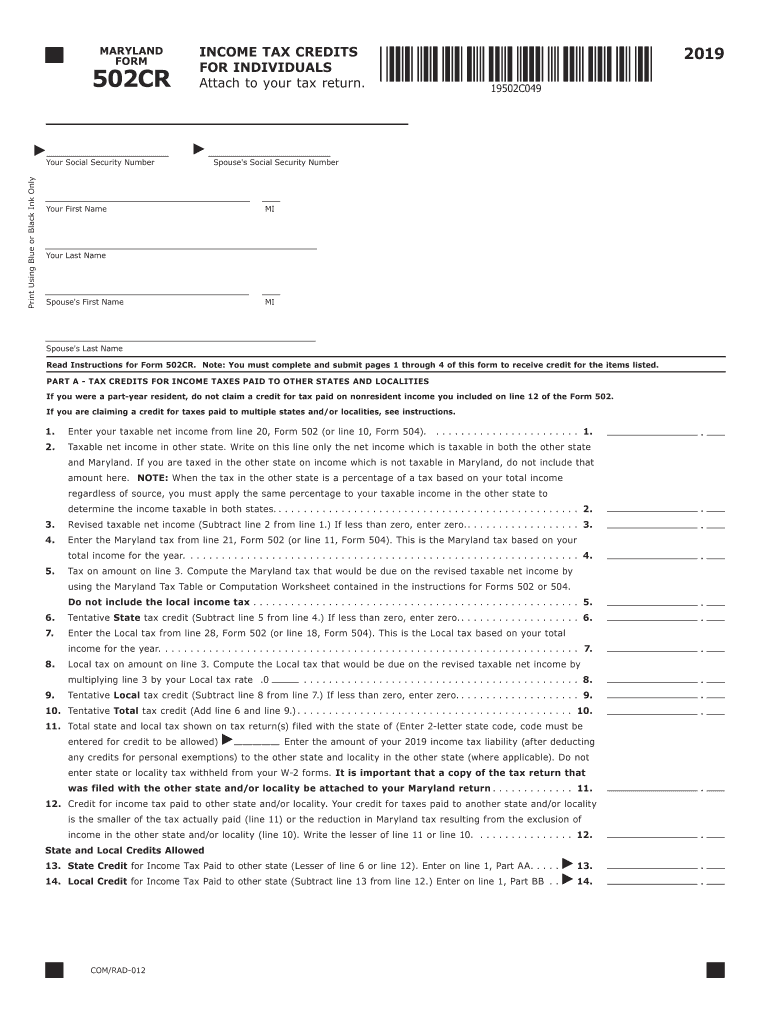

INCOME TAX CREDITS for INDIVIDUALS Attach to Your Tax 2019

What is the income tax credits for individuals attach to your tax

The income tax credits for individuals attach to your tax form are specific financial benefits designed to reduce the amount of tax owed. These credits can be applied to various tax situations, such as education expenses, childcare costs, or energy-efficient home improvements. They differ from deductions, as credits directly decrease the tax liability rather than just lowering taxable income. Understanding these credits is essential for maximizing your tax refund and ensuring compliance with IRS regulations.

How to use the income tax credits for individuals attach to your tax

To effectively use the income tax credits for individuals, you must first identify which credits you qualify for based on your financial situation and personal circumstances. Once identified, gather the necessary documentation to support your claims. When filling out your tax return, ensure you accurately report the credits on the designated forms, typically found in the IRS instructions for the specific tax year. This process can be simplified by utilizing digital tools that guide you through the necessary steps and calculations.

Steps to complete the income tax credits for individuals attach to your tax

Completing the income tax credits for individuals involves several key steps:

- Identify eligible credits based on your situation, such as the Earned Income Tax Credit or Child Tax Credit.

- Gather required documents, including proof of income, expenses, and relevant receipts.

- Fill out the appropriate tax forms, ensuring to include the credits in the correct sections.

- Review your entries for accuracy to prevent delays or issues with the IRS.

- Submit your tax return electronically or via mail, depending on your preference.

Eligibility criteria for the income tax credits for individuals attach to your tax

Eligibility for income tax credits varies depending on the specific credit. Common criteria include income levels, filing status, and the number of dependents. For example, the Earned Income Tax Credit is available primarily to low- to moderate-income workers, while the Child Tax Credit requires the taxpayer to have qualifying children. It is crucial to review the specific requirements for each credit to ensure compliance and maximize your potential benefits.

IRS guidelines for the income tax credits for individuals attach to your tax

The IRS provides detailed guidelines regarding the income tax credits for individuals, including eligibility requirements, documentation needed, and how to claim the credits. These guidelines are updated annually, reflecting changes in tax law and policy. Taxpayers should refer to the latest IRS publications and instructions related to their tax return to ensure they are following the correct procedures and claiming all eligible credits.

Required documents for the income tax credits for individuals attach to your tax

When claiming income tax credits, certain documents are necessary to substantiate your claims. Commonly required documents include:

- W-2 forms or 1099 forms showing income.

- Receipts for qualifying expenses, such as tuition or childcare.

- Proof of residency or dependent status, if applicable.

- Any relevant tax forms that support your credit claims.

Having these documents organized can streamline the filing process and help avoid potential issues with the IRS.

Quick guide on how to complete income tax credits for individuals attach to your tax

Effortlessly Prepare INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax on any device via airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Alter and eSign INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax with Ease

- Find INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has exactly the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Edit and eSign INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax credits for individuals attach to your tax

Create this form in 5 minutes!

How to create an eSignature for the income tax credits for individuals attach to your tax

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax?

INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax are deductions that can reduce your overall tax liability. These credits can stem from various sectors, including education, health, and child care. By utilizing these credits, individuals have the potential to save signNowly on their taxes.

-

How can airSlate SignNow help with filing for INCOME TAX CREDITS FOR INDIVIDUALS?

airSlate SignNow streamlines the document management process, allowing you to efficiently prepare your tax documents. With our eSigning features, you can securely sign and send important forms necessary for claiming INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax. This enhances your overall filing experience and ensures you meet all deadlines.

-

Are there any costs associated with using airSlate SignNow for tax-related documents?

Yes, there are pricing plans associated with using airSlate SignNow, but they are designed to be cost-effective. Our pricing includes various features to help you manage documents efficiently for your INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax needs. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features including eSigning, secure document storage, and template creation for tax-related forms. These tools are specifically designed to assist in organizing the necessary documents for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax. Simplifying the document workflow helps minimize errors and saves valuable time.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various tax preparation software, making it easy to share documents needed for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax. This integration ensures that your tax process is comprehensive and eliminates the hassle of handling multiple platforms.

-

What are the benefits of using airSlate SignNow for tax filings?

Using airSlate SignNow for your tax filings offers several benefits, such as enhanced security, easy access to documents, and efficient collaboration with stakeholders. These advantages are particularly useful when dealing with INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax. Our solution helps you file accurately and on time.

-

How secure is my data when using airSlate SignNow for tax purposes?

Data security is a top priority for airSlate SignNow. We employ high-level encryption and compliance measures to ensure that your information, especially regarding INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax, is protected. You can confidently manage sensitive documents knowing your data is safeguarded.

Get more for INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax

Find out other INCOME TAX CREDITS FOR INDIVIDUALS Attach To Your Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors