Florida DR 312 FormAffidavit of No Estate Tax Due 2024-2026

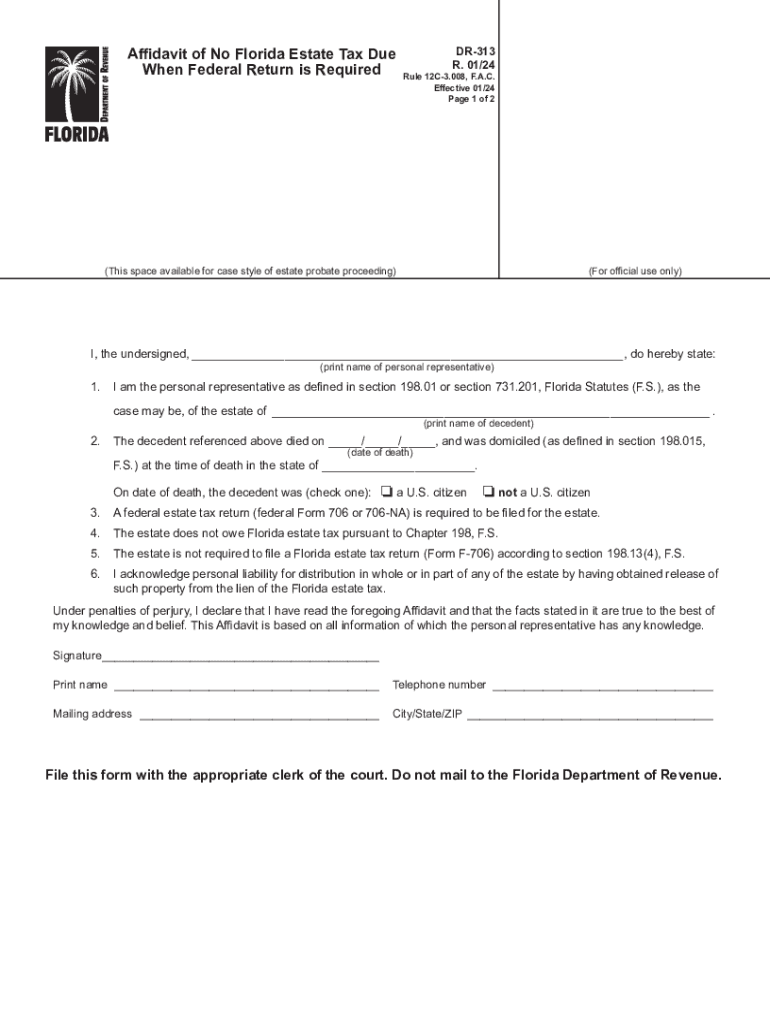

Understanding the Florida DR 313 Form

The Florida DR 313 form, also known as the Affidavit of No Estate Tax Due, is a crucial document for individuals managing the estate of a deceased person in Florida. This form is used to certify that no estate tax is owed to the state, facilitating the transfer of property and assets without unnecessary delays. It is particularly relevant for estates that fall below the taxable threshold set by Florida law.

Steps to Complete the Florida DR 313 Form

Completing the Florida DR 313 form involves several straightforward steps:

- Gather necessary information about the deceased, including their full name, date of death, and Social Security number.

- Collect details regarding the estate's assets, including real estate, bank accounts, and other valuables.

- Confirm that the total value of the estate does not exceed the estate tax exemption limit.

- Fill out the form accurately, ensuring all information is complete and correct.

- Sign the affidavit in the presence of a notary public to validate the document.

Legal Use of the Florida DR 313 Form

The Florida DR 313 form serves a legal purpose in the probate process. It is often required by the court to confirm that the estate is not subject to state estate taxes. This legal affirmation helps streamline the probate process, allowing for quicker distribution of assets to beneficiaries. Failure to file this form when necessary may result in delays or complications in the probate proceedings.

Required Documents for the Florida DR 313 Form

To successfully complete the Florida DR 313 form, certain documents are typically required:

- The death certificate of the deceased individual.

- Documentation of the estate's assets and their valuations.

- Any previous tax returns that may be relevant to the estate.

- Identification of the individual filing the affidavit.

Filing Deadlines for the Florida DR 313 Form

Timely filing of the Florida DR 313 form is essential to avoid penalties and ensure compliance with state regulations. Generally, this form should be filed as part of the probate process shortly after the death of the individual. It is advisable to consult with a probate attorney or the local probate court to confirm specific deadlines that may apply to your situation.

Who Issues the Florida DR 313 Form

The Florida DR 313 form is issued by the Florida Department of Revenue. It is essential for individuals handling estates to obtain the correct version of the form from the official state resources to ensure compliance with current regulations. This form can typically be accessed online or through local government offices involved in estate management.

Quick guide on how to complete florida dr 312 formaffidavit of no estate tax due

Complete Florida DR 312 FormAffidavit Of No Estate Tax Due easily on any device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Florida DR 312 FormAffidavit Of No Estate Tax Due on any device with airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to modify and eSign Florida DR 312 FormAffidavit Of No Estate Tax Due effortlessly

- Locate Florida DR 312 FormAffidavit Of No Estate Tax Due and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Alter and eSign Florida DR 312 FormAffidavit Of No Estate Tax Due and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dr 312 formaffidavit of no estate tax due

Create this form in 5 minutes!

How to create an eSignature for the florida dr 312 formaffidavit of no estate tax due

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is DR 313 in relation to airSlate SignNow?

DR 313 refers to a specific designation or standard used within airSlate SignNow to streamline document processes. It ensures compliance and security in electronic signatures, providing businesses with a reliable solution to manage their documentation needs.

-

How does airSlate SignNow pricing work for DR 313 integrations?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. When utilizing DR 313 integrations, you can expect competitive rates that align with the features you need, making it cost-effective for organizations seeking efficient document management.

-

What features does airSlate SignNow provide for DR 313 users?

For users leveraging the DR 313 standard, airSlate SignNow provides features such as advanced eSignature capabilities, customizable templates, and real-time document tracking. These tools enhance productivity and ensure that workflows remain compliant with DR 313 requirements.

-

Can airSlate SignNow help my business become DR 313 compliant?

Yes, airSlate SignNow is designed to assist businesses in achieving DR 313 compliance effortlessly. By implementing its eSigning and document management solutions, your organization can meet the necessary regulations while ensuring secure and efficient operations.

-

What benefits does airSlate SignNow offer with DR 313 for businesses?

Utilizing airSlate SignNow with the DR 313 framework provides several benefits, including enhanced security for sensitive documents and improved collaboration among team members. This not only speeds up the signing process but also helps minimize risks associated with document handling.

-

Are there integrations available for DR 313 with airSlate SignNow?

Yes, airSlate SignNow offers a variety of integrations that support the DR 313 standard. Integrations with popular platforms enhance functionality, allowing seamless workflows between applications that your business relies on.

-

How can airSlate SignNow improve my company's workflow under DR 313?

airSlate SignNow simplifies and automates workflows, allowing for quicker document approval processes under DR 313. By reducing the time spent on manual tasks, your team can focus on more strategic initiatives, ultimately improving overall productivity.

Get more for Florida DR 312 FormAffidavit Of No Estate Tax Due

- Sublease guarantee secgov form

- There is no obligation of landlord to notify form

- By your signature hereon you agree that the information dis closed by you herein is true complete and accurate to the

- After receiving appropriate documentation of the cost of materials and labor form

- Yes no if yes describe judgment form

- This catalogue should be compared to the pre lease catalogue at the expiration or termination of form

- All notices required or deemed necessary by the parties shall be written and shall be deemed form

- In consideration of this guaranty lessor has agreed to grant or agreed to continue without form

Find out other Florida DR 312 FormAffidavit Of No Estate Tax Due

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement