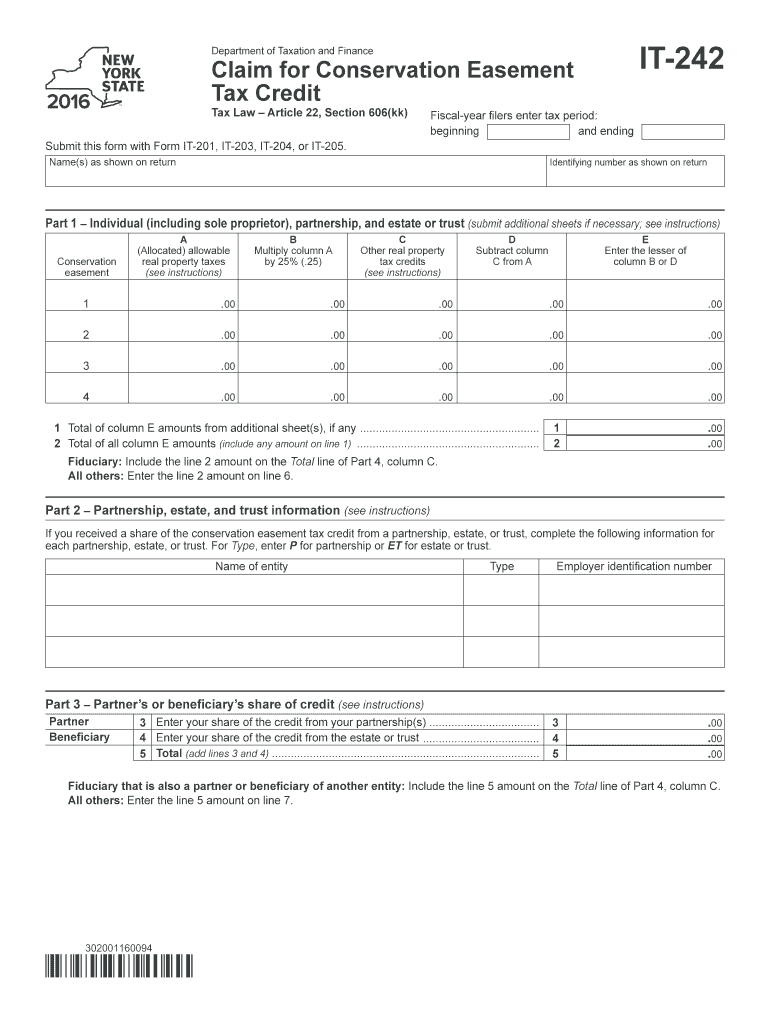

New York Form it 242 Claim for Conservation Easement Tax Credit 2016

What is the New York Form IT 242 Claim For Conservation Easement Tax Credit

The New York Form IT 242 Claim For Conservation Easement Tax Credit is a tax document used by individuals and businesses to claim a tax credit for contributions made toward conservation easements. This form is specifically designed for taxpayers who have donated land or rights to land that contribute to the preservation of natural resources, open spaces, or agricultural land in New York State. By filling out this form, taxpayers can potentially reduce their state tax liability, encouraging conservation efforts and sustainable land use.

Steps to complete the New York Form IT 242 Claim For Conservation Easement Tax Credit

Completing the New York Form IT 242 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation related to the conservation easement, including appraisals and any agreements. Next, accurately fill out the form, providing detailed information about the easement, its value, and your personal or business information. After completing the form, review it carefully for any errors or omissions. Finally, sign and date the form before submitting it to the appropriate state tax authority.

Eligibility Criteria

To qualify for the New York Form IT 242 Claim For Conservation Easement Tax Credit, taxpayers must meet specific eligibility criteria. This includes being a resident of New York State or a business entity operating within the state. Additionally, the conservation easement must be legally established and recognized, with a clear intent to preserve the land for conservation purposes. Taxpayers should also ensure that the easement meets the requirements set forth by the New York State Department of Environmental Conservation and the Internal Revenue Service.

Required Documents

When filing the New York Form IT 242, several documents are required to support your claim. These typically include:

- A copy of the conservation easement agreement.

- An appraisal report detailing the value of the easement.

- Any correspondence with state or federal agencies regarding the easement.

- Proof of payment for any fees associated with the easement.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Form Submission Methods

The New York Form IT 242 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online through the New York State Department of Taxation and Finance website. Alternatively, the form can be printed, completed, and mailed to the appropriate tax office. In some cases, in-person submissions may also be accepted, depending on local regulations and office policies. It is essential to verify the submission method that best suits your needs and complies with state guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the New York Form IT 242 are crucial for ensuring that taxpayers do not miss out on potential tax credits. Generally, the form must be submitted by the due date of the tax return for the year in which the easement was granted. For most taxpayers, this date falls on April fifteenth. However, if you are filing for an extension, be sure to check the specific deadlines for submitting the form to avoid penalties or delays in processing your claim.

Quick guide on how to complete new york form it 242 claim for conservation easement tax credit

Your assistance manual on how to prepare your New York Form IT 242 Claim For Conservation Easement Tax Credit

If you’re interested in learning how to finalize and submit your New York Form IT 242 Claim For Conservation Easement Tax Credit, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to alter the way you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to edit, generate, and complete your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to modify answers as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your New York Form IT 242 Claim For Conservation Easement Tax Credit in a matter of minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our directory to find any IRS tax document; explore various versions and schedules.

- Click Get form to access your New York Form IT 242 Claim For Conservation Easement Tax Credit in our editor.

- Provide the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and amend any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically using airSlate SignNow. Be aware that filing in paper form can lead to return errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 242 claim for conservation easement tax credit

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the new york form it 242 claim for conservation easement tax credit

How to generate an eSignature for your New York Form It 242 Claim For Conservation Easement Tax Credit in the online mode

How to generate an eSignature for your New York Form It 242 Claim For Conservation Easement Tax Credit in Chrome

How to make an electronic signature for putting it on the New York Form It 242 Claim For Conservation Easement Tax Credit in Gmail

How to make an electronic signature for the New York Form It 242 Claim For Conservation Easement Tax Credit right from your mobile device

How to make an electronic signature for the New York Form It 242 Claim For Conservation Easement Tax Credit on iOS

How to generate an electronic signature for the New York Form It 242 Claim For Conservation Easement Tax Credit on Android devices

People also ask

-

What is the New York Form IT 242 Claim For Conservation Easement Tax Credit?

The New York Form IT 242 Claim For Conservation Easement Tax Credit allows taxpayers to claim a credit for the donation of conservation easements. This form is essential for maximizing tax benefits while contributing to land conservation. Completing this form correctly can ensure you receive the financial support you deserve.

-

How can airSlate SignNow assist with the New York Form IT 242 Claim For Conservation Easement Tax Credit?

airSlate SignNow provides a seamless eSigning solution that simplifies the submission process of the New York Form IT 242 Claim For Conservation Easement Tax Credit. You can complete, sign, and send this form quickly and securely, ensuring compliance with tax guidelines. This boosts efficiency and saves you valuable time.

-

What are the pricing options for airSlate SignNow when using the New York Form IT 242 Claim For Conservation Easement Tax Credit?

airSlate SignNow offers flexible pricing plans to accommodate various budgets when dealing with permissions like the New York Form IT 242 Claim For Conservation Easement Tax Credit. Each plan includes features suited for seamless document management and eSigning. Check our website for detailed pricing tiers that best fit your needs.

-

Can I integrate airSlate SignNow with other applications for the New York Form IT 242 Claim For Conservation Easement Tax Credit?

Yes, airSlate SignNow supports numerous integrations that can assist in managing your New York Form IT 242 Claim For Conservation Easement Tax Credit efficiently. Whether it's cloud storage solutions or CRM systems, our platform enables easy connections. This allows you to streamline your workflows and enhance productivity.

-

What features does airSlate SignNow offer for managing the New York Form IT 242 Claim For Conservation Easement Tax Credit?

airSlate SignNow includes features such as document templates, secure storage, and real-time tracking for the New York Form IT 242 Claim For Conservation Easement Tax Credit. These tools empower businesses to handle their documentation with ease and security. Our user-friendly interface ensures that every step is straightforward.

-

What benefits can I expect from using airSlate SignNow for my New York Form IT 242 Claim For Conservation Easement Tax Credit?

Using airSlate SignNow for your New York Form IT 242 Claim For Conservation Easement Tax Credit offers enhanced accuracy, security, and convenience. You reduce the risk of errors associated with manual handling and ensure timely submissions. This not only speeds up processing times but also helps avoid penalties.

-

Is airSlate SignNow secure for handling sensitive documents like the New York Form IT 242 Claim For Conservation Easement Tax Credit?

Absolutely! airSlate SignNow prioritizes security, offering end-to-end encryption for your documents, including the New York Form IT 242 Claim For Conservation Easement Tax Credit. Our platform complies with industry standards to ensure your data remains protected during eSigning and storage. You can confidently manage your important paperwork.

Get more for New York Form IT 242 Claim For Conservation Easement Tax Credit

- Patrick holiday outreach program application form

- Consent of director form nova scotia

- Bishops pumpkin farm application form

- Forma standarde per kontrate

- Federal quota order form

- Queens college transcript request form

- Refund request los angeles city college lacitycollege form

- Marketing request form template 214787380

Find out other New York Form IT 242 Claim For Conservation Easement Tax Credit

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe