Instructions for Form 2210 2023-2026

What is the Instructions For Form 2210

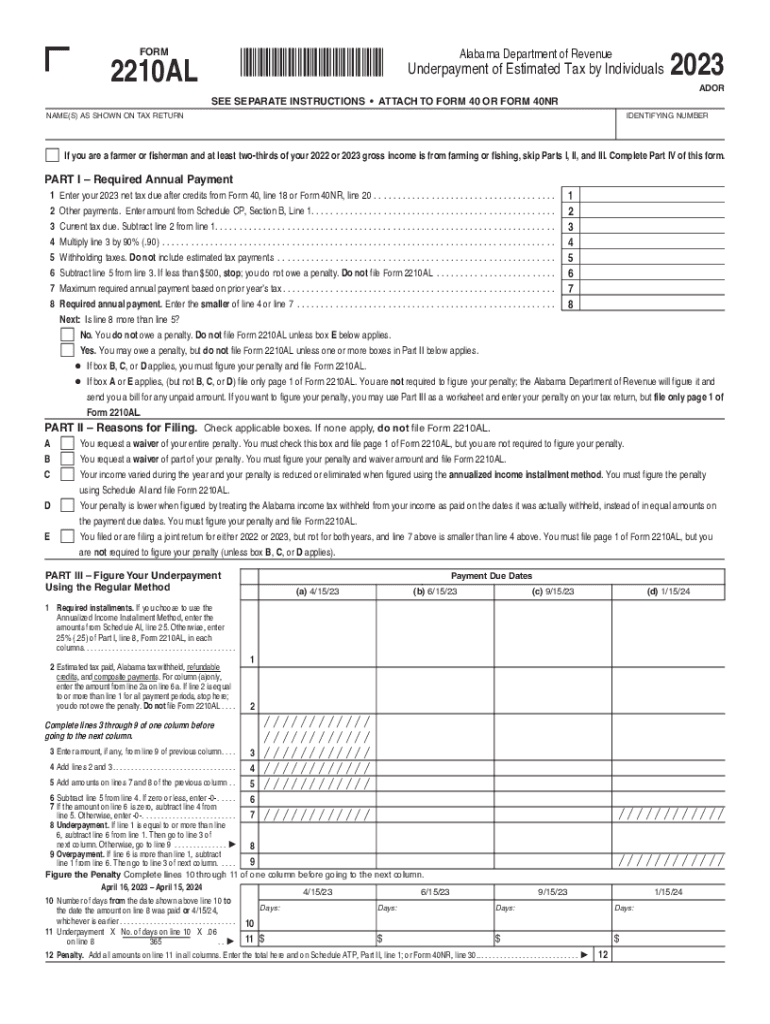

The Instructions for Form 2210 provide detailed guidance for taxpayers in Alabama who may face underpayment penalties due to insufficient estimated tax payments. This form is essential for individuals who do not meet the required payment thresholds throughout the tax year. Understanding these instructions helps ensure compliance with Alabama tax laws and avoids unnecessary penalties.

Steps to complete the Instructions For Form 2210

Completing the Instructions for Form 2210 involves several key steps:

- Gather your financial information, including income, deductions, and previous tax payments.

- Determine your total tax liability for the year to assess if you have underpaid.

- Calculate the required estimated tax payments based on your income and tax bracket.

- Fill out the Form 2210, ensuring all sections are completed accurately.

- Review your calculations to confirm that all figures align with your financial records.

- Submit the completed form to the Alabama Department of Revenue by the specified deadline.

Key elements of the Instructions For Form 2210

The key elements of the Instructions for Form 2210 include:

- Eligibility Criteria: Guidelines on who needs to file the form based on income levels and payment history.

- Payment Calculation: Detailed methods for calculating estimated tax payments to avoid penalties.

- Penalties for Non-Compliance: Information on potential penalties if the form is not filed correctly or on time.

- Submission Methods: Options for submitting the form, including online and by mail.

Filing Deadlines / Important Dates

Filing deadlines for Form 2210 are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is April 15 for most taxpayers. However, if you are filing for an extension, you may have until October 15. It is important to keep track of these dates to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 2210 can be submitted through various methods:

- Online: Many taxpayers prefer electronic submission through the Alabama Department of Revenue's online portal.

- Mail: You can also print the form and send it via postal service to the designated address provided in the instructions.

- In-Person: For those who prefer face-to-face interactions, forms can be submitted at local revenue offices.

Penalties for Non-Compliance

Failing to file Form 2210 or underpaying estimated taxes can lead to significant penalties. The Alabama Department of Revenue may impose fines based on the amount of underpayment and the duration of non-compliance. Understanding these penalties is essential for taxpayers to avoid unnecessary financial burdens.

Quick guide on how to complete instructions for form 2210

Prepare Instructions For Form 2210 effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Instructions For Form 2210 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign Instructions For Form 2210 seamlessly

- Obtain Instructions For Form 2210 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you'd like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form 2210 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 2210

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with 2023 alabama underpayment?

airSlate SignNow is an electronic signature platform that allows businesses to send and eSign documents efficiently. For those dealing with the 2023 alabama underpayment, it streamlines the paperwork process, ensuring that documents are signed and sent out promptly, minimizing delays in compliance and payment.

-

What features does airSlate SignNow offer for managing 2023 alabama underpayment?

airSlate SignNow includes features such as customizable templates, advanced tracking, and audit trails, which are especially useful for managing 2023 alabama underpayment documents. These features help ensure that all necessary forms are complete and submitted on time, reducing the risk of penalties.

-

How does airSlate SignNow's pricing compare for handling 2023 alabama underpayment?

airSlate SignNow offers competitive pricing that makes it a cost-effective solution for managing 2023 alabama underpayment needs. With various plans tailored to different business sizes, you can choose the option that best fits your budget while effectively managing your documentation.

-

Can airSlate SignNow integrate with other software to assist with 2023 alabama underpayment?

Yes, airSlate SignNow seamlessly integrates with many popular applications and software systems, enhancing your ability to manage 2023 alabama underpayment efficiently. This allows you to automate workflows and gather signatures through your existing tools, ensuring a smooth process.

-

What benefits does using airSlate SignNow provide for 2023 alabama underpayment documentation?

By using airSlate SignNow for 2023 alabama underpayment documentation, businesses can enjoy greater efficiency, improved compliance, and reduced turnaround time. This not only simplifies the process but also helps avoid costly mistakes and penalties associated with underpayment.

-

Is airSlate SignNow user-friendly for handling sensitive 2023 alabama underpayment information?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing anyone to navigate the platform easily when handling sensitive 2023 alabama underpayment information. Furthermore, it employs strong security measures to protect your documents and data.

-

How can I get support for issues related to 2023 alabama underpayment in airSlate SignNow?

airSlate SignNow provides excellent customer support for users facing issues with 2023 alabama underpayment. You can access the help center, contact customer support, or browse through tutorials and FAQs, ensuring you have the resources needed to resolve your queries.

Get more for Instructions For Form 2210

- Demand to clean up property landlord to tenant form

- Pursuant to my telephone conversation with form

- Affidavit of john doe i john doe being duly sworn declare form

- Consignment agreement wherefore harper college form

- Fillable online home affordable modification program hardship form

- State of fla et al v andre d peterson form

- State of indiana in thecourtcounty form

- Augusta county federal credit form

Find out other Instructions For Form 2210

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter