Www Online Tax ID Number OrgTennessee Sales TaxTENNESSEE DEPARTMENT of REVENUE REVISED STATE and LOCAL SALES 2022-2026

Understanding Tennessee Sales Tax

Tennessee sales tax is a tax imposed on the sale of goods and certain services in the state. The current state sales tax rate is seven percent, but local jurisdictions can add additional taxes, leading to varying rates across the state. Businesses must collect this tax from customers at the point of sale and remit it to the Tennessee Department of Revenue. It is important for businesses to be aware of the specific rates applicable in their local areas, as this can affect pricing and compliance.

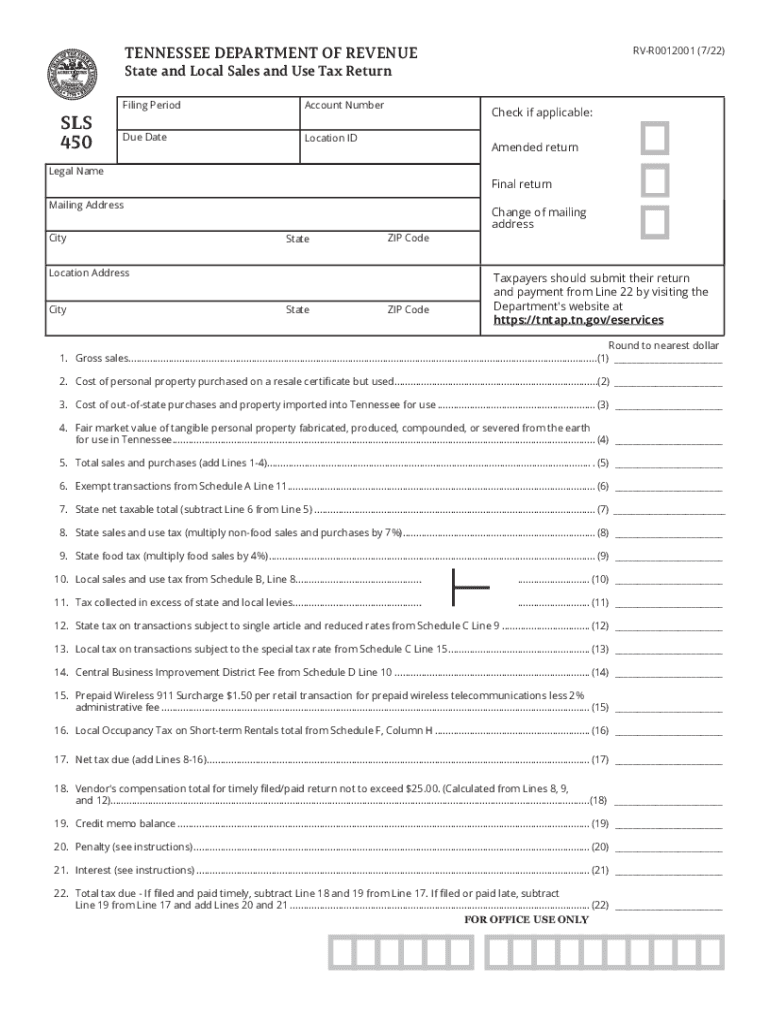

Steps to Complete the Tennessee Sales Tax Return (Form SLS 450)

To complete the Tennessee sales tax return using Form SLS 450, follow these steps:

- Gather all sales records for the reporting period, including invoices and receipts.

- Calculate the total sales subject to sales tax.

- Determine the total sales tax collected based on the applicable rates.

- Complete the form by entering the total sales and sales tax amounts in the designated fields.

- Review the form for accuracy before submission.

Filing Deadlines for Tennessee Sales Tax Returns

Filing deadlines for Tennessee sales tax returns vary based on the frequency of your reporting period. Monthly filers must submit their returns by the 20th of the following month. Quarterly filers have until the 20th of the month following the end of the quarter. Annual filers must submit their returns by January 31 of the following year. It is crucial to adhere to these deadlines to avoid penalties and interest on late payments.

Required Documents for Filing Tennessee Sales Tax

When filing your Tennessee sales tax return, you will need several documents to ensure accurate reporting:

- Sales records, including invoices and receipts.

- Previous sales tax returns for reference.

- Documentation of any exempt sales.

- Records of any local taxes collected.

Penalties for Non-Compliance with Tennessee Sales Tax Regulations

Failure to comply with Tennessee sales tax regulations can result in significant penalties. Businesses that do not file their returns on time may face a late filing penalty, which is typically a percentage of the tax due. Additionally, interest may accrue on unpaid taxes. In severe cases, the state may impose further legal action against non-compliant businesses. It is essential to maintain accurate records and file returns promptly to avoid these consequences.

Digital vs. Paper Version of Form SLS 450

Businesses have the option to file their Tennessee sales tax return either digitally or via paper. The digital version of Form SLS 450 is often more convenient, allowing for quicker processing and confirmation of submission. Electronic filing can reduce errors and streamline record-keeping. However, some businesses may prefer the paper version for its tangible nature. Regardless of the method chosen, ensuring accurate completion is critical for compliance.

Quick guide on how to complete www online tax id number orgtennessee sales taxtennessee department of revenue revised state and local sales

Handle Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly, without delays. Manage Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES with ease

- Obtain Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal value as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES and achieve seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www online tax id number orgtennessee sales taxtennessee department of revenue revised state and local sales

Create this form in 5 minutes!

How to create an eSignature for the www online tax id number orgtennessee sales taxtennessee department of revenue revised state and local sales

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tennessee sales tax and how does it affect my business?

Tennessee sales tax is a tax imposed on the sale of goods and services in the state of Tennessee. It can affect your business by influencing pricing strategies and compliance requirements. Understanding the implications of Tennessee sales tax is crucial for accurate billing and customer satisfaction.

-

How does airSlate SignNow help with managing sales tax documents?

airSlate SignNow provides an efficient platform to manage sales tax documents by enabling seamless electronic signing and secure document storage. This can simplify the process of obtaining necessary signatures on sales tax-related forms, helping you stay compliant with Tennessee sales tax regulations effectively.

-

Can I automate my sales tax processes with airSlate SignNow?

Yes, airSlate SignNow allows you to automate your sales tax document workflows. By integrating electronic signatures and automated reminders, you can efficiently handle Tennessee sales tax paperwork without manual intervention, saving time and reducing errors.

-

What features does airSlate SignNow offer for eSigning sales tax documents?

airSlate SignNow offers multiple features for eSigning sales tax documents, including template creation, bulk sending, and remote signing capabilities. These features optimize the signing process for your Tennessee sales tax documents, ensuring all parties can complete transactions quickly and easily.

-

Is airSlate SignNow compliant with Tennessee sales tax regulations?

Absolutely! airSlate SignNow is designed with compliance in mind, ensuring all electronic signatures and document processes adhere to Tennessee sales tax regulations. This commitment helps you maintain legal integrity while handling your sales tax documentation.

-

What are the pricing options for airSlate SignNow for small businesses dealing with Tennessee sales tax?

airSlate SignNow offers flexible pricing plans tailored for small businesses, making it affordable for those managing Tennessee sales tax processes. You can choose a plan that fits your budget while ensuring you have all the necessary tools for effective document management.

-

Can I integrate airSlate SignNow with other accounting software for sales tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and ERP software. This integration allows for streamlined coordination between your sales tax management and other financial tools, ensuring accuracy in your Tennessee sales tax computations.

Get more for Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES

- Sd notarial certificates notary stamp form

- Ohio southern district bankruptcy guide and forms package

- Alabama abandoned motor vehicle bill of salefrkwita form

- County of state of south dakota hereinafter seller whether one or form

- City of county of and state of south dakota towit form

- Plan dated form

- Bankruptcy fundamentals and advanced bankruptcy institute form

- 2019 bankruptcy forms for south dakotaupsolve

Find out other Www online tax id number orgTennessee Sales TaxTENNESSEE DEPARTMENT OF REVENUE REVISED STATE AND LOCAL SALES

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word