Massachusetts State Tax Information 2023

Understanding Massachusetts State Tax Information

The Massachusetts state tax information is essential for residents and businesses when filing their taxes. This includes details about income tax rates, deductions, and credits applicable to taxpayers. Understanding the nuances of Massachusetts tax laws ensures compliance and helps in maximizing potential refunds or minimizing liabilities.

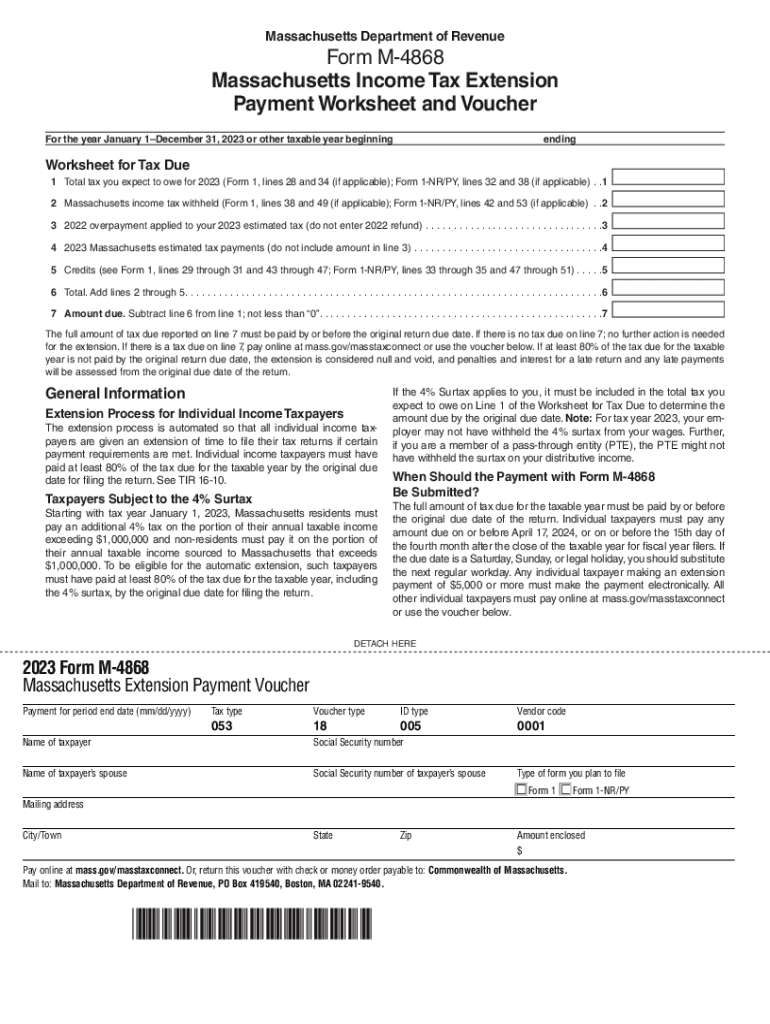

Steps to Complete the Massachusetts Tax Extension Form

Completing the Massachusetts tax extension form, known as MA Form 4868, involves several key steps. First, gather necessary personal and financial information, including your Social Security number and estimated tax liability. Next, accurately fill out the form, ensuring all required fields are completed. After filling out the form, review it for accuracy before submission. Lastly, submit the form either electronically or by mail to the appropriate Massachusetts Department of Revenue address.

Filing Deadlines and Important Dates

For taxpayers in Massachusetts, it is crucial to be aware of the filing deadlines associated with the MA Form 4868. Typically, the deadline to file for a tax extension aligns with the federal tax deadline, which is usually April 15. However, it is advisable to confirm specific dates each year, as they may vary. Filing on time helps avoid penalties and ensures compliance with state tax regulations.

Required Documents for Filing

When filing the MA Form 4868, certain documents are necessary to support your extension request. These include your previous year's tax return, income statements such as W-2s or 1099s, and any relevant documentation that supports your estimated tax liability. Having these documents ready can streamline the filing process and ensure accuracy in your submission.

Form Submission Methods

MA Form 4868 can be submitted through various methods. Taxpayers can file electronically using the Massachusetts Department of Revenue's online services. Alternatively, the form can be printed and mailed to the appropriate address. In-person submissions are also an option at designated tax offices. Each method has its advantages, so choose the one that best fits your needs.

Eligibility Criteria for Tax Extensions

To qualify for a tax extension in Massachusetts using MA Form 4868, taxpayers must meet specific eligibility criteria. Generally, any individual or business that needs additional time to prepare their tax return can apply. It is important to note that an extension to file does not extend the time to pay any taxes owed, so estimated payments should be made by the original due date to avoid penalties.

Penalties for Non-Compliance

Failing to file the MA Form 4868 by the deadline can result in penalties imposed by the Massachusetts Department of Revenue. Taxpayers may incur late filing fees, as well as interest on any unpaid taxes. Understanding these potential penalties emphasizes the importance of timely filing and compliance with state tax laws.

Quick guide on how to complete massachusetts state tax information

Easily prepare Massachusetts State Tax Information on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without any hold-ups. Manage Massachusetts State Tax Information on any platform using airSlate SignNow’s Android or iOS applications and enhance your document-centered process today.

How to modify and eSign Massachusetts State Tax Information effortlessly

- Find Massachusetts State Tax Information and click Get Form to initiate the process.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Massachusetts State Tax Information while ensuring excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts state tax information

Create this form in 5 minutes!

How to create an eSignature for the massachusetts state tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Massachusetts tax extension, and how does it work?

The 2023 Massachusetts tax extension allows taxpayers to file their state income tax returns later than the usual deadline. By filing a Form M-4868, individuals can receive an automatic extension of up to six months, giving them additional time without incurring late fees. It's crucial to remember that this extension only applies to filing, not to paying any taxes owed.

-

How can airSlate SignNow help with the 2023 Massachusetts tax extension process?

AirSlate SignNow provides an effortless way to prepare and eSign your tax extension documents. With our platform, you can quickly complete the Form M-4868 and send it directly to the Massachusetts Department of Revenue. Our service streamlines the workflow, making tax time less stressful for individuals and businesses alike.

-

Is there a cost associated with using airSlate SignNow for the 2023 Massachusetts tax extension?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different user needs. These plans ensure that users can access the necessary features and support for their 2023 Massachusetts tax extension filings at a competitive and cost-effective rate. You can choose the plan that best fits your business size and document signing needs.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you gain access to essential features like electronic signatures, document templates, and secure cloud storage. For the 2023 Massachusetts tax extension, these tools allow you to manage your forms efficiently. Additionally, you can track document status and receive automated reminders, ensuring timely submissions.

-

Can airSlate SignNow integrate with other tools for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with popular tax preparation and accounting software. This means you can easily sync your documents and forms necessary for the 2023 Massachusetts tax extension, making your overall tax management process more efficient and cohesive.

-

What are the benefits of using airSlate SignNow for tax extensions?

Using airSlate SignNow for your 2023 Massachusetts tax extension simplifies the entire process. You save time with easy document preparation and eSigning while ensuring compliance with state regulations. Our cost-effective solution also enhances collaboration among team members, allowing you to focus on your business instead of paperwork.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We use advanced encryption technology and adhere to strict data protection regulations to ensure the safety of your sensitive documents, including those related to the 2023 Massachusetts tax extension. You can trust our platform to keep your information confidential and secure.

Get more for Massachusetts State Tax Information

- Dorgeorgiagovsitesdorstate of georgia department of revenue sales tax certificate form

- Fillable form ga 9465 installment agreement request

- Wwwmassgovservice details1095 b and 1099 hc1095 b and 1099 hc tax formmassgov

- Cdlecoloradogovmyuihomedepartment of labor ampamp employment form

- 2020 form 3 partnership return of income massgov

- Georgia form 500ez short individual income tax return

- Corporation estimated tax payments instructions for form

- Dorgeorgiagov500 individual income tax return500 individual income tax returngeorgia department of revenue form

Find out other Massachusetts State Tax Information

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors