502INJ 121322 a 502INJ 121322 a 2022

What is the Maryland Claim 502?

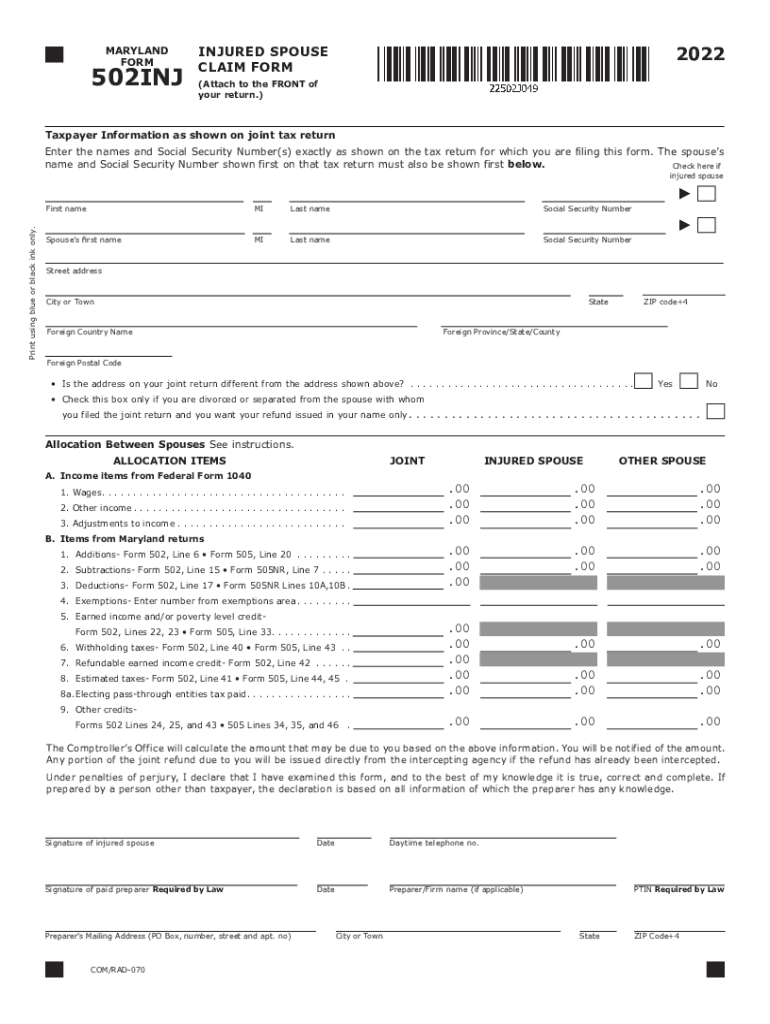

The Maryland Claim 502, also known as the Maryland Injured Spouse Form, is specifically designed for individuals who are married and filing a joint tax return. This form allows a spouse to claim their portion of a tax refund that may be withheld due to the other spouse's debts, such as child support or tax obligations. By completing this form, the injured spouse can protect their share of the refund and ensure it is not applied to the other spouse's liabilities.

Steps to Complete the Maryland Claim 502

Completing the Maryland Claim 502 involves several key steps to ensure accuracy and compliance. Here’s a brief overview of the process:

- Gather Required Information: Collect necessary documents, including your tax return and any relevant financial records.

- Fill Out the Form: Provide personal details, including your name, Social Security number, and information about your spouse.

- Indicate the Amount of the Refund: Clearly state the amount of the tax refund you are claiming.

- Sign and Date the Form: Ensure both spouses sign the form to validate the submission.

- Submit the Form: Follow the guidelines for submitting the form, whether online, by mail, or in person.

Required Documents for Maryland Claim 502

When filing the Maryland Claim 502, certain documents are necessary to support your claim. These include:

- Your completed Maryland tax return.

- Any documentation related to your spouse's debts that may affect the refund.

- Proof of identity, such as a driver's license or Social Security card.

Having these documents ready will facilitate a smoother filing process and help ensure that your claim is processed efficiently.

Form Submission Methods for Maryland Claim 502

The Maryland Claim 502 can be submitted through various methods, allowing flexibility based on your preferences. Here are the available options:

- Online Submission: Use the state’s tax filing portal to submit your form electronically.

- Mail: Print the completed form and send it to the appropriate Maryland tax office address.

- In-Person: Visit a local tax office to submit the form directly.

Choosing the right submission method can help ensure timely processing of your claim.

Eligibility Criteria for Maryland Claim 502

To qualify for the Maryland Claim 502, certain eligibility criteria must be met. These include:

- You must be married and filing a joint tax return.

- One spouse must have a tax refund that is subject to being withheld due to debts.

- The injured spouse must have contributed to the income that generated the refund.

Meeting these criteria is essential for successfully filing the form and claiming your rightful portion of the tax refund.

Legal Use of the Maryland Claim 502

The Maryland Claim 502 is legally recognized and provides a framework for protecting the rights of spouses in tax matters. By filing this form, individuals can ensure that their tax refunds are not unfairly diverted to cover their spouse's debts. It is important to comply with all state regulations and guidelines when completing and submitting the form to maintain its legal standing.

Quick guide on how to complete 502inj 121322 a 502inj 121322 a

Effortlessly Prepare 502INJ 121322 A 502INJ 121322 A on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect sustainable alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without any delays. Manage 502INJ 121322 A 502INJ 121322 A on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

Simplest Way to Modify and Electronically Sign 502INJ 121322 A 502INJ 121322 A with Ease

- Obtain 502INJ 121322 A 502INJ 121322 A and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 502INJ 121322 A 502INJ 121322 A to ensure outstanding communication at every stage of form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 502inj 121322 a 502inj 121322 a

Create this form in 5 minutes!

How to create an eSignature for the 502inj 121322 a 502inj 121322 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maryland claim 502 and how can SignNow assist in the process?

A Maryland claim 502 is a specific form used in the state of Maryland for claims related to certain service or recovery issues. airSlate SignNow provides an easy-to-use platform that enables users to create, send, and electronically sign Maryland claim 502 forms efficiently, ensuring compliance with state regulations.

-

How does SignNow ensure the security of my Maryland claim 502 documents?

Security is a top priority at airSlate SignNow. When handling Maryland claim 502 documents, we utilize advanced encryption protocols, secure data storage, and comprehensive access controls to protect your sensitive information from unauthorized access.

-

Are there any costs associated with using SignNow for my Maryland claim 502 documents?

Yes, there are various pricing plans available for utilizing airSlate SignNow services, which can be tailored depending on your volume of Maryland claim 502 documents. The plans are designed to be cost-effective, offering features that suit both small businesses and larger organizations.

-

Can I integrate SignNow with other tools for managing my Maryland claim 502 processes?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications like Google Drive, Salesforce, and Dropbox, making it easy to streamline your workflow for Maryland claim 502 documents and other related tasks.

-

What features does SignNow offer for managing Maryland claim 502 documents?

airSlate SignNow offers a range of features such as customizable templates, real-time tracking, and automated workflows. These features signNowly enhance the management process for Maryland claim 502 documents, ensuring a smoother experience from start to finish.

-

How can SignNow benefit my business when processing Maryland claim 502 forms?

Using airSlate SignNow for Maryland claim 502 forms can greatly boost efficiency and reduce turnaround times. Our platform allows for quick sending and receiving of signed documents, minimizing delays in claim processing and improving overall productivity.

-

Is it easy to use SignNow for first-time users dealing with Maryland claim 502?

Yes, airSlate SignNow is designed with a user-friendly interface, making it accessible for first-time users dealing with Maryland claim 502 documents. Our intuitive processes and step-by-step guidance ensure that even those unfamiliar with eSigning can navigate the platform with ease.

Get more for 502INJ 121322 A 502INJ 121322 A

- Living trust individual 497325811 form

- Living trust for husband and wife with one child south carolina form

- Living trust for husband and wife with minor and or adult children south carolina form

- South carolina trust form

- Living trust property record south carolina form

- Financial account transfer to living trust south carolina form

- Assignment to living trust south carolina form

- Notice of assignment to living trust south carolina form

Find out other 502INJ 121322 A 502INJ 121322 A

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form