SLS 450 Sales & Use Tax for Periods Beginning 11 and After SLS 450 Sales & Use Tax for Periods Beginning 11 and After 2020

Understanding the SLS 450 Sales & Use Tax Form

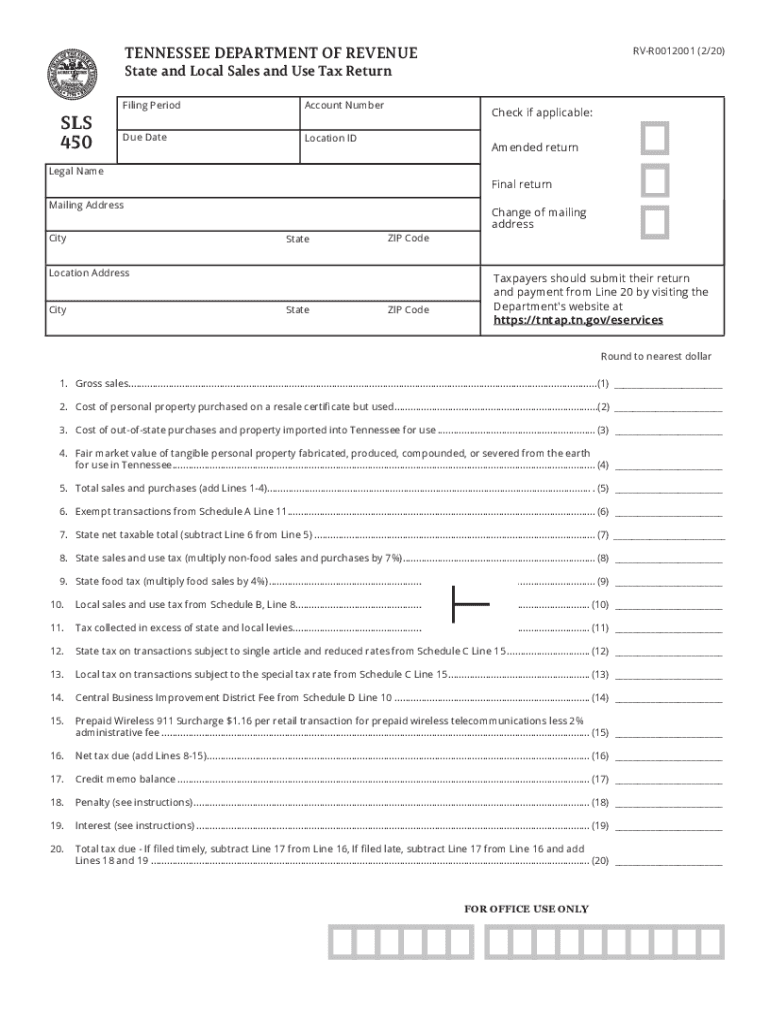

The SLS 450 form is essential for reporting sales and use tax in Tennessee. It is specifically designed for businesses to accurately declare their tax obligations for periods beginning on the eleventh day of the month and thereafter. Understanding the purpose of this form is crucial for compliance with state tax regulations. The form captures details about taxable sales, exempt sales, and the total amount of tax due.

Steps to Complete the SLS 450 Form

Completing the SLS 450 form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary sales records for the reporting period. Next, calculate the total taxable sales and any exemptions. Fill in the form with the required information, ensuring that all figures are accurate. Finally, review the completed form for any errors before submission.

Filing Deadlines for the SLS 450 Form

Timely filing of the SLS 450 form is crucial to avoid penalties. The form must be submitted by the last day of the month following the end of the reporting period. For example, if the reporting period ends on December 31, the form is due by January 31. Keeping track of these deadlines helps ensure compliance with Tennessee state tax laws.

Penalties for Non-Compliance with the SLS 450

Failure to file the SLS 450 form on time can result in significant penalties. The state of Tennessee imposes fines for late submissions, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid taxes. Understanding these consequences emphasizes the importance of timely and accurate filing.

Legal Use of the SLS 450 Form

The SLS 450 form is legally binding when filled out correctly and submitted on time. It serves as an official record of a business's sales and use tax obligations in Tennessee. Compliance with the form's requirements ensures that businesses meet state tax laws and avoid legal issues related to tax evasion or misreporting.

State-Specific Rules for the SLS 450 Form

Tennessee has specific rules governing the use of the SLS 450 form. Businesses must adhere to guidelines regarding what constitutes taxable sales and the types of exemptions that can be claimed. Familiarity with these rules is essential for accurate reporting and compliance with state tax regulations.

Quick guide on how to complete sls 450 sales amp use tax for periods beginning 112020 and after sls 450 sales amp use tax for periods beginning 112020 and

Effortlessly Prepare SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process now.

How to Edit and eSign SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After with Ease

- Obtain SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, shareable link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sls 450 sales amp use tax for periods beginning 112020 and after sls 450 sales amp use tax for periods beginning 112020 and

Create this form in 5 minutes!

How to create an eSignature for the sls 450 sales amp use tax for periods beginning 112020 and after sls 450 sales amp use tax for periods beginning 112020 and

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is tennessee sales tax and how does it affect my business?

Tennessee sales tax is a tax imposed on the sale of goods and services in the state. Businesses operating in Tennessee must understand their obligations to collect and remit this tax. Using airSlate SignNow can help streamline your document processes, ensuring that any transaction documents are compliant with Tennessee sales tax regulations.

-

How can airSlate SignNow help me manage tennessee sales tax documents?

airSlate SignNow provides an efficient solution for managing all your sales tax-related documents. With features like eSignature and document tracking, you can ensure that all contracts and agreements related to Tennessee sales tax are executed promptly and stored securely. This can help you minimize errors and save time.

-

What pricing options does airSlate SignNow offer for businesses handling tennessee sales tax?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes managing Tennessee sales tax. You can choose from varied plans that cater to different organizational needs, ensuring you only pay for the features you require. This cost-effective solution is designed to provide signNow value, especially for those dealing with complex tax requirements.

-

Are there any integrations available with airSlate SignNow that assist in managing tennessee sales tax?

Yes, airSlate SignNow offers integrations with various accounting and tax software that can help businesses streamline their Tennessee sales tax processes. These integrations enable automatic updates and better tracking of sales tax documentation. By combining airSlate SignNow’s eSigning capabilities with your existing tools, you can enhance efficiency in managing your tax obligations.

-

What are the benefits of using airSlate SignNow for Tennessee sales tax compliance?

Using airSlate SignNow for managing Tennessee sales tax compliance offers several advantages, including increased accuracy, reduced administrative burden, and faster document turnaround. Its user-friendly interface and robust features simplify the signing process for all parties involved. By ensuring that documents are correctly handled, you can maintain compliance with Tennessee sales tax laws.

-

Can airSlate SignNow assist in generating reports related to tennessee sales tax?

Yes, airSlate SignNow can assist in generating reports related to Tennessee sales tax by providing access to tracking and audit trails of all signed documents. This feature allows businesses to easily compile necessary information for reporting purposes. Having accurate reports readily available simplifies audits and compliance checks regarding Tennessee sales tax.

-

Is airSlate SignNow secure for handling sensitive tennessee sales tax information?

Absolutely, airSlate SignNow is designed with security in mind. It employs top-notch encryption measures to ensure that sensitive information related to Tennessee sales tax is protected. This commitment to security gives businesses peace of mind when managing their tax-related documents.

Get more for SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After

Find out other SLS 450 Sales & Use Tax For Periods Beginning 11 And After SLS 450 Sales & Use Tax For Periods Beginning 11 And After

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online