Florida Form DR 313 Florida Department of Revenue 2021

What is the Florida Form DR 313?

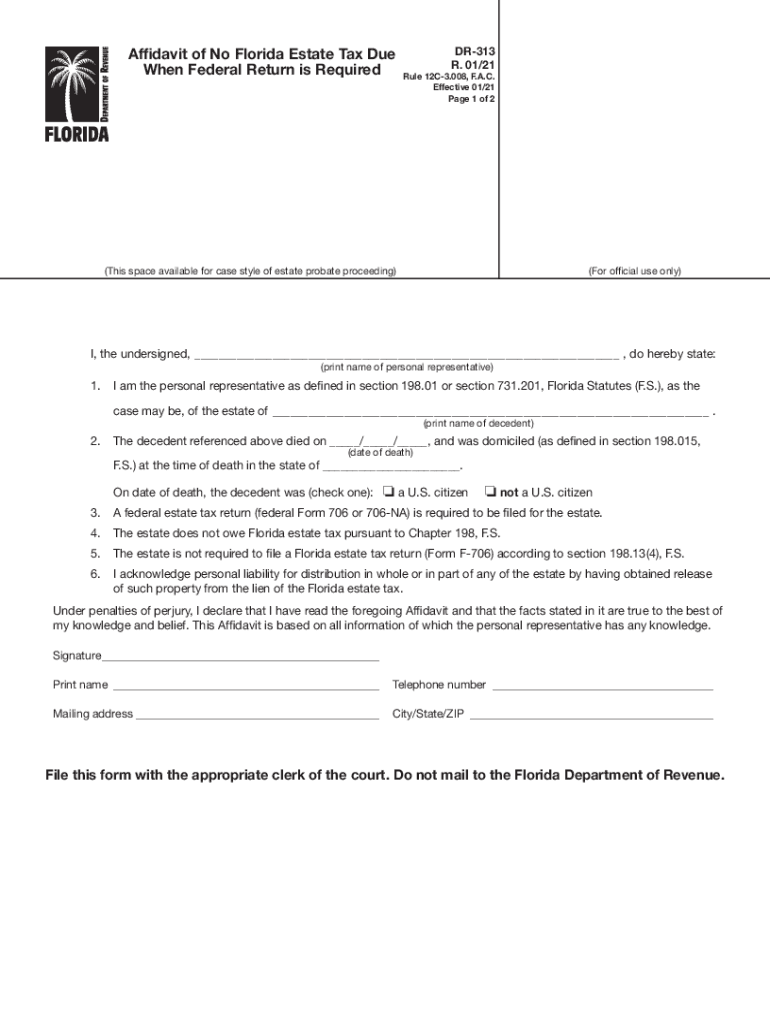

The Florida Form DR 313 is a crucial document issued by the Florida Department of Revenue, primarily used for filing estate tax returns in the state. This form is essential for individuals who are responsible for settling the estate of a deceased person. It serves to report the value of the estate and calculate any taxes owed to the state of Florida. Understanding the purpose and requirements of this form is vital for compliance with state tax laws.

Steps to Complete the Florida Form DR 313

Completing the Florida Form DR 313 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the estate, including asset valuations, debts, and any prior tax returns. Next, fill out the form by providing the required information, such as the decedent's details, asset descriptions, and tax calculations. It is important to double-check all entries for accuracy. Finally, ensure that the form is signed and dated before submission.

How to Obtain the Florida Form DR 313

The Florida Form DR 313 can be obtained directly from the Florida Department of Revenue's website. It is available as a downloadable PDF, which can be printed and filled out manually or completed digitally. Additionally, copies may be available at local tax offices or through legal and financial advisors who assist with estate matters.

Legal Use of the Florida Form DR 313

The Florida Form DR 313 is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be signed by the responsible party, typically the personal representative of the estate. Compliance with all filing requirements and deadlines is essential to avoid penalties. The form must also adhere to the guidelines set forth by the Florida Department of Revenue regarding estate tax calculations.

Key Elements of the Florida Form DR 313

Key elements of the Florida Form DR 313 include sections for reporting the decedent's information, a detailed inventory of the estate's assets, and calculations for the estate tax owed. The form requires specific valuations for real estate, personal property, and financial accounts. Additionally, it includes sections for deductions, such as debts and funeral expenses, which can reduce the taxable estate value.

Filing Deadlines / Important Dates

Filing deadlines for the Florida Form DR 313 are critical to ensure compliance and avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to follow the proper procedures to avoid complications. Keeping track of important dates related to estate tax filings is crucial for responsible estate management.

Quick guide on how to complete florida form dr 313 florida department of revenue

Accomplish Florida Form DR 313 Florida Department Of Revenue seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with everything necessary to create, amend, and electronically sign your documents promptly without interruptions. Manage Florida Form DR 313 Florida Department Of Revenue on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and electronically sign Florida Form DR 313 Florida Department Of Revenue effortlessly

- Find Florida Form DR 313 Florida Department Of Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a customary wet ink signature.

- Verify the information and click on the Done button to secure your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Florida Form DR 313 Florida Department Of Revenue to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida form dr 313 florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the florida form dr 313 florida department of revenue

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Florida Form DR and how can airSlate SignNow help with it?

The Florida Form DR is used for document requests in various legal and business scenarios. With airSlate SignNow, you can easily create, send, and electronically sign Florida Form DR documents, ensuring a streamlined process that saves time and enhances efficiency.

-

Is there a cost associated with using airSlate SignNow for Florida Form DR?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost-effective solution ensures that you only pay for the features you require when managing Florida Form DR documents, making it a great option for any budget.

-

What features does airSlate SignNow offer for the Florida Form DR?

airSlate SignNow provides various features including customizable templates, automated reminders, and secure cloud storage, specifically for Florida Form DR. These features help you manage your documents more efficiently and keep track of important deadlines.

-

Can I integrate airSlate SignNow with other applications when handling Florida Form DR?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications and platforms. This allows you to enhance your workflow when dealing with Florida Form DR by combining your favorite tools in one easy-to-use solution.

-

What are the benefits of using airSlate SignNow for Florida Form DR?

Using airSlate SignNow for Florida Form DR provides several benefits, including enhanced security, compliance with legal standards, and time savings through automation. These advantages allow you to focus on more critical business aspects while ensuring your documents are managed effectively.

-

How can I ensure compliance when signing Florida Form DR with airSlate SignNow?

airSlate SignNow prioritizes compliance by adhering to electronic signature laws and regulations relevant to Florida Form DR. The platform ensures that your signed documents are legally binding and compliant with state requirements, providing peace of mind for users.

-

Is airSlate SignNow suitable for businesses of all sizes needing Florida Form DR?

Yes, airSlate SignNow is designed to cater to businesses of all sizes when it comes to managing Florida Form DR. Whether you’re a small startup or a large enterprise, the platform offers flexible solutions that adapt to your specific needs.

Get more for Florida Form DR 313 Florida Department Of Revenue

Find out other Florida Form DR 313 Florida Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors