Printable Maryland Form 588 Direct Deposit of Maryland Income Tax Refund to More Than One Account 2020

What is the Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

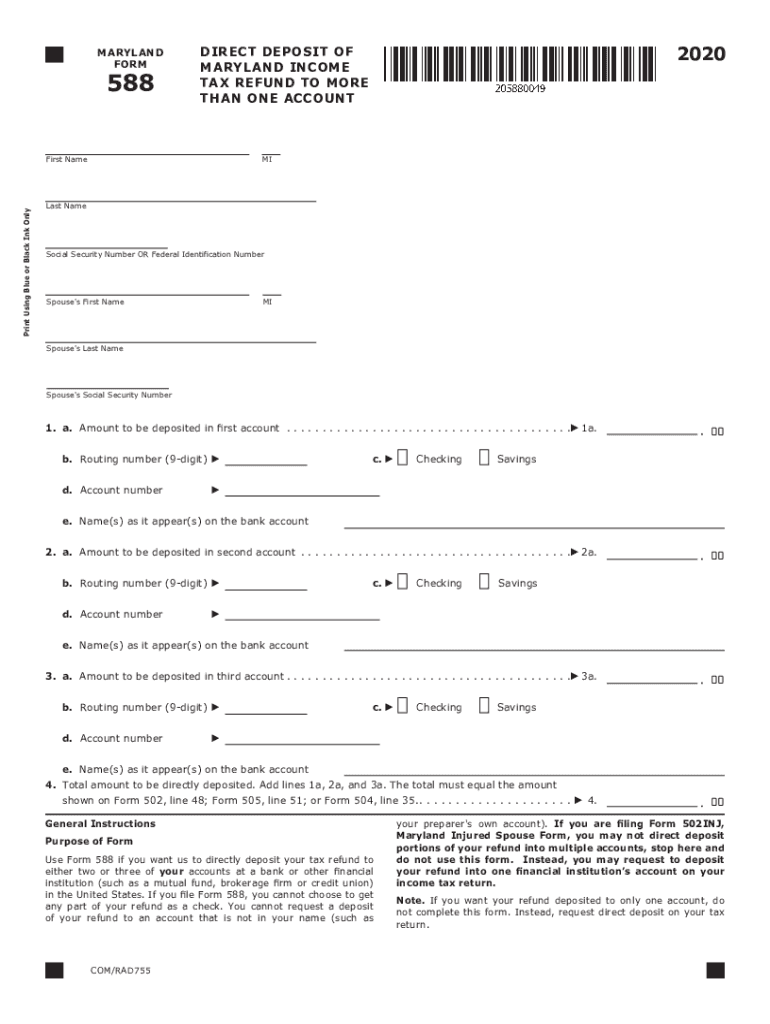

The Maryland Form 588 is specifically designed for taxpayers who wish to direct deposit their Maryland income tax refunds into more than one bank account. This form allows individuals to specify multiple accounts, ensuring that their refunds can be allocated according to their preferences. Utilizing this form can streamline the process of receiving tax refunds, providing convenience and flexibility for taxpayers.

How to use the Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

To effectively use the Maryland Form 588, begin by downloading the form from an official source. Once you have the form, fill out your personal details, including your name, Social Security number, and address. Next, indicate the account details for the direct deposit. You can specify the amount to be deposited into each account, ensuring that the total does not exceed your expected refund. After completing the form, it must be submitted along with your tax return to ensure proper processing.

Steps to complete the Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

Completing the Maryland Form 588 involves several straightforward steps:

- Download the form from an official source.

- Fill in your personal information, including your name, Social Security number, and address.

- Provide the bank account details where you want your refund deposited.

- Specify the amounts to be deposited into each account, ensuring the total matches your refund.

- Review the form for accuracy and sign it if required.

- Submit the completed form along with your Maryland tax return.

Legal use of the Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

The Maryland Form 588 is legally recognized for directing tax refunds to multiple accounts, provided it is filled out correctly and submitted in accordance with state tax regulations. The use of this form complies with the legal requirements for electronic signatures and document submissions, ensuring that taxpayers can securely manage their refunds. Adhering to the guidelines outlined by the Maryland State Comptroller is essential for the form's validity.

Key elements of the Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

Key elements of the Maryland Form 588 include:

- Taxpayer identification information, such as name and Social Security number.

- Bank account details, including account numbers and routing numbers.

- Specified amounts for each account receiving a portion of the refund.

- Signature of the taxpayer, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Maryland Form 588. Typically, taxpayers must submit their income tax returns, along with Form 588, by the tax filing deadline, which is usually April 15. If the deadline falls on a weekend or holiday, it may be extended. Ensuring timely submission is vital to avoid penalties and ensure prompt processing of refunds.

Quick guide on how to complete printable 2020 maryland form 588 direct deposit of maryland income tax refund to more than one account

Easily Create Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to generate, amend, and eSign your documents swiftly without delays. Manage Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account on any device with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Edit and eSign Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account Effortlessly

- Find Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 maryland form 588 direct deposit of maryland income tax refund to more than one account

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 maryland form 588 direct deposit of maryland income tax refund to more than one account

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is Maryland 588 and how does it relate to airSlate SignNow?

Maryland 588 is a specific form used for tax purposes in the state of Maryland. airSlate SignNow simplifies the process of electronically signing and sending the Maryland 588 form, ensuring that your file is completed accurately and submitted on time.

-

How much does airSlate SignNow cost for processing Maryland 588?

The pricing for airSlate SignNow is competitive and varies depending on your business needs. With various plans available, businesses can choose the one that best fits their requirements for handling documents like the Maryland 588 efficiently.

-

What features does airSlate SignNow offer for signing Maryland 588?

airSlate SignNow offers a user-friendly interface, advanced security features, and the ability to track the status of your Maryland 588 document. Users can easily invite others to sign and securely store completed forms within the platform.

-

Can I integrate airSlate SignNow with other software for Maryland 588 submissions?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for documents like Maryland 588. This allows you to manage your signing process alongside other essential business tools.

-

Is airSlate SignNow legally compliant for Maryland 588 electronic signatures?

Absolutely! airSlate SignNow complies with all legal standards for electronic signatures, including those applicable to the Maryland 588 form. This ensures your signed documents are legally binding and accepted by state agencies.

-

What are the benefits of using airSlate SignNow for the Maryland 588 form?

Using airSlate SignNow for the Maryland 588 form offers numerous benefits including faster processing times, reduced paper usage, and enhanced security. Additionally, it streamlines the eSigning process, making it more efficient for businesses and individuals alike.

-

How can I get started with airSlate SignNow for Maryland 588?

Getting started with airSlate SignNow for your Maryland 588 is straightforward. Simply sign up for an account, choose the appropriate plan, and start creating, sending, and signing your documents electronically.

Get more for Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

- Westchestergov form

- Application for supplemental security income ssi social security form

- Ny lottery winner claim form

- Westchester county civil service rules form

- Interdisciplinary units of study form

- Insulation compliance certificate template form

- Nevada subcontractor agreement template form

- Albuquerque fire marshalamp39s office exhibit application cabq form

Find out other Printable Maryland Form 588 Direct Deposit Of Maryland Income Tax Refund To More Than One Account

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed