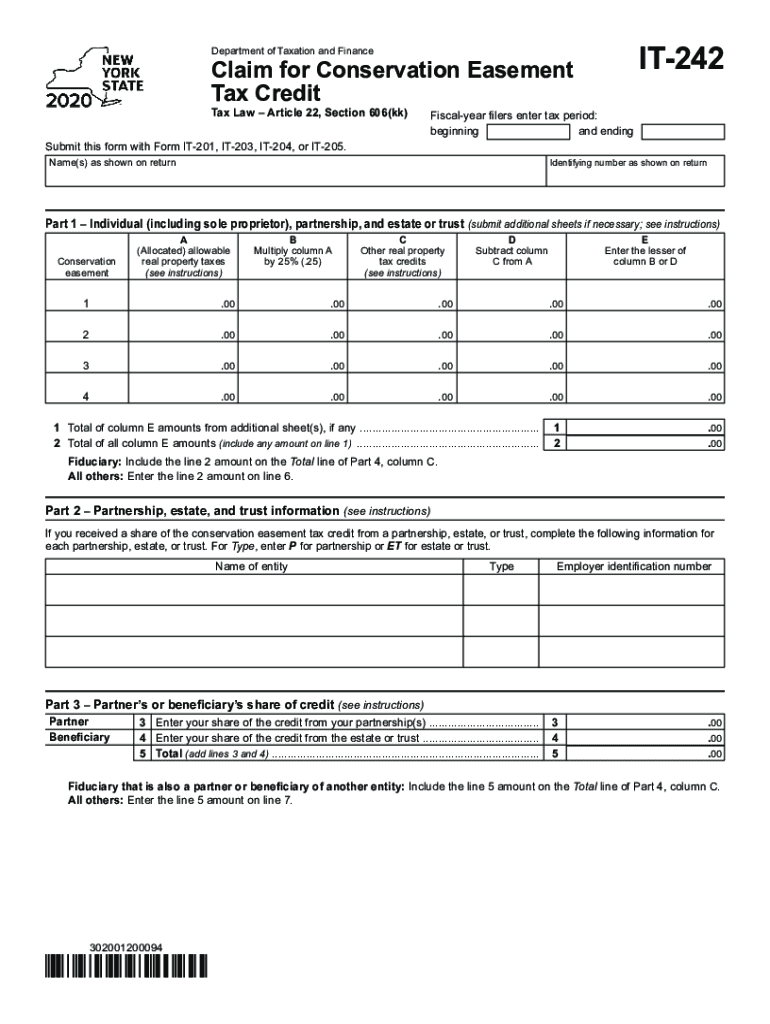

Form it 242 Claim for Conservation Easement Tax Credit Tax Year 2020

What is the Form IT 242 Claim For Conservation Easement Tax Credit Tax Year

The Form IT 242 is a tax form used in New York State for claiming a conservation easement tax credit. This credit is available to taxpayers who donate a conservation easement on their property, allowing for the preservation of open space, agricultural land, and natural resources. The form is specifically designed to help individuals and businesses report their contributions and claim the associated tax benefits for the relevant tax year.

How to use the Form IT 242 Claim For Conservation Easement Tax Credit Tax Year

To use the Form IT 242 effectively, taxpayers must first ensure they meet the eligibility criteria for the conservation easement tax credit. Once eligibility is confirmed, the taxpayer should fill out the form accurately, providing information about the property, the easement donation, and any other required details. It is important to follow the instructions carefully to ensure that all necessary information is included, which will facilitate the processing of the claim.

Steps to complete the Form IT 242 Claim For Conservation Easement Tax Credit Tax Year

Completing the Form IT 242 involves several key steps:

- Gather necessary documentation, including proof of the easement donation and property details.

- Fill out the form with accurate information regarding the taxpayer's identity, property, and easement specifics.

- Review the completed form to ensure all sections are filled out correctly.

- Submit the form by the designated deadline, either electronically or via mail, as per the submission guidelines.

Eligibility Criteria

To qualify for the conservation easement tax credit using Form IT 242, taxpayers must meet specific eligibility criteria. These include being an owner of the property where the easement is donated and ensuring that the easement meets the definition set forth by New York State law. Additionally, the easement must be granted to a qualified organization that is authorized to hold such easements. Taxpayers should review the full eligibility requirements outlined in the form instructions to confirm their status.

Required Documents

When completing the Form IT 242, taxpayers must provide several supporting documents to substantiate their claim. These typically include:

- Proof of the conservation easement donation, such as a copy of the easement agreement.

- Documentation of the property's value before and after the easement.

- Any additional forms or schedules required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Form IT 242. Generally, the form must be submitted by the due date for the tax return for the year in which the easement was donated. Taxpayers should check the New York State Department of Taxation and Finance website for the most current deadlines and any updates that may affect their filing schedule.

Quick guide on how to complete form it 242 claim for conservation easement tax credit tax year 2020

Complete Form IT 242 Claim For Conservation Easement Tax Credit Tax Year seamlessly on any device

Digital document management has gained traction with companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the required form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Administer Form IT 242 Claim For Conservation Easement Tax Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form IT 242 Claim For Conservation Easement Tax Credit Tax Year effortlessly

- Find Form IT 242 Claim For Conservation Easement Tax Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your method for submitting your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 242 Claim For Conservation Easement Tax Credit Tax Year and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 242 claim for conservation easement tax credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 242 claim for conservation easement tax credit tax year 2020

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is NYS Form IT 242?

NYS Form IT 242 is a tax form used by businesses in New York for filing certain tax credits and deductions. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow can help streamline the process of preparing and submitting NYS Form IT 242 electronically.

-

How can airSlate SignNow help with NYS Form IT 242?

airSlate SignNow simplifies the signing and submission process of NYS Form IT 242 by providing a user-friendly platform for eSigning documents. With its easy-to-navigate interface, you can quickly gather needed signatures and ensure that your tax form is filed correctly and on time.

-

Is there a cost to use airSlate SignNow for NYS Form IT 242?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan is designed to provide cost-effective solutions, so you can efficiently handle documents like NYS Form IT 242 without breaking the bank.

-

What features does airSlate SignNow provide for NYS Form IT 242?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure document storage. These features are particularly beneficial when working with NYS Form IT 242, as they facilitate a fast, secure, and organized way to manage your tax filings.

-

Can airSlate SignNow integrate with other software for NYS Form IT 242?

Yes, airSlate SignNow integrates seamlessly with various applications, making it easier to manage your documents related to NYS Form IT 242. This capability allows you to automate workflows and keep your documents organized across different platforms.

-

What are the benefits of using airSlate SignNow for NYS Form IT 242?

Using airSlate SignNow for NYS Form IT 242 offers many benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform helps businesses save time and minimizes errors in document management, making tax season less stressful.

-

Is airSlate SignNow secure for handling NYS Form IT 242?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption technologies to protect your documents, including NYS Form IT 242. You can trust that your sensitive information is safe throughout the signing and submission process.

Get more for Form IT 242 Claim For Conservation Easement Tax Credit Tax Year

- Driver induction template form

- English file intermediate third edition tests pdf form

- Form 51 pdf

- Klb chemistry book 2 notes pdf form

- Cpt code guidelines for x ray ct and mri form

- T20 cricket score sheet pdf form

- Upper miramichi firearms club incorporated form

- Application for utility service starkville utilities form

Find out other Form IT 242 Claim For Conservation Easement Tax Credit Tax Year

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement