Tax Extention Forms Ma 2019

What is the Massachusetts Tax Extension Form?

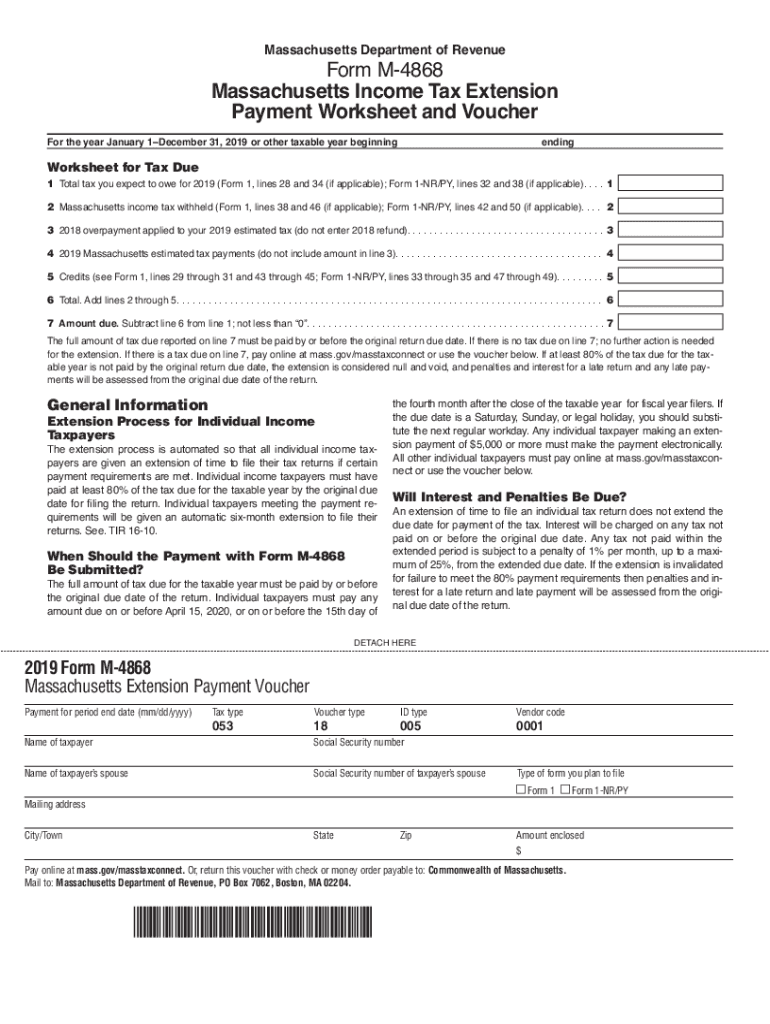

The 2018 Massachusetts extension form, known as the M-4868, allows taxpayers to request an extension for filing their state income tax returns. This form is essential for individuals who need additional time to prepare their tax documents, ensuring they can meet their obligations without incurring penalties for late submissions. The extension typically grants an additional six months to file the tax return, although it is important to note that this does not extend the time to pay any taxes owed.

Steps to Complete the Massachusetts Tax Extension Form

Completing the 2018 Massachusetts M-4868 form involves several straightforward steps:

- Gather necessary information, including your Social Security number, income details, and any tax credits or deductions you plan to claim.

- Fill out the form accurately, ensuring all required fields are completed. This includes your name, address, and the estimated tax liability.

- Review the form for any errors or omissions to avoid delays in processing.

- Submit the form by the original tax deadline to ensure the extension is valid.

Legal Use of the Massachusetts Tax Extension Form

The M-4868 form is legally recognized as a valid request for an extension of time to file your Massachusetts tax return. To ensure compliance, it is crucial to submit the form on or before the tax deadline. The extension allows taxpayers to avoid penalties for late filing, provided they pay any taxes owed by the original due date. Using a reliable eSignature solution can further enhance the legal standing of your submission, as it ensures that all signatures are authenticated and securely recorded.

Required Documents for Filing the Massachusetts Tax Extension Form

When preparing to file the M-4868 form, certain documents are necessary to ensure accurate completion:

- Your previous year’s tax return for reference.

- Income statements, such as W-2 forms or 1099 forms.

- Records of any deductions or credits you intend to claim.

- Details of any estimated tax payments made during the year.

Filing Deadlines for the Massachusetts Tax Extension Form

The deadline to file the 2018 Massachusetts extension form is typically the same as the original tax return due date, which is usually April 15. It is important to submit the M-4868 by this date to ensure that you receive the full six-month extension. However, any taxes owed must be paid by the original deadline to avoid interest and penalties.

Form Submission Methods for the Massachusetts Tax Extension Form

The M-4868 form can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing services, which can streamline the process and provide immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate state tax authority. If choosing to submit by mail, it is advisable to send the form via certified mail to ensure it is received by the deadline.

Quick guide on how to complete tax extention forms ma

Complete Tax Extention Forms Ma seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Tax Extention Forms Ma on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Tax Extention Forms Ma effortlessly

- Obtain Tax Extention Forms Ma and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Extention Forms Ma to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax extention forms ma

Create this form in 5 minutes!

How to create an eSignature for the tax extention forms ma

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 2018 Massachusetts extension form and why do I need it?

The 2018 Massachusetts extension form allows taxpayers to request an extension for filing their state income tax returns. This form is essential for those who need additional time to gather their tax information and avoid penalties for late filing. Using the airSlate SignNow platform, you can easily eSign and submit your extension form.

-

How can I complete the 2018 Massachusetts extension form using airSlate SignNow?

To complete the 2018 Massachusetts extension form, simply upload the document onto the airSlate SignNow platform. You can fill out the necessary information, eSign it, and send it directly to the Massachusetts Department of Revenue. This streamlined process ensures your form is submitted promptly and securely.

-

Is there a cost associated with using airSlate SignNow for the 2018 Massachusetts extension form?

Yes, there is a cost associated with the airSlate SignNow service, which offers various pricing plans depending on your needs. Our cost-effective solution includes features for eSigning documents like the 2018 Massachusetts extension form, making it an affordable choice for both individuals and businesses.

-

What features does airSlate SignNow offer for managing the 2018 Massachusetts extension form?

airSlate SignNow provides features such as document uploading, easy eSigning, and templates specifically for the 2018 Massachusetts extension form. These tools simplify the filing process and reduce the time spent on paperwork, allowing you to focus on other important tasks.

-

Can I track the status of my 2018 Massachusetts extension form submission?

Yes, airSlate SignNow lets you track the status of your submissions, including the 2018 Massachusetts extension form. You will receive notifications when your document is signed and can monitor documents in progress, ensuring you are updated at every step.

-

Does airSlate SignNow integrate with other software for managing tax documents, including the 2018 Massachusetts extension form?

Absolutely, airSlate SignNow integrates seamlessly with various software used for managing tax documents and filing, enhancing your productivity. These integrations allow for easy access to fill and complete the 2018 Massachusetts extension form alongside other accounting tools you may be using.

-

What are the benefits of using airSlate SignNow for the 2018 Massachusetts extension form?

Using airSlate SignNow for the 2018 Massachusetts extension form provides convenience, security, and efficiency. The platform allows for rapid preparation and submission of your form while ensuring that your personal information remains protected through encryption and secure storage.

Get more for Tax Extention Forms Ma

Find out other Tax Extention Forms Ma

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney