Fill in St 131 Form 2018-2026

What is the Fill In St 131 Form

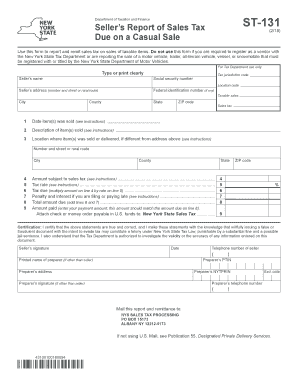

The Fill In St 131 Form, also known as the NYS Casual Sales Tax Form, is a document used by individuals and businesses in New York State to report casual sales of tangible personal property. This form is essential for taxpayers who engage in occasional sales that are not part of their regular business activities. It allows sellers to comply with state tax regulations and ensure proper reporting of sales tax collected on these transactions.

Steps to Complete the Fill In St 131 Form

Completing the Fill In St 131 Form involves several straightforward steps. First, gather all necessary information regarding the sale, including the date of the transaction, the type of goods sold, and the total sales amount. Next, accurately fill in the required fields on the form, ensuring that all details are correct to avoid any issues with processing.

After filling out the form, review it for accuracy. It is crucial to double-check that the sales tax amount has been calculated correctly based on the total sales. Once confirmed, you can proceed to sign the form electronically or manually, depending on your preference. Finally, submit the completed form according to the specified submission methods.

Legal Use of the Fill In St 131 Form

The Fill In St 131 Form is legally recognized by the New York State Department of Taxation and Finance. It serves as an official record of casual sales and the corresponding sales tax collected. Using this form correctly ensures compliance with state tax laws and helps avoid potential penalties for non-compliance. It is important to retain a copy of the completed form for your records, as it may be required for future reference or audits.

Required Documents

When preparing to complete the Fill In St 131 Form, certain documents may be necessary to ensure accurate reporting. These documents typically include:

- Invoices or receipts from the sale

- Records of sales tax collected

- Any relevant correspondence related to the sale

Having these documents on hand will facilitate the completion of the form and help ensure compliance with state regulations.

Form Submission Methods

The Fill In St 131 Form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form online, which offers a quick and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Timely filing of the Fill In St 131 Form is crucial to avoid penalties. The specific deadlines for submitting this form may vary based on the nature of the sale and the reporting period. Generally, it is recommended to file the form as soon as the sale occurs and the sales tax is collected. Keeping track of important dates related to tax filing will help ensure compliance and avoid any late fees.

Quick guide on how to complete form st 131 2018 2019

Your assistance manual on how to prepare your Fill In St 131 Form

If you’re seeking to understand how to generate and send your Fill In St 131 Form, here are some concise guidelines to simplify tax submission.

To begin, all you need is to create your airSlate SignNow profile to transform how you handle documents online. airSlate SignNow is a user-friendly and powerful document solution that permits you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust information as needed. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Fill In St 131 Form in just a few minutes:

- Establish your account and start processing PDFs immediately.

- Utilize our catalog to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Fill In St 131 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can increase errors and delay refunds. Furthermore, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form st 131 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form st 131 2018 2019

How to make an electronic signature for your Form St 131 2018 2019 online

How to make an electronic signature for the Form St 131 2018 2019 in Google Chrome

How to create an eSignature for signing the Form St 131 2018 2019 in Gmail

How to generate an electronic signature for the Form St 131 2018 2019 right from your mobile device

How to make an electronic signature for the Form St 131 2018 2019 on iOS

How to create an eSignature for the Form St 131 2018 2019 on Android devices

People also ask

-

What are the st 131 instructions for eSigning documents?

The st 131 instructions outline the process for electronically signing documents using airSlate SignNow. This includes guidance on how to initiate the signing process, where to place your signature, and how to save or send the signed document once completed. Understanding these instructions can streamline your document management.

-

How does airSlate SignNow help with the st 131 instructions?

airSlate SignNow simplifies following the st 131 instructions by providing an intuitive platform for eSigning. Users can easily upload documents, prepare them for signatures, and directly follow the instructions without any confusion. This ultimately enhances efficiency in your signing process.

-

Is there a cost associated with the st 131 instructions feature?

Using airSlate SignNow is cost-effective, with various pricing plans available to suit your business needs. Access to the st 131 instructions and eSigning features comes included in all plans, ensuring that you can use these guidelines without incurring extra charges. Explore our plans to find the best fit for you.

-

Can I integrate airSlate SignNow while following the st 131 instructions?

Yes, airSlate SignNow offers seamless integrations with numerous apps to enhance your workflow while following the st 131 instructions. This includes integrations with CRM tools, cloud storage services, and more, allowing you to manage your documents effectively. Check our integration options to see what fits your needs.

-

What benefits does airSlate SignNow provide when following the st 131 instructions?

When using airSlate SignNow with the st 131 instructions, you benefit from a streamlined eSignature process that saves time and reduces errors. The platform also offers enhanced security and compliance features, ensuring your documents are handled safely and securely. This allows for a more efficient and reliable signing experience.

-

How user-friendly are the st 131 instructions on airSlate SignNow?

The st 131 instructions are designed to be straightforward and easily understood on the airSlate SignNow platform. The user interface guides you step-by-step, ensuring that even those unfamiliar with eSigning can navigate the process without difficulty. User-friendliness is a priority, making it accessible to all.

-

What types of documents can I sign using the st 131 instructions?

You can sign a variety of document types using the st 131 instructions with airSlate SignNow. This includes contracts, agreements, forms, and more, making it versatile for business needs. The platform allows for multiple file formats to ensure compatibility with your documents.

Get more for Fill In St 131 Form

- Real estate schedule template form

- Affidavit of lost warrant colorado gov colorado form

- Dos 1509 barber shop owner or area renter application dos ny form

- Sample expulsion letter from school form

- Putting the pieces together the discovery of dna structure and replication answer key form

- Request for driver review instructions georgia dds ga form

- Missouri forage and grassland councilgrazing lands form

- Youth baseball softball sponsorship forms poplarbluff mo

Find out other Fill In St 131 Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF