Instructions for Form it 201 X Tax NY Gov New York State

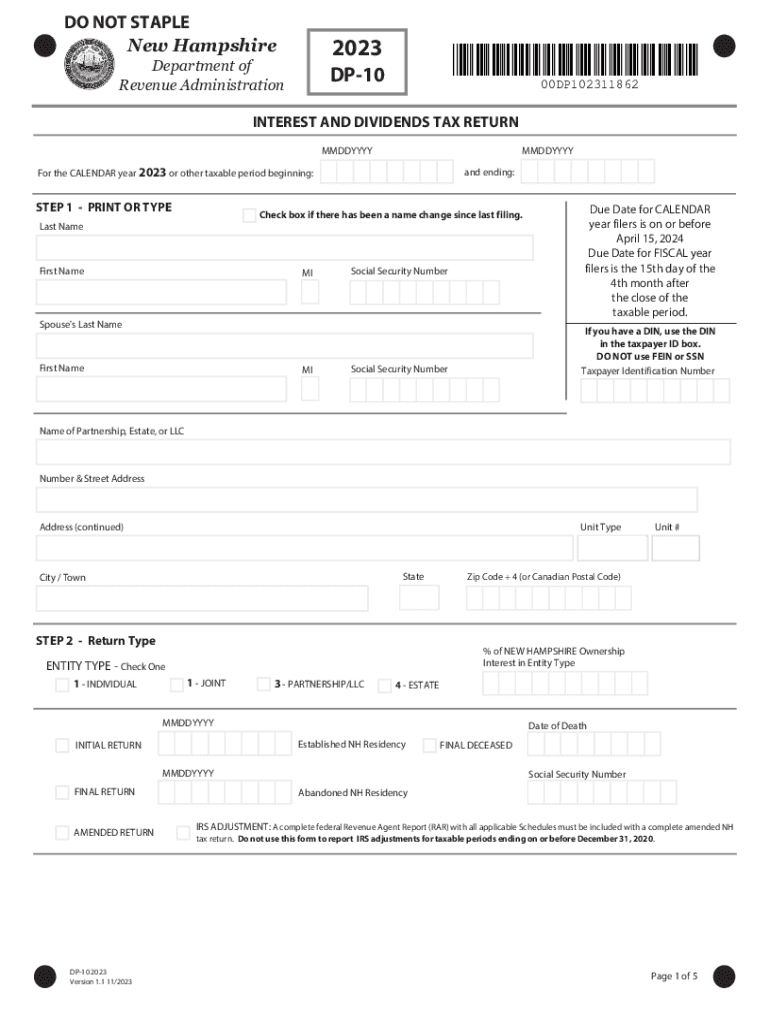

Understanding the New Hampshire DP 10 Form

The New Hampshire DP 10 form, also known as the NH DP 10, is a crucial document used for revenue reporting purposes. It is primarily utilized by businesses to report their revenue and other financial information to the state. This form plays a significant role in ensuring compliance with state tax regulations and helps in the accurate assessment of business taxes. Understanding the purpose and requirements of the DP 10 form is essential for any business operating in New Hampshire.

Steps to Complete the New Hampshire DP 10 Form

Completing the NH DP 10 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including revenue statements and expense reports. Next, fill out the form with accurate figures, ensuring that all sections are completed thoroughly. It's important to double-check the calculations to avoid errors that could lead to penalties. After completing the form, review it for completeness before submission.

Required Documents for the NH DP 10 Form

To accurately complete the New Hampshire DP 10 form, certain documents are required. These typically include:

- Financial statements for the reporting period

- Records of all revenue sources

- Expense reports detailing business costs

- Any prior year tax documents that may affect current reporting

Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is included.

Filing Deadlines for the NH DP 10 Form

Timely submission of the New Hampshire DP 10 form is crucial to avoid penalties. The filing deadline is typically aligned with the end of the business’s fiscal year. Businesses should be aware of specific deadlines set by the New Hampshire Department of Revenue Administration to ensure compliance. It is advisable to mark these dates on a calendar to avoid missing the submission window.

Penalties for Non-Compliance with the NH DP 10 Form

Failure to file the New Hampshire DP 10 form on time or inaccuracies in the submitted information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is essential for businesses to maintain good standing with state authorities.

Who Issues the New Hampshire DP 10 Form

The New Hampshire DP 10 form is issued by the New Hampshire Department of Revenue Administration. This department is responsible for overseeing tax compliance and ensuring that businesses adhere to state tax laws. For any questions regarding the form or its requirements, businesses can reach out directly to this department for assistance.

Quick guide on how to complete instructions for form it 201 x tax ny gov new york state

Effortlessly Prepare Instructions For Form IT 201 X Tax NY gov New York State on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any holdups. Handle Instructions For Form IT 201 X Tax NY gov New York State on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Simplest Method to Edit and eSign Instructions For Form IT 201 X Tax NY gov New York State with Ease

- Obtain Instructions For Form IT 201 X Tax NY gov New York State and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form IT 201 X Tax NY gov New York State while ensuring seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 201 x tax ny gov new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new hampshire dp 10, and how can it benefit my business?

The new hampshire dp 10 is an innovative digital document management solution designed to streamline the signing process. By using new hampshire dp 10, businesses can enhance workflow efficiency, reduce turnaround times, and improve overall document handling.

-

How does new hampshire dp 10 help with compliance and security?

New hampshire dp 10 includes robust security features that ensure your documents are protected and compliant with industry regulations. This solution offers encryption, user authentication, and audit trails, giving businesses peace of mind regarding their sensitive information.

-

What are the pricing options for new hampshire dp 10?

AirSlate SignNow offers competitive pricing for new hampshire dp 10, designed to accommodate businesses of all sizes. You can choose from monthly or yearly subscription plans that include all features, ensuring that you get the best value for your investment.

-

Can I integrate new hampshire dp 10 with other software solutions?

Yes, the new hampshire dp 10 integrates seamlessly with a variety of applications and software solutions, including CRM systems, cloud storage, and project management tools. This flexibility allows businesses to enhance their workflows without disrupting existing processes.

-

What features are included in the new hampshire dp 10 package?

The new hampshire dp 10 package includes features such as customizable templates, automatic reminders, and real-time tracking of document statuses. These tools help businesses manage documents efficiently and provide a superior signing experience.

-

Is it easy to set up and use the new hampshire dp 10?

Absolutely! The new hampshire dp 10 is designed with user-friendliness in mind. Users can easily set up the platform and start sending documents for e-signature within minutes, thanks to its intuitive interface and helpful resources.

-

What are the benefits of using new hampshire dp 10 compared to traditional signing methods?

Using new hampshire dp 10 offers numerous benefits, including faster turnaround times, reduced costs, and enhanced accuracy compared to traditional signing methods. Additionally, it eliminates the need for physical storage of documents, promoting a more organized and eco-friendly approach.

Get more for Instructions For Form IT 201 X Tax NY gov New York State

- Liability for defects in construction contracts form

- The air force journal of indo pacific affairs form

- Tx deed general warranty cash 12009 6formswww

- This arbitration submission agreement this agreementquot is made this form

- I have received your letter of resignation form

- Of shareholders on the day of 20 at form

- Irs tax lien help request right to redeem property pub 4235 form

- Dictionarycom form

Find out other Instructions For Form IT 201 X Tax NY gov New York State

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online