MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ 2020

What is the Maryland injured spouse form 502inj?

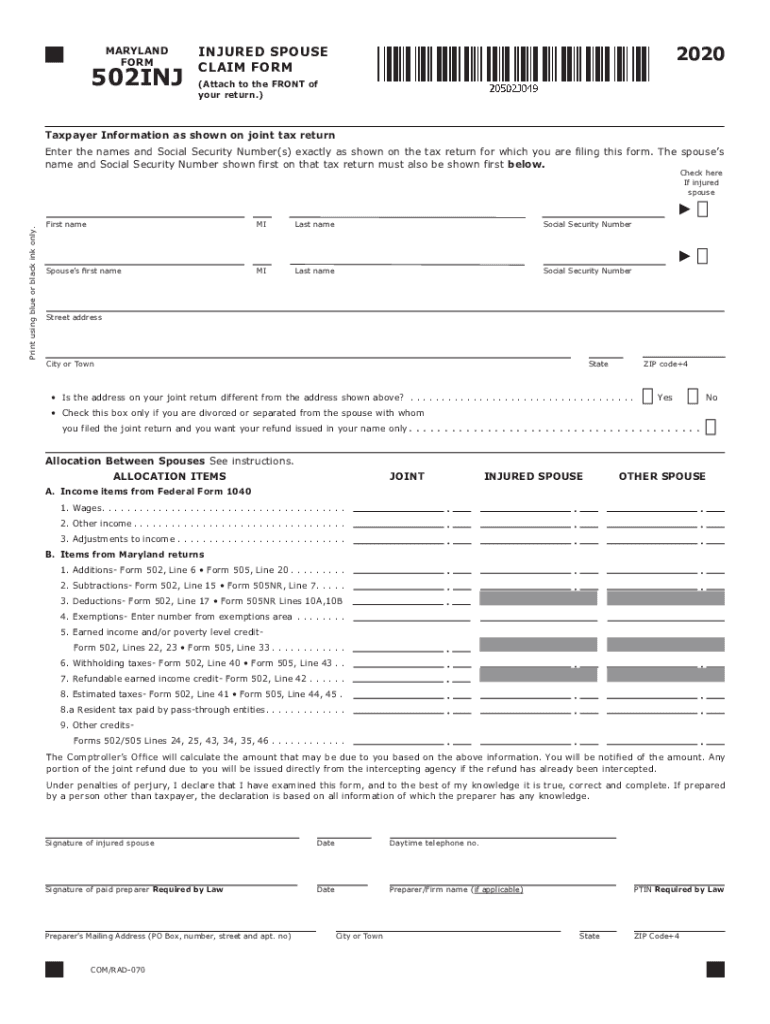

The Maryland injured spouse form 502inj is a specific tax form used by individuals who are married and are seeking relief from the IRS for their share of a tax refund that may have been applied to their spouse's tax debts. This form is particularly relevant for taxpayers who have had their refunds offset due to their spouse's financial obligations, such as unpaid child support or federal tax debts. By filing this form, the injured spouse can claim their portion of the refund, ensuring they receive the funds they are entitled to.

Steps to complete the Maryland injured spouse form 502inj

Completing the Maryland injured spouse form 502inj involves several key steps to ensure accuracy and compliance. Here’s a concise guide:

- Gather necessary information: Collect your tax documents, including W-2s, 1099s, and any other income statements.

- Identify your filing status: Confirm your marital status and whether you are filing jointly or separately.

- Complete the form: Fill out the 502inj form with accurate details about your income and your spouse's debts.

- Provide supporting documentation: Include any relevant documents that support your claim for relief.

- Review for accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit the form: File the form with the appropriate tax authority by the deadline.

Eligibility criteria for the Maryland injured spouse form 502inj

To qualify for relief using the Maryland injured spouse form 502inj, certain eligibility criteria must be met. These include:

- Marital status: You must be legally married and filing a joint tax return.

- Income requirements: Your income must be reported accurately, and you should not be responsible for your spouse's tax debts.

- Timely filing: The form must be submitted within the specified timeframe to be considered for the current tax year.

Required documents for the Maryland injured spouse form 502inj

When filing the Maryland injured spouse form 502inj, several documents are necessary to support your claim. These include:

- Tax returns: Your completed federal and state tax returns for the relevant year.

- Income statements: W-2s, 1099s, and any other documentation of income received.

- Proof of debts: Documentation showing your spouse's tax debts or obligations that have led to the refund offset.

Form submission methods for the Maryland injured spouse form 502inj

The Maryland injured spouse form 502inj can be submitted through various methods, ensuring flexibility for taxpayers. The available submission options include:

- Online submission: If you are filing electronically, you can submit the form through approved tax software.

- Mail: You can print the completed form and send it via postal mail to the designated tax office.

- In-person submission: Some taxpayers may choose to deliver the form directly to a local tax office for processing.

Legal use of the Maryland injured spouse form 502inj

The Maryland injured spouse form 502inj is legally recognized and provides a structured process for individuals seeking to reclaim their tax refunds. It is essential to understand that the form must be filled out accurately and submitted in accordance with state and federal regulations. Failure to comply with these legal requirements may result in delays or denial of the claim. By adhering to the guidelines and providing necessary documentation, taxpayers can ensure their rights are protected and their claims are processed efficiently.

Quick guide on how to complete maryland injured spouse 00 form claim form 0inj

Complete MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ effortlessly on any gadget

Online document management has become increasingly preferred by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ on any device with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to alter and eSign MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ effortlessly

- Locate MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland injured spouse 00 form claim form 0inj

Create this form in 5 minutes!

How to create an eSignature for the maryland injured spouse 00 form claim form 0inj

The way to create an eSignature for your PDF file in the online mode

The way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

How can airSlate SignNow benefit my spouse when signing documents?

airSlate SignNow provides a seamless eSigning experience that your spouse will appreciate. With its user-friendly interface, your spouse can sign documents anytime, anywhere, eliminating the hassle of paperwork. This convenience helps streamline processes for couples managing shared documents.

-

Is there a pricing plan suitable for couples using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to both individuals and couples. If your spouse often needs to sign documents, the pricing allows you to manage all your eSigning needs efficiently and affordably. Explore the different plans to find one that best fits your partnership.

-

What features does airSlate SignNow include for managing documents with my spouse?

airSlate SignNow includes features such as document templates, real-time tracking, and customizable workflows that make it easy for you and your spouse to collaborate. These tools help ensure that all necessary documents are completed accurately and securely. This means you can efficiently handle all your shared paperwork.

-

How secure is airSlate SignNow for documents shared between spouses?

Security is a top priority for airSlate SignNow, especially for sensitive documents shared between spouses. The platform uses encryption and secure authentication measures to keep your documents safe from unauthorized access. You can confidently share personal and legal documents with your spouse knowing they are protected.

-

Does airSlate SignNow integrate with other tools my spouse and I use?

Absolutely! airSlate SignNow integrates with a variety of popular applications, such as Google Drive, Microsoft Office, and Dropbox. This means you can easily manage and sign documents alongside the tools you and your spouse already use, enhancing your overall experience.

-

Can I set reminders for my spouse to sign documents?

Yes, airSlate SignNow allows you to set automated reminders for your spouse to sign important documents. This feature ensures that both parties are always aware of pending signatures, helping to avoid any delays in processes that require timely completion. It's a useful tool for couples managing shared responsibilities.

-

What types of documents can my spouse sign using airSlate SignNow?

Your spouse can sign various document types with airSlate SignNow, including contracts, agreements, and forms. This versatility makes it ideal for both personal and business-related documents. Whether it's a lease, loan agreement, or any important paperwork, your spouse can handle it all with ease.

Get more for MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ

Find out other MARYLAND INJURED SPOUSE 00 FORM CLAIM FORM 0INJ

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement