Printable Alabama Form 2210AL Estimated Tax Penalties for Individuals 2019

What is the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

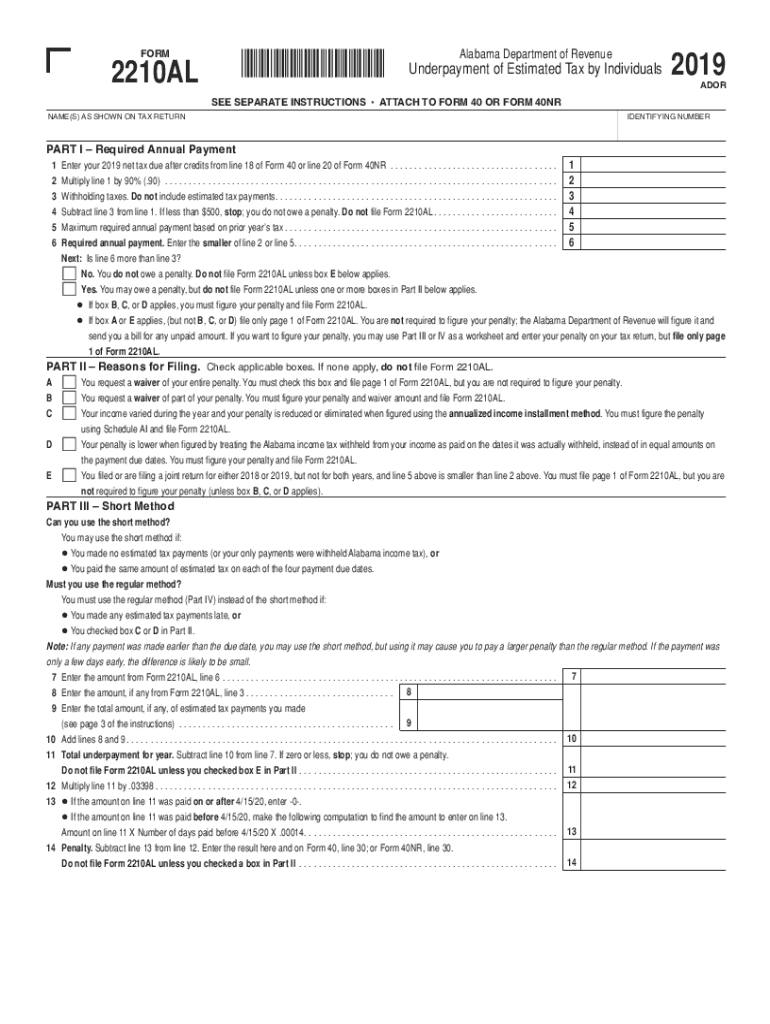

The Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals is a tax form specifically designed for individuals in Alabama who may face penalties related to underpayment of estimated taxes. This form helps taxpayers calculate any penalties incurred due to insufficient tax payments throughout the year. Understanding this form is essential for individuals who wish to ensure compliance with Alabama tax laws and avoid unnecessary penalties.

How to use the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

To effectively use the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals, start by gathering your financial information, including your income, deductions, and any previous tax payments made. The form requires you to input these details to determine if you owe any penalties. Follow the instructions provided on the form carefully, ensuring all calculations are accurate to avoid further issues with your tax obligations.

Steps to complete the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

Completing the Printable Alabama Form 2210AL involves several key steps:

- Gather necessary documents, such as income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have paid to date.

- Use the form to calculate any penalties based on the difference between your estimated tax liability and payments made.

- Review the completed form for accuracy before submission.

Legal use of the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

The legal use of the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals is crucial for ensuring compliance with state tax regulations. When filled out correctly, this form serves as an official document that can be used to report and rectify any underpayment issues. It is important to adhere to the guidelines set forth by the Alabama Department of Revenue to maintain the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Alabama Form 2210AL are typically aligned with the state’s tax deadlines. It is essential to be aware of these dates to avoid penalties. Generally, the form should be filed by the same deadlines as your annual tax return, which is usually April 15. However, if you are filing for an extension, ensure that you submit the form by the extended deadline to remain compliant.

Penalties for Non-Compliance

Failure to properly file the Printable Alabama Form 2210AL can result in significant penalties. These may include fines for late payments, interest on unpaid taxes, and additional penalties for not filing the form at all. It is crucial for individuals to understand these consequences and take appropriate measures to file the form on time to avoid financial repercussions.

Quick guide on how to complete printable 2020 alabama form 2210al estimated tax penalties for individuals

Effortlessly Prepare Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without hassle. Manage Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals with Ease

- Locate Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all information and click the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or save it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 alabama form 2210al estimated tax penalties for individuals

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 alabama form 2210al estimated tax penalties for individuals

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals?

The Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals is a tax form used by Alabama residents to calculate and report penalties for underpayment of estimated tax. This form helps individuals understand their tax obligations and avoid penalties, ensuring compliance with Alabama tax laws.

-

How can I use airSlate SignNow for the Printable Alabama Form 2210AL?

airSlate SignNow allows you to easily fill out and eSign the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals online. Using our platform, you can save time and ensure that your documents are signed securely and efficiently.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms such as the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals provides convenience and speed. Our platform not only simplifies the signing process but also allows for easy document sharing and collaboration, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow to manage tax forms?

Yes, there is an affordable subscription fee for using airSlate SignNow, which includes access to various features like document templates and eSignature capabilities. The cost is justified by the time and resources saved when managing forms like the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software systems. This means you can streamline your workflow even further when preparing forms like the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals.

-

Are there templates available for the Printable Alabama Form 2210AL?

Yes, airSlate SignNow provides customizable templates for the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals. This feature helps you quickly prepare and fill out the form while ensuring all necessary information is included.

-

What security measures does airSlate SignNow offer for sensitive documents?

airSlate SignNow prioritizes the security of your documents, including sensitive forms like the Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals. We utilize encryption, secure storage, and compliant practices to keep your data safe from unauthorized access.

Get more for Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

Find out other Printable Alabama Form 2210AL Estimated Tax Penalties For Individuals

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form