502CR INCOME TAX CREDITS for INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS for INDIVIDUALS 2023-2026

What is the MD Form 502CR?

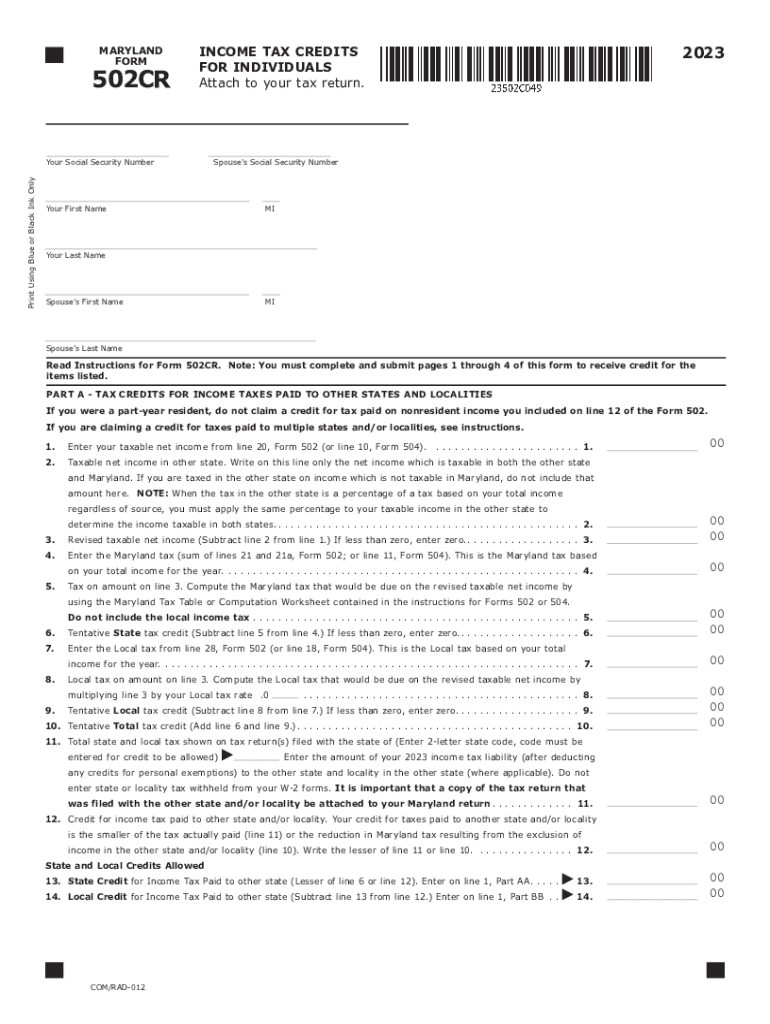

The MD Form 502CR is a tax form used in Maryland to claim income tax credits for individuals. This form is essential for taxpayers seeking to reduce their tax liability by applying for various credits available under Maryland state tax law. The credits may include those for low-income individuals, earned income, and other specific tax benefits aimed at supporting residents financially. Understanding the purpose and use of this form is crucial for eligible taxpayers to maximize their tax savings.

Eligibility Criteria for MD Form 502CR

To qualify for the income tax credits claimed on the MD Form 502CR, individuals must meet specific eligibility requirements set by the Maryland State Department of Assessments and Taxation. Generally, these criteria include:

- Residency in Maryland for the entire tax year.

- Meeting income thresholds as defined by the state.

- Filing a Maryland income tax return.

- Providing necessary documentation to support the claim for credits.

It is essential for taxpayers to review these criteria carefully to determine their eligibility before completing the form.

Steps to Complete the MD Form 502CR

Filling out the MD Form 502CR involves several steps to ensure accuracy and compliance with state regulations. Here is a simplified process:

- Gather all required documents, including your Maryland tax return and supporting documentation for the credits you wish to claim.

- Complete the form by accurately entering your personal information, including your name, address, and Social Security number.

- Detail the specific credits you are applying for, ensuring that you meet the eligibility requirements for each.

- Review the completed form for any errors or omissions.

- Submit the form along with your Maryland income tax return by the specified deadline.

Following these steps will help ensure that your claim is processed smoothly and efficiently.

Required Documents for MD Form 502CR

When filing the MD Form 502CR, certain documents are necessary to substantiate your claims for income tax credits. These documents typically include:

- Your completed Maryland income tax return (Form 502).

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation supporting eligibility for specific credits, like pay stubs or tax credit certificates.

Having these documents ready can expedite the filing process and reduce the likelihood of delays in processing your credits.

Filing Deadlines for MD Form 502CR

Timely submission of the MD Form 502CR is crucial to ensure that you receive your eligible tax credits. The filing deadlines generally align with those of the Maryland income tax return, which is typically due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Maryland State Department of Assessments and Taxation website for any updates or changes to the filing schedule.

Form Submission Methods

Taxpayers can submit the MD Form 502CR through various methods. These include:

- Online submission via the Maryland state tax portal, which allows for electronic filing.

- Mailing a paper copy of the form to the appropriate state tax office.

- In-person submission at designated tax offices, if required.

Choosing the right submission method can facilitate a quicker processing time for your tax credits.

Quick guide on how to complete 502cr income tax credits for individuals tax year 502cr income tax credits for individuals

Complete 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any delays. Manage 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS with ease

- Obtain 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize essential sections of the documents or conceal sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal status as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 502cr income tax credits for individuals tax year 502cr income tax credits for individuals

Create this form in 5 minutes!

How to create an eSignature for the 502cr income tax credits for individuals tax year 502cr income tax credits for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the md form 502cr and how is it used?

The md form 502cr is a crucial document for businesses in Maryland that need to report certain taxes. Using airSlate SignNow, you can easily fill out and eSign this form, ensuring compliance with state regulations. Our platform streamlines the submission process, making it more efficient and less prone to errors.

-

How much does it cost to use airSlate SignNow for md form 502cr?

airSlate SignNow offers various pricing plans that cater to different business needs. You can access features for handling the md form 502cr at a competitive rate, allowing you to manage your documents without breaking the bank. Our affordable solutions make electronic signatures accessible to everyone.

-

What features does airSlate SignNow offer for managing md form 502cr?

With airSlate SignNow, you can enjoy a range of features designed to simplify the process of managing the md form 502cr. These include customizable templates, automated reminders, and a secure eSignature function. This ensures that your documents are handled quickly and securely.

-

Can I collaborate with my team on the md form 502cr using airSlate SignNow?

Yes, airSlate SignNow allows seamless collaboration among team members when working on the md form 502cr. You can share documents, leave comments, and track changes in real time, fostering efficient teamwork. Collaboration has never been easier with our user-friendly platform.

-

Is airSlate SignNow secure for handling sensitive information on md form 502cr?

Absolutely! airSlate SignNow provides high-level security measures, ensuring that your md form 502cr and other sensitive information are protected. We use encryption and compliant protocols to safeguard your data, giving you peace of mind while handling important documents.

-

What integrations does airSlate SignNow offer for the md form 502cr?

airSlate SignNow integrates seamlessly with a variety of third-party applications, enhancing the functionality of your md form 502cr management. Whether you use CRM systems, cloud storage, or project management tools, our integrations make it easy to streamline your workflow. This adaptability allows you to work efficiently with all your preferred tools.

-

Can I track the status of my md form 502cr in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including the md form 502cr. You can easily monitor the progress of your forms, see who has signed, and get notifications when actions are completed. This feature enhances transparency and helps you stay organized.

Get more for 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS

Find out other 502CR INCOME TAX CREDITS FOR INDIVIDUALS Tax Year 502CR INCOME TAX CREDITS FOR INDIVIDUALS

- Sign Nevada Hold Harmless (Indemnity) Agreement Easy

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online