Fillable Online INCOME TAX CREDITS for INDIVIDUALS Attach 2021

What is the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

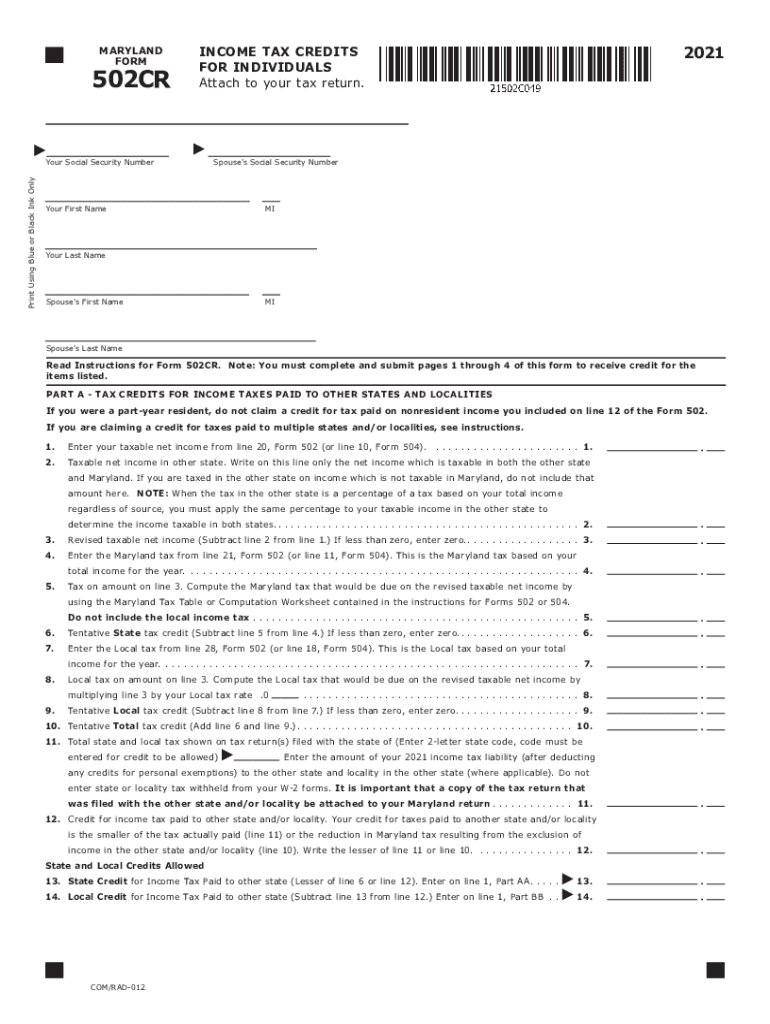

The Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form is a crucial document for U.S. taxpayers seeking to claim various tax credits available to individuals. This form allows taxpayers to report and attach relevant information regarding their eligibility for credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and others. By utilizing this fillable online form, individuals can streamline the process of documenting their claims, ensuring that they meet the necessary requirements set forth by the IRS.

How to use the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

Using the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form is straightforward. First, access the form through a reliable online platform. Once open, you can fill in the required fields, which typically include personal information, income details, and specifics about the tax credits you are claiming. The form is designed to guide you through each section, ensuring that you provide all necessary information. After completing the form, it can be electronically signed and submitted directly to the IRS, simplifying the filing process.

Steps to complete the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

Completing the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form involves several key steps:

- Access the form through a secure online platform.

- Enter your personal information, including your name, address, and Social Security number.

- Provide details about your income and any applicable deductions.

- Indicate the specific tax credits you are claiming by filling in the required fields.

- Review the form for accuracy and completeness.

- Electronically sign the form to validate your submission.

- Submit the form to the IRS as directed.

Legal use of the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

The Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form is legally recognized when completed in accordance with IRS guidelines. Electronic signatures on this form are valid under the ESIGN Act and UETA, provided that the signer has consented to use electronic records and signatures. It is essential to ensure that all information is accurate and that the form is submitted within the required deadlines to avoid any potential legal issues.

Required Documents

To successfully complete the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form, certain documents may be required. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Social Security numbers for all dependents.

- Documentation supporting eligibility for claimed tax credits.

- Any prior year tax returns, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach form align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing dates, especially for those claiming tax credits, as late submissions may result in the loss of potential benefits.

Quick guide on how to complete fillable online income tax credits for individuals attach

Complete Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly, without delays. Manage Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most efficient way to edit and eSign Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach effortlessly

- Obtain Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online income tax credits for individuals attach

Create this form in 5 minutes!

How to create an eSignature for the fillable online income tax credits for individuals attach

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF document on Android OS

People also ask

-

What are fillable online income tax credits for individuals?

Fillable online income tax credits for individuals are digital forms that allow you to input your tax credit information easily and accurately. These forms simplify the process of claiming credits, making it more efficient for taxpayers. By using our platform, you can ensure that your forms are completed correctly and submitted on time.

-

How does airSlate SignNow facilitate the filling and attaching of income tax credits?

airSlate SignNow provides a user-friendly interface for filling out your income tax credits easily. With our fillable online forms, you can quickly input the needed data and attach any necessary documents. This streamlines your tax preparation process, reducing time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for fillable online income tax credits?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans to suit different needs. Our solutions are designed to be cost-effective, providing great value for users needing fillable online income tax credits for individuals. You can choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for income tax credit forms?

airSlate SignNow offers features such as customizable fillable forms, e-signature capability, and document sharing. These features ensure that your fillable online income tax credits for individuals can be completed and submitted with ease. Additionally, you can track the progress of your documents in real time.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow can be integrated with various tax preparation software and tools. This flexibility allows you to enhance your workflow and efficiently manage your fillable online income tax credits for individuals. Integrations help streamline the data transfer process and minimize errors.

-

What benefits will I experience using airSlate SignNow for my tax credits?

Using airSlate SignNow for your fillable online income tax credits provides numerous benefits, including saving time, reducing errors, and improving efficiency. With our platform, you can complete your forms from anywhere, at any time, ensuring you never miss a filing deadline. Additionally, our e-signature feature helps speed up the approval process.

-

Are my documents secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and security measures. When you use our fillable online income tax credits for individuals, you can rest assured that your sensitive information remains safe and confidential during the entire process.

Get more for Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

Find out other Fillable Online INCOME TAX CREDITS FOR INDIVIDUALS Attach

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP