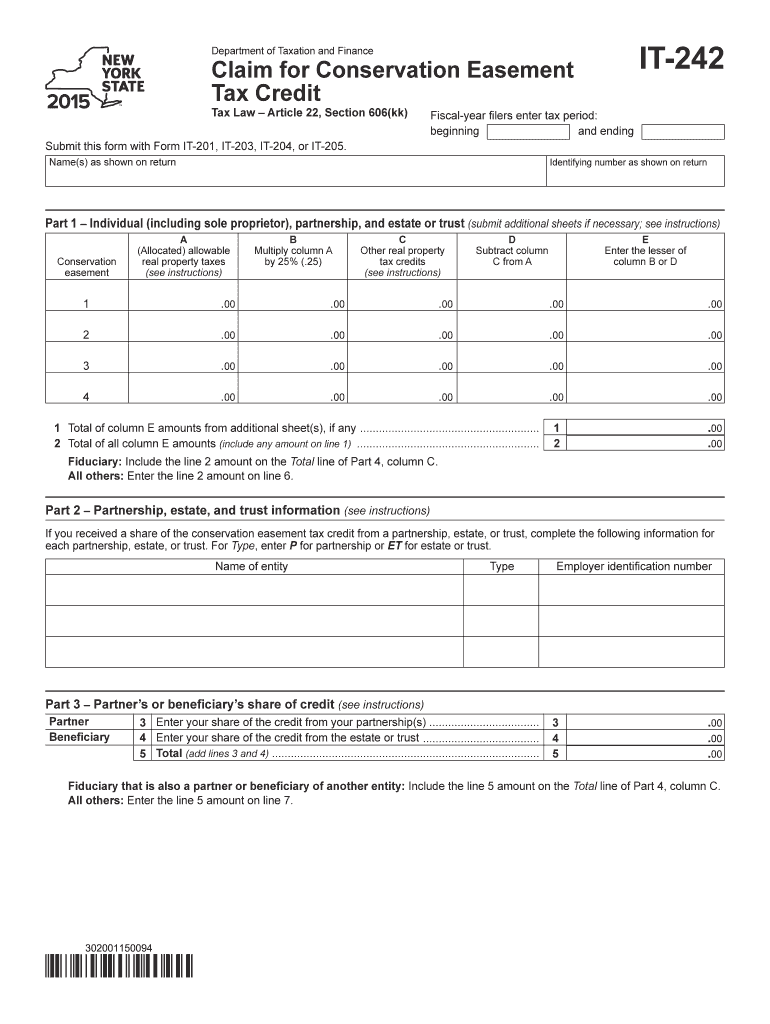

it 242 Form 2015

What is the It 242 Form

The It 242 Form is a specific tax document used by residents of the United States to report certain income and deductions on their state tax returns. This form is essential for ensuring compliance with state tax regulations and accurately calculating tax liabilities. It is designed to capture various financial details, allowing taxpayers to disclose their income sources and applicable deductions effectively. Understanding the purpose and requirements of the It 242 Form is crucial for individuals and businesses to fulfill their tax obligations accurately.

Steps to complete the It 242 Form

Completing the It 242 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as W-2s, 1099s, and receipts for deductions. Next, carefully read the instructions provided with the form to understand the required information. Fill in the form with accurate details, ensuring that all income sources and deductions are reported correctly. After completing the form, review it for any errors or omissions before signing and dating it. Finally, submit the form through the appropriate channels, whether electronically or by mail, based on your state’s submission guidelines.

How to obtain the It 242 Form

The It 242 Form can be obtained through various channels. Most states provide the form on their official tax department websites, where taxpayers can download and print it. Additionally, local tax offices may have physical copies available for pickup. Some tax preparation software also includes the It 242 Form, allowing users to complete it digitally. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal use of the It 242 Form

The It 242 Form must be used in accordance with state tax laws to ensure its legal validity. Taxpayers are required to provide accurate information and adhere to the guidelines set forth by their state’s tax authority. Misrepresentation or failure to file the form can result in penalties, including fines or additional taxes owed. It is essential to understand the legal implications of submitting the It 242 Form and to maintain accurate records to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the It 242 Form vary by state, but they typically align with the federal tax filing deadline of April 15. Some states may offer extensions or have different deadlines for specific circumstances, such as for businesses or individuals with special tax situations. It is important to stay informed about these dates to avoid late penalties and ensure timely compliance with tax obligations. Mark your calendar and set reminders to ensure you meet all necessary deadlines.

Required Documents

To complete the It 242 Form accurately, several documents are required. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any deductions claimed, such as receipts for business expenses or charitable contributions. Having these documents organized and readily available will facilitate the completion of the form and help ensure that all information is reported accurately. Failure to provide necessary documentation may result in delays or issues with your tax filing.

Form Submission Methods (Online / Mail / In-Person)

The It 242 Form can be submitted through various methods, depending on state regulations. Many states offer online submission options, allowing taxpayers to file their forms electronically for faster processing. Alternatively, the form can be mailed to the appropriate tax authority, ensuring that it is sent well before the deadline to avoid late penalties. Some states may also allow in-person submissions at local tax offices. It is essential to verify the submission methods accepted by your state to ensure compliance and timely processing of your tax return.

Quick guide on how to complete it 242 2015 form

Your assistance manual on how to prepare your It 242 Form

If you're wondering how to complete and submit your It 242 Form, here are a few concise guidelines to make tax processing more manageable.

To begin, you simply need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, create, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify details as necessary. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing features.

Follow the steps below to complete your It 242 Form in just a few minutes:

- Establish your account and start working on PDFs within no time.

- Utilize our directory to acquire any IRS tax form; browse through variants and schedules.

- Press Get form to access your It 242 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Review your document and rectify any inaccuracies.

- Store changes, print your version, send it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return discrepancies and delay refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct it 242 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 242 2015 form

How to generate an eSignature for your It 242 2015 Form in the online mode

How to create an electronic signature for the It 242 2015 Form in Google Chrome

How to make an electronic signature for signing the It 242 2015 Form in Gmail

How to create an electronic signature for the It 242 2015 Form from your smart phone

How to make an electronic signature for the It 242 2015 Form on iOS devices

How to create an electronic signature for the It 242 2015 Form on Android OS

People also ask

-

What is the IT 242 Form and why is it important?

The IT 242 Form is a crucial document used for reporting income and expenses for tax purposes. It helps businesses accurately file their taxes and maintain compliance with state regulations. Using airSlate SignNow, you can easily eSign and send the IT 242 Form securely, ensuring timely submission.

-

How does airSlate SignNow simplify the process of completing the IT 242 Form?

airSlate SignNow streamlines the process of completing the IT 242 Form by allowing users to fill out, sign, and send documents digitally. This eliminates the need for printing and mailing, saving time and resources. With our intuitive platform, you can focus on your business while we handle the paperwork.

-

What features does airSlate SignNow offer for handling the IT 242 Form?

AirSlate SignNow offers features like customizable templates, mobile access, and real-time tracking for the IT 242 Form. These tools enhance efficiency by allowing businesses to manage their documents from anywhere, ensuring that all signatures are collected promptly. Additionally, our audit trail keeps your documents secure and compliant.

-

Is there a cost associated with using airSlate SignNow for the IT 242 Form?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs, including options for handling the IT 242 Form. These plans are designed to be cost-effective, ensuring you have access to all necessary features without breaking the bank. You can choose the plan that best suits your volume of document management.

-

Can I integrate airSlate SignNow with other software for the IT 242 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to enhance your workflow with the IT 242 Form. Whether you're using CRM systems, accounting software, or cloud storage solutions, our integrations simplify document management and ensure all your data is synchronized.

-

What are the benefits of using airSlate SignNow for the IT 242 Form?

Using airSlate SignNow for the IT 242 Form provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. You can eSign documents in minutes rather than days, and our platform ensures that your sensitive information is protected. This allows you to focus on growing your business while we take care of your document needs.

-

How secure is the airSlate SignNow platform for the IT 242 Form?

The security of your documents is our top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your IT 242 Form and other sensitive documents. This ensures that your information remains confidential and secure from unauthorized access.

Get more for It 242 Form

Find out other It 242 Form

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy