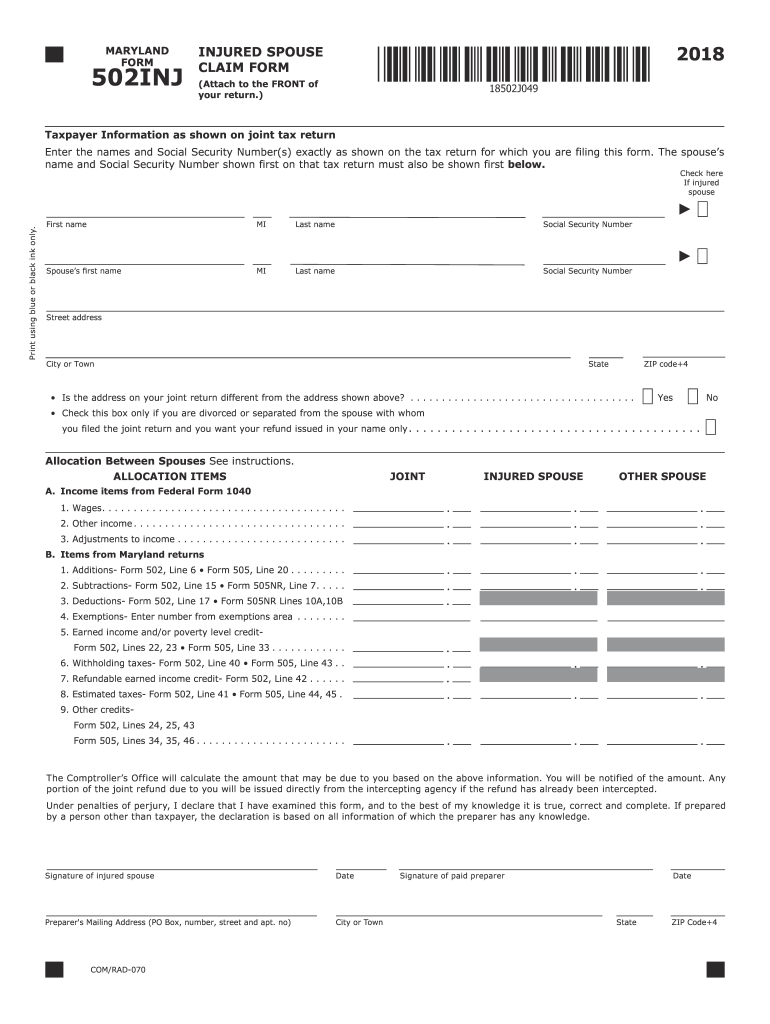

Maryland Injured Spouse Form 2018

What is the Maryland Injured Spouse Form

The Maryland Injured Spouse Form, also known as the 502inj form, is a tax document designed for individuals who have had their tax refunds offset due to their spouse's debts. This form allows the injured spouse to claim their portion of the refund, ensuring that they receive the funds they are entitled to, despite any financial obligations their spouse may have. It is particularly relevant for couples filing jointly, where one spouse’s financial issues could impact the other’s tax refunds.

How to use the Maryland Injured Spouse Form

To effectively use the Maryland Injured Spouse Form, individuals must first determine their eligibility. This involves assessing whether their tax refund has been withheld due to their spouse's debts. Once eligibility is confirmed, the next step is to complete the form accurately, ensuring all required information is provided. After filling out the form, it must be submitted to the Maryland Comptroller's office along with the tax return. It is crucial to keep a copy of the completed form for personal records.

Steps to complete the Maryland Injured Spouse Form

Completing the Maryland Injured Spouse Form involves several key steps:

- Gather all necessary tax documents, including W-2s and 1099s.

- Fill out the 502inj form, ensuring that personal information and tax details are accurate.

- Indicate the amount of the refund you believe you are entitled to.

- Sign and date the form to validate your submission.

- Submit the form with your tax return, either electronically or by mail.

Eligibility Criteria

To qualify for relief under the Maryland Injured Spouse Form, certain criteria must be met. The individual must be a spouse who filed a joint tax return and is not responsible for the debts that caused the refund offset. Additionally, the injured spouse must have reported income on the joint return and must have a valid Social Security number. Meeting these criteria is essential for a successful claim.

Required Documents

When preparing to submit the Maryland Injured Spouse Form, several documents are required:

- Completed Maryland Injured Spouse Form (502inj).

- Copy of the joint tax return.

- Documentation of income, such as W-2s or 1099s.

- Any notices received regarding the offset of the tax refund.

Form Submission Methods

The Maryland Injured Spouse Form can be submitted through various methods. Taxpayers have the option to file electronically along with their tax return or send a paper copy via mail. If filing by mail, it is advisable to use a secure method and retain proof of submission. The choice of submission method may depend on personal preference and the urgency of the refund claim.

Quick guide on how to complete 2017 spouse form 2018 2019

Your assistance manual on how to prepare your Maryland Injured Spouse Form

If you’re curious about how to finalize and send your Maryland Injured Spouse Form, below are a few brief guidelines on how to streamline tax processing.

To commence, all you need is to register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Maryland Injured Spouse Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to open your Maryland Injured Spouse Form in our editor.

- Complete the necessary fillable fields with your details (text content, numbers, checkmarks).

- Use the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting a paper version can lead to errors in returns and delays in reimbursements. Naturally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 spouse form 2018 2019

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the 2017 spouse form 2018 2019

How to make an electronic signature for the 2017 Spouse Form 2018 2019 in the online mode

How to make an electronic signature for your 2017 Spouse Form 2018 2019 in Google Chrome

How to generate an electronic signature for putting it on the 2017 Spouse Form 2018 2019 in Gmail

How to create an electronic signature for the 2017 Spouse Form 2018 2019 right from your smart phone

How to generate an eSignature for the 2017 Spouse Form 2018 2019 on iOS

How to make an electronic signature for the 2017 Spouse Form 2018 2019 on Android

People also ask

-

What is the Maryland Injured Spouse Form?

The Maryland Injured Spouse Form is a document that allows a spouse to claim their share of a tax refund when their partner has outstanding debts. By completing this form, you can ensure that your tax refund is not intercepted to pay for your spouse's debts. It's an essential tool for protecting your financial interests in Maryland.

-

How can airSlate SignNow help with the Maryland Injured Spouse Form?

airSlate SignNow simplifies the process of completing and submitting the Maryland Injured Spouse Form. With our user-friendly interface, you can easily fill out the form, eSign it, and send it directly to the IRS or state tax office. This saves you time and ensures that your submission is accurate and secure.

-

Is there a cost associated with using airSlate SignNow for the Maryland Injured Spouse Form?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs. Our plans are designed to be cost-effective, ensuring you get the best value when preparing your Maryland Injured Spouse Form and other documents. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Maryland Injured Spouse Form?

airSlate SignNow offers features like eSigning, document templates, and real-time collaboration, which are all beneficial when working on the Maryland Injured Spouse Form. These features streamline the process, making it faster and more efficient to complete your forms. Plus, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Maryland Injured Spouse Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your Maryland Injured Spouse Form along with other business documents. Whether you use CRM systems or cloud storage services, our integrations enhance your workflow and keep everything organized.

-

What are the benefits of using airSlate SignNow for tax forms like the Maryland Injured Spouse Form?

Using airSlate SignNow for the Maryland Injured Spouse Form offers numerous benefits, including enhanced security, ease of use, and efficient document management. Our platform ensures that your sensitive information is protected while allowing you to complete forms quickly and accurately, reducing the risk of errors.

-

Is airSlate SignNow compliant with legal standards for the Maryland Injured Spouse Form?

Yes, airSlate SignNow is fully compliant with legal standards and regulations for eSignature and document handling. When you use our services for the Maryland Injured Spouse Form, you can be confident that your documents meet all necessary legal requirements, ensuring their validity.

Get more for Maryland Injured Spouse Form

Find out other Maryland Injured Spouse Form

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form