State Tax Refund Intercept Program TRIP 2023-2026

What is the State Tax Refund Intercept Program TRIP

The State Tax Refund Intercept Program (TRIP) is a mechanism established to assist state agencies in collecting debts owed by taxpayers. This program allows various state entities to intercept tax refunds to satisfy outstanding obligations, such as child support, unpaid taxes, or other debts. By leveraging tax refunds, TRIP ensures that funds are directed toward fulfilling these financial responsibilities, promoting compliance and accountability among taxpayers.

How to use the State Tax Refund Intercept Program TRIP

To utilize the State Tax Refund Intercept Program, eligible agencies must first register with the program. Once registered, they can submit claims for debts owed by individuals. When a taxpayer files their state tax return, the program automatically checks for any outstanding debts. If a match is found, the corresponding amount is deducted from the refund and redirected to the agency that submitted the claim.

Eligibility Criteria

Eligibility for the State Tax Refund Intercept Program is generally limited to specific debts, including but not limited to:

- Child support arrears

- Unpaid state taxes

- Other court-ordered payments

Taxpayers who have outstanding obligations related to these areas may be subject to intercepts. It is essential for individuals to remain aware of their financial responsibilities to avoid potential interception of their tax refunds.

Steps to complete the State Tax Refund Intercept Program TRIP

Completing the process under the State Tax Refund Intercept Program involves several key steps:

- Determine eligibility by reviewing any outstanding debts.

- Register with the program if you are an agency seeking to collect debts.

- Submit claims for debts owed by taxpayers to the appropriate authorities.

- Monitor tax returns filed by individuals for potential intercepts.

- Receive intercepted funds and apply them to the outstanding debts.

Following these steps can help streamline the process for agencies and ensure that debts are effectively managed.

Required Documents

To participate in the State Tax Refund Intercept Program, agencies typically need to provide specific documentation, including:

- Proof of the debt owed, such as court orders or tax assessments.

- Registration forms for the TRIP program.

- Any additional documentation required by the state agency overseeing the program.

Having these documents prepared can facilitate a smoother process for both agencies and taxpayers involved in the program.

Penalties for Non-Compliance

Non-compliance with the State Tax Refund Intercept Program can result in significant penalties for taxpayers. These may include:

- Loss of tax refunds due to interception.

- Potential legal actions taken by agencies to recover debts.

- Increased financial obligations, including interest and fees.

It is crucial for taxpayers to address any outstanding debts promptly to avoid these consequences.

Quick guide on how to complete state tax refund intercept program trip

Complete State Tax Refund Intercept Program TRIP effortlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can obtain the correct format and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage State Tax Refund Intercept Program TRIP on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest way to adjust and eSign State Tax Refund Intercept Program TRIP with ease

- Obtain State Tax Refund Intercept Program TRIP and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign State Tax Refund Intercept Program TRIP and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax refund intercept program trip

Create this form in 5 minutes!

How to create an eSignature for the state tax refund intercept program trip

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

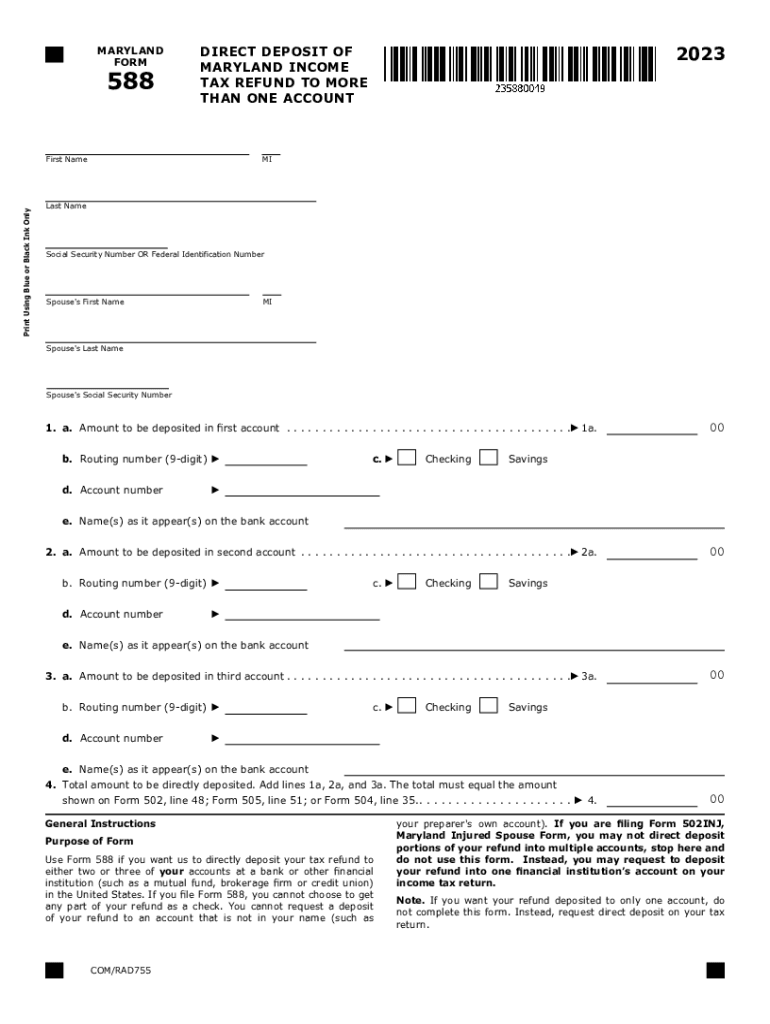

What is the Maryland 588 form and how can airSlate SignNow help with it?

The Maryland 588 form is a vital document used for various purposes in Maryland, including tax-related applications. With airSlate SignNow, you can easily send, receive, and electronically sign the Maryland 588 form, streamlining the process for both individuals and businesses.

-

How much does airSlate SignNow cost for Maryland 588 document handling?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. Whether you're handling the Maryland 588 or other documents, our packages provide excellent value to ensure you can manage your paperwork without breaking the bank.

-

What features does airSlate SignNow offer for managing Maryland 588 forms?

airSlate SignNow provides a range of features specifically designed to simplify document management, including templates, real-time tracking, and secure e-signatures. These functionalities enhance the handling of the Maryland 588 form, ensuring efficiency and compliance.

-

Are there any benefits of using airSlate SignNow for the Maryland 588?

Using airSlate SignNow for the Maryland 588 offers numerous benefits, such as faster processing times and reduced paper use. It empowers businesses to operate more efficiently and provides a secure way to manage sensitive information related to the Maryland 588 form.

-

Can I integrate airSlate SignNow with other applications for Maryland 588 processing?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the management of the Maryland 588 form. This integration allows you to connect with your existing workflows, ensuring you can easily use the Maryland 588 alongside your other tools.

-

Is airSlate SignNow suitable for personal use when handling a Maryland 588?

Absolutely! airSlate SignNow is not just for businesses; it is also perfect for personal use, especially for managing forms like the Maryland 588. Whether for tax purposes or other needs, our platform is designed for ease of use for everyone.

-

What security measures does airSlate SignNow provide for Maryland 588 documents?

Security is a top priority at airSlate SignNow, particularly when dealing with sensitive documents like the Maryland 588. We use industry-standard encryption and secure authentication to protect your information, ensuring your documents are safe and confidential.

Get more for State Tax Refund Intercept Program TRIP

- With no interest or form

- Section 153110 basis and rate of the tax illinois general form

- Transferees name please type or print form

- To be done materials to be used and the equipment to be used or installed form

- This painting contract contract effective as of the date of the last party to form

- Below is between having an address at form

- Peat humus form

- Landscaping finish grading filling or excavation is to be performed at the work site by the

Find out other State Tax Refund Intercept Program TRIP

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile