Form 2210AL Estimated Tax Penalties for Individuals 2020

Understanding the Form 2210AL for Estimated Tax Penalties

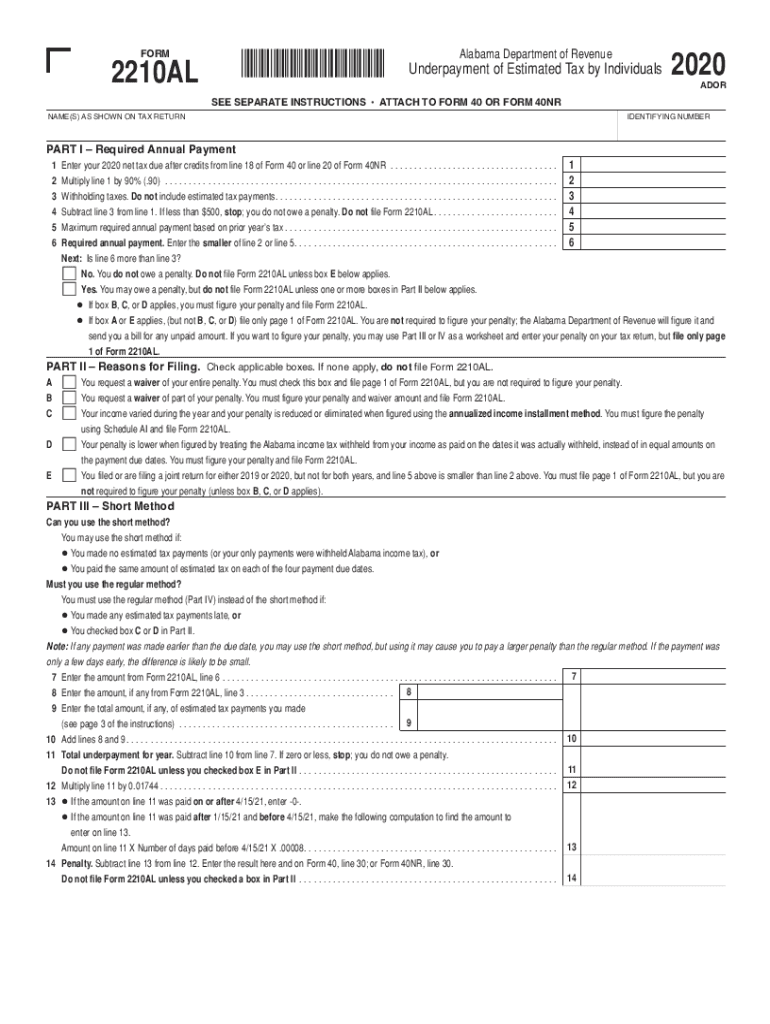

The Form 2210AL is specifically designed for individuals in Alabama who may face penalties for underpayment of estimated taxes. This form helps taxpayers calculate whether they owe a penalty due to insufficient payments throughout the tax year. Understanding the nuances of this form is crucial for ensuring compliance with Alabama tax laws and avoiding unnecessary penalties.

Steps to Complete the Form 2210AL

Completing the Form 2210AL involves several key steps that ensure accuracy and compliance. First, gather all relevant financial information, including your total income and tax liability for the year. Next, calculate your estimated tax payments made during the year. The form requires you to compare these payments against your total tax liability to determine if you owe a penalty. Follow the instructions carefully to fill out each section accurately, ensuring that all calculations are correct.

Legal Use of the Form 2210AL

The legal use of the Form 2210AL is grounded in its compliance with Alabama tax regulations. This form is recognized by the state as a valid means for taxpayers to report and calculate any penalties associated with underpayment of estimated taxes. It is essential to ensure that the form is completed accurately and submitted by the appropriate deadlines to avoid any legal repercussions.

Filing Deadlines for the Form 2210AL

Timely submission of the Form 2210AL is critical to avoid penalties. The form must be filed alongside your state tax return by the standard filing deadline, typically April 15 for individual taxpayers. If you have requested an extension for your tax return, ensure that the Form 2210AL is also submitted by the extended deadline to maintain compliance.

Obtaining the Form 2210AL

The Form 2210AL can be obtained through the Alabama Department of Revenue's website or by visiting local tax offices. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations. Additionally, many tax preparation software programs include the Form 2210AL, making it easier to complete your tax filings electronically.

Key Elements of the Form 2210AL

Key elements of the Form 2210AL include sections for reporting your total tax liability, estimated payments made, and calculations for any penalties owed. The form also includes instructions for determining if you qualify for any exceptions to the penalty, such as if your total tax liability is below a certain threshold. Understanding these elements is vital for accurately completing the form and ensuring compliance with state tax laws.

Quick guide on how to complete form 2210al 2020 estimated tax penalties for individuals

Complete Form 2210AL Estimated Tax Penalties For Individuals effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Form 2210AL Estimated Tax Penalties For Individuals on any device using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign Form 2210AL Estimated Tax Penalties For Individuals with ease

- Locate Form 2210AL Estimated Tax Penalties For Individuals and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device of your choice. Adjust and eSign Form 2210AL Estimated Tax Penalties For Individuals to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2210al 2020 estimated tax penalties for individuals

Create this form in 5 minutes!

How to create an eSignature for the form 2210al 2020 estimated tax penalties for individuals

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the 2210al form and how does airSlate SignNow simplify its signing process?

The 2210al form is an important document for taxpayers needing to report their annual underpayment of estimated tax. airSlate SignNow streamlines the signing process by providing an easy-to-use interface, allowing users to quickly eSign and send the 2210al without hassle.

-

How much does airSlate SignNow cost for users filing the 2210al?

Pricing for airSlate SignNow varies depending on the plan chosen. For users specifically dealing with the 2210al, you can select a plan that fits your needs, ensuring a cost-effective solution for eSigning and managing your documents.

-

What features does airSlate SignNow offer for eSigning the 2210al form?

airSlate SignNow offers features such as customizable templates, audit trails, and mobile signature capabilities, all optimized for efficiently managing the 2210al form. This empowers users to complete their eSigning process smoothly and securely.

-

Can I integrate airSlate SignNow with other applications to manage my 2210al forms?

Yes, airSlate SignNow provides seamless integrations with popular applications such as Google Drive and Dropbox. This allows users to efficiently manage and access their 2210al forms directly from their preferred platforms.

-

What are the benefits of using airSlate SignNow for the 2210al form?

Using airSlate SignNow for the 2210al form allows for faster processing, enhanced security, and streamlined workflows. With its user-friendly interface, it supports businesses in managing tax documentation more efficiently.

-

Is airSlate SignNow secure for signing sensitive documents like the 2210al?

Absolutely! airSlate SignNow employs robust encryption and security protocols to ensure that all documents, including the 2210al, are securely eSigned. This guarantees the confidentiality of your sensitive information.

-

Do I need any technical skills to use airSlate SignNow for the 2210al form?

No technical skills are required to use airSlate SignNow for signing the 2210al form. The platform is designed to be intuitive, making it accessible for users at any skill level to eSign documents effortlessly.

Get more for Form 2210AL Estimated Tax Penalties For Individuals

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent alaska form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable alaska form

- Letter from landlord to tenant variable day notice of expiration of lease and nonrenewal by landlord vacate by expiration alaska form

- Letter from tenant to landlord variable day notice to landlord that tenant will vacate premises on or prior to expiration of form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement alaska form

- Letter landlord rent template form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants alaska form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises alaska form

Find out other Form 2210AL Estimated Tax Penalties For Individuals

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online