00 00 00 00 DIRECT DEPOSIT of MARYLAND INCOME TAX 2022

Understanding the Maryland Income Tax Rate

The Maryland income tax rate is a progressive tax system, meaning that rates increase as income rises. The state has several tax brackets that apply to different income levels, ensuring that individuals contribute fairly based on their earnings. For the tax year, the rates range from two percent to five point seventy-five percent, depending on your taxable income. Understanding these brackets is essential for accurate tax planning and compliance.

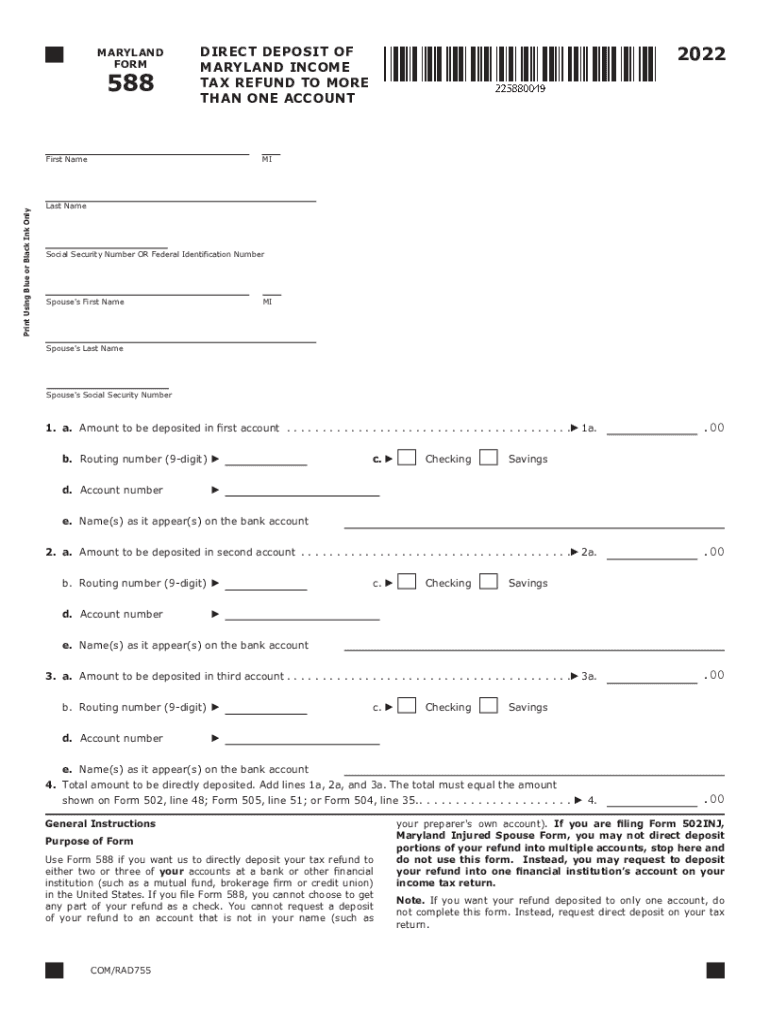

Steps to Complete the Maryland 588 Form

Completing the Maryland 588 form, which is used for claiming a Maryland deposit tax refund, involves several key steps. First, gather all necessary documentation, including your income statements and any previous tax returns. Next, accurately fill out the form, ensuring that all information is correct and complete. After completing the form, review it for any errors before submission. Finally, choose your preferred submission method, whether online or by mail, to ensure timely processing of your refund.

Required Documents for Maryland Tax Filing

When filing taxes in Maryland, specific documents are essential for a smooth process. These include your W-2 forms from employers, 1099 forms for any freelance or contract work, and any other income statements. Additionally, you may need documentation related to deductions or credits you plan to claim, such as receipts for charitable donations or medical expenses. Having these documents ready will facilitate the completion of your Maryland income tax forms.

Filing Deadlines for Maryland Taxes

It is crucial to be aware of the filing deadlines for Maryland taxes to avoid penalties. Typically, the deadline for filing individual income tax returns is April fifteenth. If this date falls on a weekend or holiday, the deadline may be adjusted. Additionally, if you need more time to prepare your return, you can file for an extension, which usually grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance with Maryland Tax Laws

Failure to comply with Maryland tax laws can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for severe violations. The state takes tax compliance seriously, and individuals should ensure they meet all filing requirements and deadlines. Understanding these penalties can help motivate timely and accurate tax submissions.

Eligibility Criteria for Maryland Tax Refunds

To qualify for a Maryland tax refund, taxpayers must meet specific eligibility criteria. Generally, you must have filed a Maryland income tax return and have overpaid your taxes for the year. Additionally, certain income thresholds and residency requirements may apply. It's essential to review these criteria carefully to determine your eligibility before submitting your refund claim.

Digital vs. Paper Version of Maryland Tax Forms

When filing Maryland taxes, taxpayers have the option to choose between digital and paper versions of tax forms. The digital version offers several advantages, including faster processing times and the convenience of e-filing from home. Conversely, some individuals may prefer paper forms for various reasons, such as familiarity or lack of access to technology. Both methods are valid, but understanding the benefits of each can help taxpayers make an informed decision.

Quick guide on how to complete 00 00 00 00 direct deposit of maryland income tax

Prepare 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, adjust, and electronically sign your documents quickly without complications. Manage 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX effortlessly

- Obtain 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your changes.

- Choose how you want to share your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Edit and electronically sign 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 00 00 00 00 direct deposit of maryland income tax

Create this form in 5 minutes!

How to create an eSignature for the 00 00 00 00 direct deposit of maryland income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the current Maryland income tax rate for individuals?

The Maryland income tax rate for individuals varies based on income levels, with rates ranging from 2% to 5.75% as of 2023. It's essential for residents to check the latest tax brackets to understand their obligations. Additionally, local taxes may apply, impacting the overall income tax rate individuals face.

-

How does the Maryland income tax rate affect my business expenses?

The Maryland income tax rate can directly impact business profits, as businesses are often subject to corporate taxes based on their income. Understanding the Maryland income tax rate helps businesses effectively budget for taxes, ensuring they remain compliant while optimizing expenses. Utilizing tools like airSlate SignNow for document management can streamline invoicing and tax-related paperwork.

-

Does airSlate SignNow help with tax-related document signing?

Yes, airSlate SignNow offers a seamless solution for signing tax-related documents, such as forms and contracts, securely. With its user-friendly interface, you can easily manage and eSign essential documents while keeping track of important tax deadlines related to the Maryland income tax rate. This enhances compliance and efficiency in tax preparation.

-

Can I integrate airSlate SignNow with my accounting software?

Absolutely! airSlate SignNow integrates smoothly with various accounting software, which is beneficial for managing documents related to the Maryland income tax rate. This integration allows you to streamline workflows, ensuring that all tax-related forms are signed efficiently, and financial data remains accurate and organized.

-

What features of airSlate SignNow can help with tax compliance?

AirSlate SignNow includes features such as secure eSigning, automated reminders, and document tracking—essential for tax compliance. With tools tailored to streamline document workflows, businesses can efficiently handle tax reports relevant to the Maryland income tax rate. These features reduce the risk of errors and facilitate timely submissions.

-

Is airSlate SignNow a cost-effective solution for managing tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing tax documents, including those governed by the Maryland income tax rate. By automating eSigning and document management, businesses can save both time and money, reducing administrative burdens signNowly. This leads to increased productivity and enhances overall profitability.

-

How secure is airSlate SignNow for eSigning tax documents?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your tax documents. This is especially crucial when dealing with sensitive information related to the Maryland income tax rate. Users can trust that their signed documents are stored securely while adhering to privacy regulations.

Get more for 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX

- Js 44 civil cover sheet federal district court south carolina form

- Lead based paint disclosure for sales transaction south carolina form

- Sc lead paint disclosure form

- Notice of lease for recording south carolina form

- Sample cover letter for filing of llc articles or certificate with secretary of state south carolina form

- Supplemental residential lease forms package south carolina

- Sc residential form

- South carolina form 497325845

Find out other 00 00 00 00 DIRECT DEPOSIT OF MARYLAND INCOME TAX

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form