Massachusetts Department of Revenue Form M 4868 Ma 2024-2026

Understanding the Massachusetts Department of Revenue Form M-4868

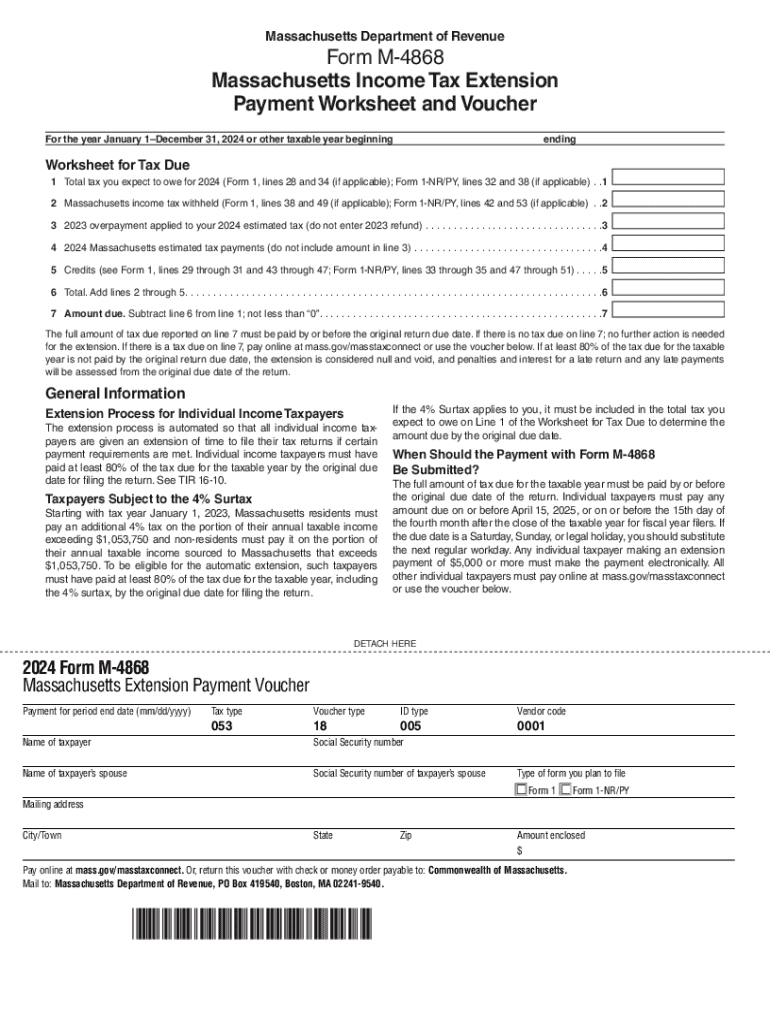

The Massachusetts Department of Revenue Form M-4868 is the official extension form for individuals seeking additional time to file their state income tax returns. This form allows taxpayers to request an automatic extension of up to six months, providing them with the necessary time to gather documents and ensure accurate reporting. It is essential for individuals who may not meet the standard filing deadline, typically falling on April 15 each year.

Steps to Complete the Massachusetts Department of Revenue Form M-4868

Completing the Massachusetts extension form involves several straightforward steps:

- Gather necessary information, including your Social Security number, estimated tax liability, and any payments made.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate your estimated tax liability and any payments you have already made to determine if you owe additional taxes.

- Submit the form by the original filing deadline to avoid penalties.

How to Obtain the Massachusetts Department of Revenue Form M-4868

The Massachusetts Department of Revenue Form M-4868 can be easily obtained through the official state website or by visiting local tax offices. The form is available in both digital and paper formats, allowing taxpayers to choose their preferred method of access. For digital versions, simply navigate to the tax forms section and download the M-4868 form directly.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Massachusetts extension form. The standard deadline for filing your state income tax return is April 15. If you file the M-4868 form by this date, you will receive an automatic extension until October 15. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the Massachusetts Department of Revenue Form M-4868

The legal use of Form M-4868 is strictly for requesting an extension on filing your Massachusetts state income tax return. It does not extend the time to pay any taxes owed. Taxpayers must ensure they submit the form correctly and on time to maintain compliance with state tax laws. Failure to do so may result in penalties or interest on unpaid taxes.

Key Elements of the Massachusetts Department of Revenue Form M-4868

Key elements of the M-4868 form include:

- Taxpayer identification information, such as name and Social Security number.

- Estimated tax liability for the year.

- Any payments made towards the tax liability.

- Signature and date to validate the submission.

Form Submission Methods

Taxpayers have multiple options for submitting the Massachusetts Department of Revenue Form M-4868. The form can be filed electronically through the Massachusetts Department of Revenue's online portal or printed and mailed to the appropriate tax office. In-person submissions are also possible at designated tax offices, providing flexibility for individuals to choose the method that best suits their needs.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 4868 ma

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 4868 ma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts extension form and how can airSlate SignNow help?

The Massachusetts extension form allows taxpayers to request an extension for filing their state tax returns. With airSlate SignNow, you can easily fill out, sign, and send your Massachusetts extension form electronically, streamlining the process and ensuring timely submission.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts extension form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and provide access to features that simplify the completion and submission of your Massachusetts extension form.

-

What features does airSlate SignNow offer for managing the Massachusetts extension form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking. These tools make it easy to manage your Massachusetts extension form efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for my Massachusetts extension form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to manage your Massachusetts extension form alongside your other business processes.

-

How does airSlate SignNow ensure the security of my Massachusetts extension form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Massachusetts extension form and any sensitive information it contains, ensuring your data remains safe.

-

Can I track the status of my Massachusetts extension form with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your documents. You can easily monitor the status of your Massachusetts extension form, ensuring you know when it has been signed and submitted.

-

What are the benefits of using airSlate SignNow for my Massachusetts extension form?

Using airSlate SignNow for your Massachusetts extension form offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, making it easier for you to focus on your business.

Get more for Massachusetts Department Of Revenue Form M 4868 Ma

Find out other Massachusetts Department Of Revenue Form M 4868 Ma

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT