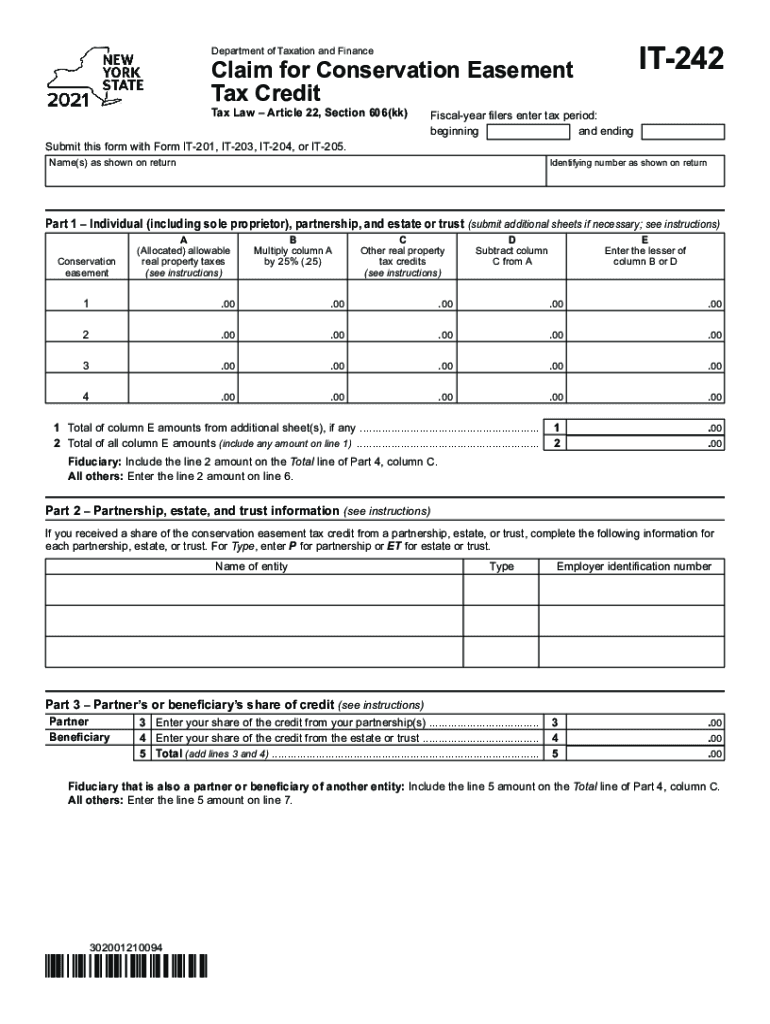

Form it 242 Claim for Conservation Easement Tax Credit Tax 2021

What is the Form IT 242 Claim For Conservation Easement Tax Credit Tax

The Form IT 242 is a tax form used in the United States for claiming the Conservation Easement Tax Credit. This credit is designed to encourage landowners to preserve their land for conservation purposes. By donating a conservation easement, landowners can receive a tax credit that reduces their overall tax liability. The form captures essential information about the property, the easement, and the taxpayer, ensuring compliance with state regulations.

How to use the Form IT 242 Claim For Conservation Easement Tax Credit Tax

Using the Form IT 242 involves several steps to ensure accurate submission. First, gather all necessary documentation related to the conservation easement, including appraisals and legal descriptions of the property. Next, complete the form by providing detailed information about the property, the easement, and the taxpayer. It is crucial to review the instructions carefully to ensure all required fields are filled out correctly. Finally, submit the completed form to the appropriate tax authority, either electronically or via mail.

Steps to complete the Form IT 242 Claim For Conservation Easement Tax Credit Tax

Completing the Form IT 242 requires attention to detail. Here are the essential steps:

- Gather all relevant documents, including property deeds and easement agreements.

- Fill out the taxpayer information section, including name, address, and Social Security number.

- Provide details about the property, including its location and size.

- Describe the conservation easement, including its purpose and any restrictions.

- Calculate the tax credit based on the value of the easement and follow the provided guidelines.

- Review the completed form for accuracy before submission.

Legal use of the Form IT 242 Claim For Conservation Easement Tax Credit Tax

The legal use of the Form IT 242 is governed by state tax laws and regulations. To ensure that the tax credit is valid, the conservation easement must meet specific criteria established by law. This includes the easement's purpose, which should align with conservation efforts, as well as compliance with any local or federal regulations. Proper documentation and adherence to legal requirements are essential for the form to be accepted by tax authorities.

Eligibility Criteria

To qualify for the Conservation Easement Tax Credit using Form IT 242, taxpayers must meet certain eligibility criteria. The property must be located in the United States and must be subject to a qualified conservation easement. Additionally, the landowner must be the property owner at the time of the easement donation. It is also essential that the easement is for a qualified purpose, such as preserving open space, protecting wildlife habitats, or maintaining agricultural land.

Required Documents

When completing the Form IT 242, several documents are required to support the claim. These include:

- A copy of the conservation easement deed.

- An appraisal report that establishes the value of the easement.

- Any relevant legal agreements or contracts related to the easement.

- Proof of ownership of the property, such as a deed or title.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 242 vary based on the tax year and specific state regulations. Generally, it is advisable to submit the form by the tax filing deadline for the year in which the easement was donated. Taxpayers should be aware of any extensions that may apply and ensure timely submission to avoid penalties. Keeping track of important dates is crucial for maintaining eligibility for the tax credit.

Quick guide on how to complete form it 242 claim for conservation easement tax credit tax

Complete Form IT 242 Claim For Conservation Easement Tax Credit Tax effortlessly on any device

Online document management has become widely adopted by companies and individuals alike. It serves as a perfect environmentally-friendly replacement for conventional printed and signed paperwork, since you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without any delays. Handle Form IT 242 Claim For Conservation Easement Tax Credit Tax on any device with the airSlate SignNow Android or iOS apps and enhance any document-related process today.

The easiest way to modify and eSign Form IT 242 Claim For Conservation Easement Tax Credit Tax with ease

- Obtain Form IT 242 Claim For Conservation Easement Tax Credit Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Select how you wish to share your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Edit and eSign Form IT 242 Claim For Conservation Easement Tax Credit Tax and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 242 claim for conservation easement tax credit tax

Create this form in 5 minutes!

How to create an eSignature for the form it 242 claim for conservation easement tax credit tax

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to it 242?

airSlate SignNow is a digital signature solution that enables businesses to send and eSign documents seamlessly. The tool is designed to streamline workflows and improve document management processes, making it an effective choice for organizations looking to optimize their 'it 242' operations.

-

How much does airSlate SignNow cost for my business needs, particularly regarding it 242?

Pricing for airSlate SignNow varies based on the plan you choose, but it is generally affordable and designed to fit the budget of businesses investing in 'it 242.' Several pricing tiers are available, offering options to suit different organizational needs and sizes.

-

What features does airSlate SignNow offer that are relevant for it 242?

airSlate SignNow provides features such as template creation, document tracking, and robust security, which are all beneficial for enhancing 'it 242' processes. These features help businesses manage their electronic documents efficiently while ensuring compliance with legal standards.

-

What are the main benefits of using airSlate SignNow for it 242?

The main benefits of airSlate SignNow for 'it 242' include increased efficiency, reduced turnaround time for document signing, and improved accuracy in document management. This solution empowers teams to focus more on critical tasks by automating mundane aspects of the signing process.

-

How does airSlate SignNow integrate with other tools for it 242?

airSlate SignNow offers a variety of integrations with popular business applications, which can signNowly enhance your 'it 242' workflow. By connecting with tools like Google Drive, Salesforce, and Zapier, teams can automate workflows that involve multiple platforms.

-

Can airSlate SignNow help with compliance and security for it 242?

Absolutely. airSlate SignNow prioritizes compliance by adhering to industry standards such as GDPR and HIPAA, supporting businesses in their 'it 242' compliance efforts. With options like two-factor authentication, you can ensure that your documents remain secure throughout the signing process.

-

Is airSlate SignNow user-friendly for teams focusing on it 242?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for teams to adopt the platform while focusing on their 'it 242' tasks. The intuitive interface simplifies the process of sending and signing documents, reducing the learning curve for new users.

Get more for Form IT 242 Claim For Conservation Easement Tax Credit Tax

Find out other Form IT 242 Claim For Conservation Easement Tax Credit Tax

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF