Declaration of Estimated Tax for Individuals General 2022

What is the Declaration of Estimated Tax for Individuals?

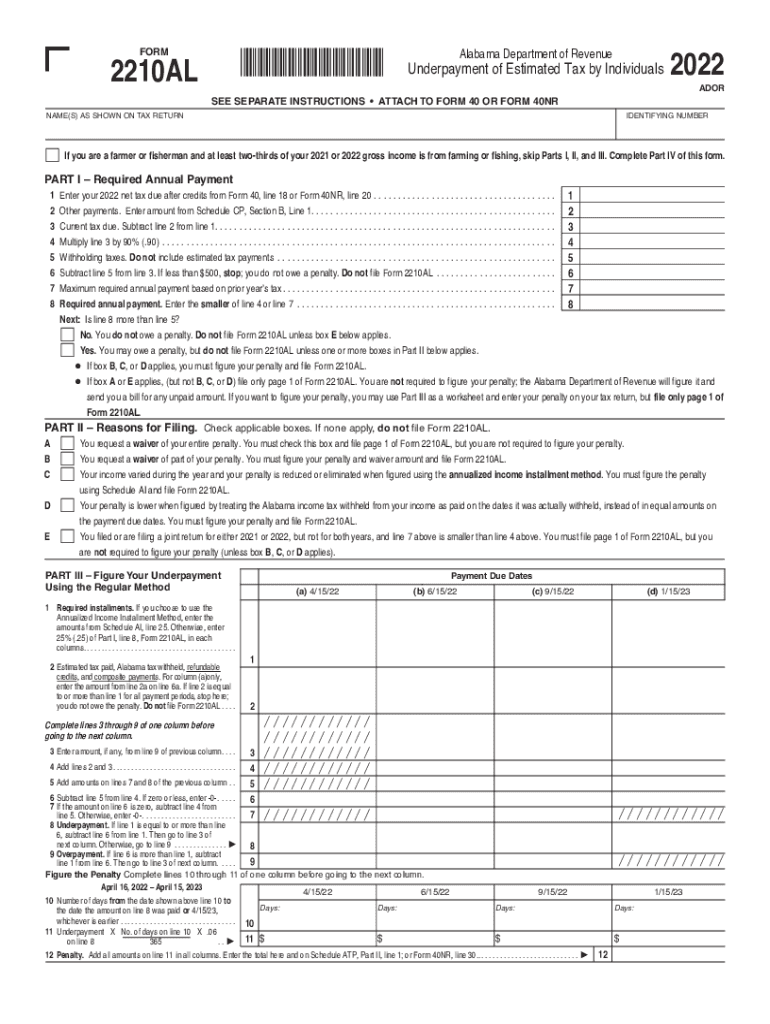

The Declaration of Estimated Tax for Individuals, commonly referred to as the 2210AL form, is a crucial document for Alabama taxpayers who expect to owe tax of $500 or more when filing their annual return. This form allows individuals to report and pay estimated taxes on income not subject to withholding, such as self-employment income, rental income, or dividends. By accurately completing the 2210AL, taxpayers can avoid underpayment penalties and ensure compliance with Alabama tax laws.

How to Use the Declaration of Estimated Tax for Individuals

Using the 2210AL form involves a few essential steps. First, gather all necessary financial information, including income sources and any applicable deductions. Next, calculate your expected tax liability for the year. This estimate will help determine your required quarterly payments. The form itself requires you to report your estimated income, deductions, and credits, which will ultimately guide your tax payments throughout the year. It is important to submit the form and make your payments on time to avoid penalties.

Steps to Complete the Declaration of Estimated Tax for Individuals

Completing the 2210AL form involves several key steps:

- Gather financial documents, including W-2s, 1099s, and previous tax returns.

- Estimate your total income for the year, including all sources of revenue.

- Calculate your expected deductions and credits to determine your taxable income.

- Use the Alabama tax tables to find your estimated tax liability based on your taxable income.

- Divide your total estimated tax by the number of payment periods to determine quarterly payment amounts.

- Fill out the 2210AL form with your calculated figures and submit it to the Alabama Department of Revenue.

Filing Deadlines / Important Dates

Timely filing of the 2210AL form is essential to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15: First quarter payment

- June 15: Second quarter payment

- September 15: Third quarter payment

- January 15 of the following year: Fourth quarter payment

It is advisable to mark these dates on your calendar to ensure compliance with Alabama tax regulations.

Penalties for Non-Compliance

Failure to file the 2210AL form or make the necessary estimated tax payments can result in significant penalties. Alabama imposes a penalty of one percent per month on any unpaid estimated tax. Additionally, if the total tax due exceeds $500 and the taxpayer has not made sufficient estimated payments, they may also face an underpayment penalty. It is crucial to stay informed and compliant to avoid these financial repercussions.

Legal Use of the Declaration of Estimated Tax for Individuals

The 2210AL form is legally recognized as a valid means for reporting and paying estimated taxes in Alabama. When completed accurately and submitted on time, it fulfills the taxpayer's obligations under Alabama tax law. The form must be signed and dated to ensure its legal standing. Digital signatures are accepted, provided they comply with the state’s eSignature regulations.

Quick guide on how to complete declaration of estimated tax for individuals general

Effortlessly Prepare Declaration Of Estimated Tax For Individuals General on Any Device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the right template and secure it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Declaration Of Estimated Tax For Individuals General on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Easiest Way to Edit and eSign Declaration Of Estimated Tax For Individuals General Seamlessly

- Find Declaration Of Estimated Tax For Individuals General and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Declaration Of Estimated Tax For Individuals General and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct declaration of estimated tax for individuals general

Create this form in 5 minutes!

How to create an eSignature for the declaration of estimated tax for individuals general

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Alabama underpayment tax?

The Alabama underpayment tax refers to the penalty imposed on taxpayers who have not paid enough tax throughout the year. It generally applies when your estimated tax payments fall short of your total tax liability. Understanding this concept is crucial for compliance and to avoid additional penalties.

-

How can airSlate SignNow help with Alabama underpayment tax documents?

airSlate SignNow simplifies the process of signing and sending documents related to the Alabama underpayment tax. Our electronic signature solution ensures that all your tax-related documents are securely signed and promptly delivered. This helps you maintain compliance while streamlining your tax submission process.

-

What features does airSlate SignNow offer for managing Alabama underpayment tax documents?

With airSlate SignNow, you can create templates, set signing workflows, and easily track the status of your Alabama underpayment tax documents. Features like automatic reminders and in-app notifications keep you informed and organized. These tools help save time and reduce the risk of errors when dealing with important tax documents.

-

Is airSlate SignNow cost-effective for small businesses handling Alabama underpayment tax?

Absolutely! airSlate SignNow offers competitive pricing that makes it an ideal solution for small businesses dealing with Alabama underpayment tax. Our plans are designed to fit various budgets while providing essential features for document management and e-signatures. You'll find that investing in our platform can lead to signNow time and cost savings.

-

Are there any integrations available to help with Alabama underpayment tax filing?

Yes, airSlate SignNow integrates with popular accounting and tax software, which can assist you in filing your Alabama underpayment tax. These integrations enable seamless data transfer and reduce duplication of effort. By incorporating SignNow into your existing workflow, you can enhance your efficiency during tax season.

-

What benefits do businesses gain by using airSlate SignNow for Alabama underpayment tax?

By using airSlate SignNow for your Alabama underpayment tax documentation, businesses gain efficiency and accuracy. Our platform ensures all documents are legally compliant and securely stored, reducing the risk of potential penalties. Furthermore, the ability to sign and send documents anytime, anywhere, enhances overall productivity.

-

Can airSlate SignNow help avoid penalties related to Alabama underpayment tax?

While airSlate SignNow cannot prevent tax penalties directly, it plays a signNow role in ensuring timely submission of Alabama underpayment tax documents. By streamlining the signing and sending process, you reduce the chances of late submissions. Proper organization and timely action can help you avoid underpayment penalties.

Get more for Declaration Of Estimated Tax For Individuals General

Find out other Declaration Of Estimated Tax For Individuals General

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free