Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form 2023-2026

What is the Maryland Injured Spouse Claim Form?

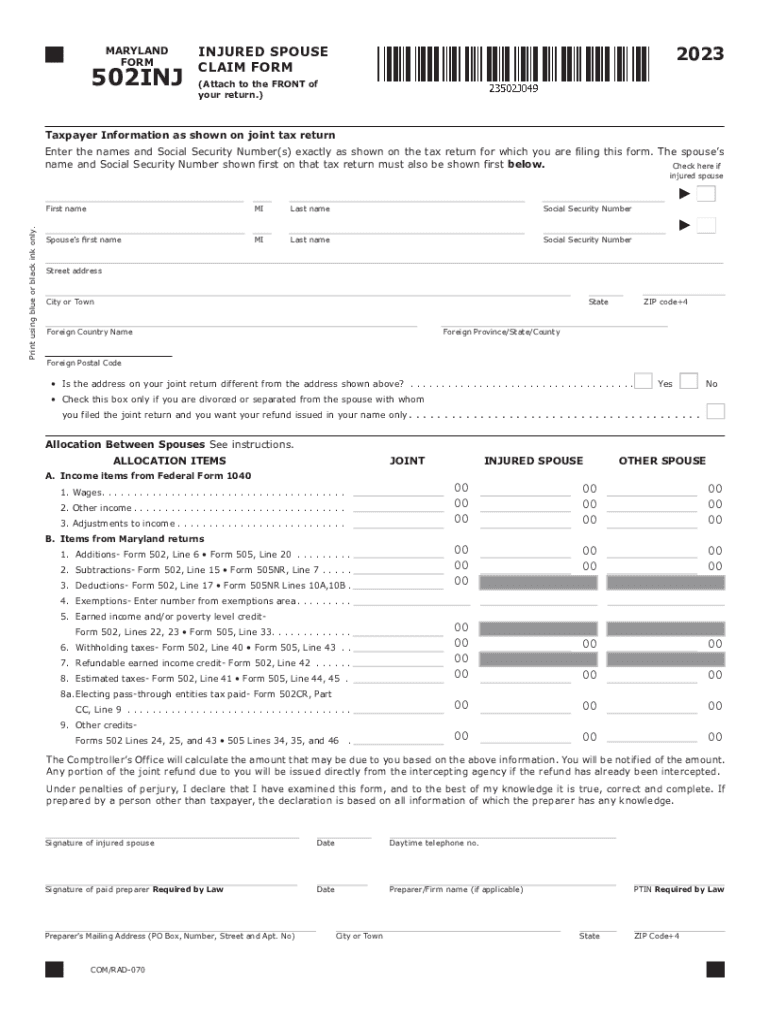

The Maryland Injured Spouse Claim Form, known as the 502INJ form, is designed for individuals who have filed a joint tax return but wish to claim their portion of a tax refund that may have been withheld due to their spouse's debts. This form allows the injured spouse to protect their share of the refund from being applied to their partner's tax liabilities, child support, or other debts. Understanding this form is essential for ensuring that eligible taxpayers can receive their rightful refunds without complications.

How to Obtain the Maryland Injured Spouse Claim Form

The 502INJ form can be easily accessed through the Maryland State Comptroller's website or by visiting local tax offices. Taxpayers can also request a physical copy by contacting the Comptroller's office directly. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Steps to Complete the Maryland Injured Spouse Claim Form

Completing the Maryland Injured Spouse Claim Form involves several key steps:

- Gather necessary documents, including your joint tax return and any relevant financial information.

- Fill out the 502INJ form accurately, providing details about your income and the debts of your spouse.

- Clearly indicate the portion of the tax refund you are claiming as an injured spouse.

- Review the form for accuracy and completeness before submission.

- Submit the form along with your tax return or separately, depending on your situation.

Eligibility Criteria for the Maryland Injured Spouse Claim Form

To qualify for filing the Maryland Injured Spouse Claim Form, certain eligibility criteria must be met:

- You must have filed a joint tax return with your spouse.

- Your portion of the refund must be at risk of being applied to your spouse's debts.

- You must have earned income during the tax year in question.

- Documentation proving your income and any debts should be readily available.

Form Submission Methods for the Maryland Injured Spouse Claim Form

The 502INJ form can be submitted through various methods:

- Online submission through the Maryland State Comptroller's e-filing system.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at local tax offices, where assistance may be available.

Key Elements of the Maryland Injured Spouse Claim Form

Understanding the key elements of the 502INJ form is crucial for successful filing. Important sections include:

- Your personal information, including Social Security numbers and contact details.

- Details regarding your income and any tax withholdings.

- Information about your spouse's debts that may affect the refund.

- Signature and date to validate the information provided.

Quick guide on how to complete tax year 502inj injured spouse claim form tax year 502inj injured spouse claim form

Effortlessly Prepare Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, as you can access the needed form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form across any platform using airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form with Ease

- Find Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form and ensure exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year 502inj injured spouse claim form tax year 502inj injured spouse claim form

Create this form in 5 minutes!

How to create an eSignature for the tax year 502inj injured spouse claim form tax year 502inj injured spouse claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does airSlate SignNow offer for Maryland injured clients?

airSlate SignNow provides a comprehensive eSigning solution tailored for Maryland injured clients who need to manage legal documents efficiently. Our platform allows for secure document sharing, signing, and storage, making it ideal for personal injury cases. With user-friendly features, you can streamline processes and focus on your recovery while we handle the paperwork.

-

How does airSlate SignNow ensure document security for Maryland injured cases?

For Maryland injured cases, airSlate SignNow utilizes top-tier encryption and security protocols to protect your sensitive information. Our platform complies with industry standards and regulations, ensuring that your documents are safe from unauthorized access. Trust us to keep your legal documents secure as you navigate your recovery.

-

What are the pricing options available for Maryland injured clients?

airSlate SignNow offers flexible pricing plans designed to accommodate the needs of Maryland injured clients. Our competitive rates include tiered options, so you pay only for the features you need. Enjoy the benefits of an affordable and efficient solution for managing your documents without breaking the bank.

-

Can airSlate SignNow integrate with other tools often used by Maryland injured clients?

Yes, airSlate SignNow easily integrates with various tools and applications that Maryland injured clients may already be using. These integrations include popular CRM systems, cloud storage solutions, and project management tools to enhance your workflow. This seamless connectivity ensures that managing your documents is as efficient as possible.

-

What are the key benefits of using airSlate SignNow for Maryland injured cases?

Using airSlate SignNow for Maryland injured cases provides numerous benefits, including faster document turnaround times and efficient collaboration. Our platform helps eliminate the need for physical paperwork, saving you time and hassle. This means you can focus more on your recovery while we streamline your document management processes.

-

How do I get started with airSlate SignNow as a Maryland injured client?

Getting started with airSlate SignNow is simple for Maryland injured clients. Just sign up for an account on our website, choose a suitable pricing plan, and start uploading your documents. Our intuitive interface guides you through the process, so you can begin leveraging our eSigning capabilities in no time.

-

Is customer support available for Maryland injured clients using airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support for Maryland injured clients. Whether you have questions about features, need assistance with your account, or require help with document handling, our friendly support team is here to assist you through various channels, including phone and email.

Get more for Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form

- Q guardian or conservator for minor form

- Official and local forms united states courts

- Warranty bill of sale insured aircraft title service form

- That a form

- City of county of and state of kentucky to wit form

- Local formseastern district of kentuckyunited states

- Document systems inc loan document worksheet form

- United states of america v kenneth douglas form

Find out other Tax Year 502INJ Injured Spouse Claim Form Tax Year 502INJ Injured Spouse Claim Form

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement