Florida Dept of Revenue Insurance Premium Tax Incentives 2024

What is the Florida Dept Of Revenue Insurance Premium Tax Incentives

The Florida Department of Revenue offers Insurance Premium Tax Incentives to promote economic growth and support businesses operating within the state. These incentives are designed to reduce the tax burden on insurance companies, thereby encouraging them to invest in Florida. The program aims to stimulate job creation and enhance the overall business environment by providing tax credits and exemptions related to insurance premiums. Understanding these incentives is crucial for businesses looking to optimize their tax strategies and contribute to the local economy.

Eligibility Criteria

To qualify for the Florida Dept Of Revenue Insurance Premium Tax Incentives, businesses must meet specific eligibility requirements. Generally, these include being a licensed insurance company operating in Florida and complying with state regulations. Additionally, companies must demonstrate that they are contributing to the local economy through job creation or investment. It is essential for businesses to review the detailed criteria outlined by the Florida Department of Revenue to ensure compliance and maximize their benefits.

Steps to complete the Florida Dept Of Revenue Insurance Premium Tax Incentives

Completing the application for the Florida Dept Of Revenue Insurance Premium Tax Incentives involves several key steps:

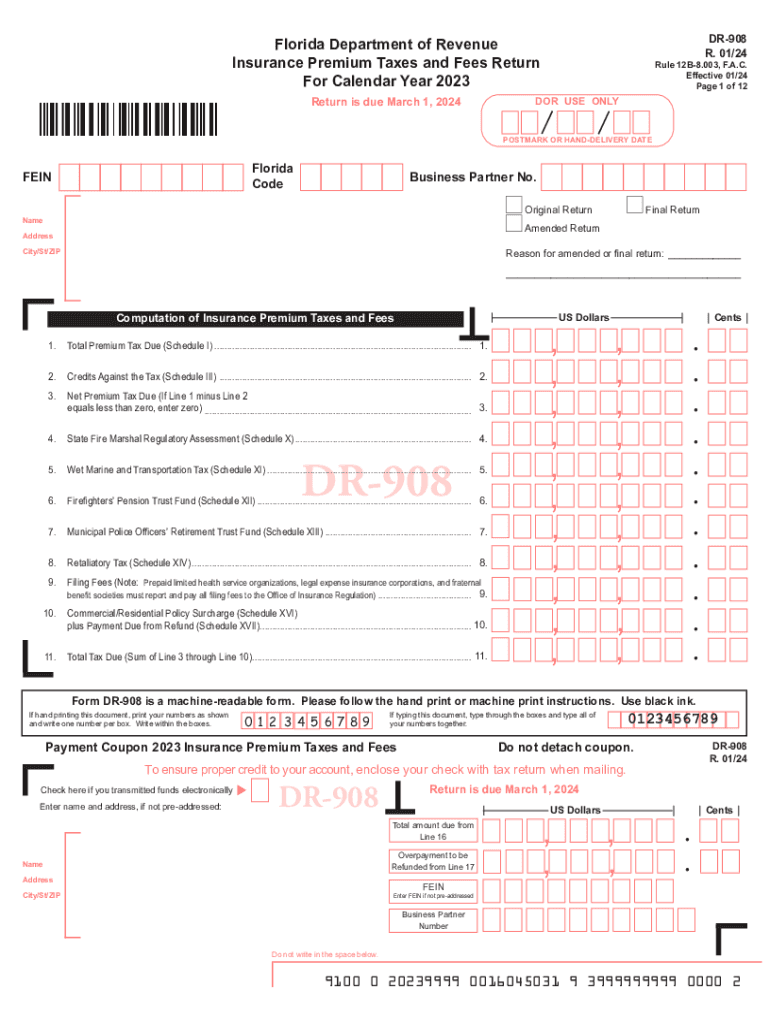

- Gather all necessary documentation, including proof of business operation in Florida and financial records.

- Complete the required application forms provided by the Florida Department of Revenue.

- Submit the application along with all supporting documents by the specified deadline.

- Await confirmation from the Department regarding the approval status of your application.

Following these steps carefully ensures a smoother application process and increases the likelihood of receiving the incentives.

Required Documents

When applying for the Florida Dept Of Revenue Insurance Premium Tax Incentives, businesses must prepare and submit several important documents. These typically include:

- Proof of business registration and licensing in Florida.

- Financial statements demonstrating the company's operations and tax obligations.

- Documentation supporting job creation or investment efforts within the state.

- Completed application forms as specified by the Florida Department of Revenue.

Ensuring that all documents are accurate and complete helps expedite the review process and reduces the risk of delays.

Legal use of the Florida Dept Of Revenue Insurance Premium Tax Incentives

The legal framework governing the Florida Dept Of Revenue Insurance Premium Tax Incentives is established by state law. Businesses must adhere to all applicable regulations when applying for and utilizing these incentives. This includes maintaining compliance with tax reporting requirements and ensuring that all claims for incentives are substantiated by appropriate documentation. Failure to comply with these legal standards can result in penalties or disqualification from future incentives.

Application Process & Approval Time

The application process for the Florida Dept Of Revenue Insurance Premium Tax Incentives involves submitting the required forms and documentation to the appropriate state agency. Once submitted, the review process typically takes several weeks, depending on the volume of applications received and the complexity of the submissions. Businesses should plan accordingly and allow sufficient time for approval before relying on the incentives for financial planning.

Quick guide on how to complete florida dept of revenue insurance premium tax incentives

Effortlessly Prepare Florida Dept Of Revenue Insurance Premium Tax Incentives on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as a flawless eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Florida Dept Of Revenue Insurance Premium Tax Incentives on any operating system with the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The Most Efficient Way to Modify and eSign Florida Dept Of Revenue Insurance Premium Tax Incentives with Ease

- Locate Florida Dept Of Revenue Insurance Premium Tax Incentives and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your edits.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device of your choice. Revise and eSign Florida Dept Of Revenue Insurance Premium Tax Incentives and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dept of revenue insurance premium tax incentives

Create this form in 5 minutes!

How to create an eSignature for the florida dept of revenue insurance premium tax incentives

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Florida Dept Of Revenue Insurance Premium Tax Incentives?

Florida Dept Of Revenue Insurance Premium Tax Incentives are financial benefits provided to eligible businesses to help reduce the tax burden related to insurance premiums. These incentives are designed to promote economic growth and support local businesses in Florida. By understanding these incentives, companies can effectively leverage them to enhance their financial performance.

-

How can airSlate SignNow help me apply for Florida Dept Of Revenue Insurance Premium Tax Incentives?

With airSlate SignNow, you can easily prepare and send the necessary documentation required for applying for Florida Dept Of Revenue Insurance Premium Tax Incentives. Our platform streamlines the e-signature process, making it efficient to gather signatures without any physical paperwork. This ensures a faster application process and a smoother experience.

-

What is the cost to use airSlate SignNow for accessing Florida Dept Of Revenue Insurance Premium Tax Incentives?

airSlate SignNow offers a cost-effective solution for managing your documentation, including those related to Florida Dept Of Revenue Insurance Premium Tax Incentives. Pricing plans are designed to cater to diverse business needs and budgets, with scalable options that ensure you only pay for what you use. This makes it accessible for small to large businesses alike.

-

What features does airSlate SignNow provide for managing Florida Dept Of Revenue Insurance Premium Tax Incentives?

airSlate SignNow includes several valuable features for managing Florida Dept Of Revenue Insurance Premium Tax Incentives, such as customizable templates, real-time tracking, and easy document sharing. Additionally, the platform ensures secure cloud storage and compliance with industry regulations. These features help businesses efficiently handle essential paperwork.

-

What are the benefits of using airSlate SignNow for Florida Dept Of Revenue Insurance Premium Tax Incentives?

Using airSlate SignNow for Florida Dept Of Revenue Insurance Premium Tax Incentives allows businesses to save time and reduce errors in their documentation. The easy-to-use interface helps streamline the signing process, enabling teams to focus on growth rather than administrative tasks. This boosts overall efficiency and drives better financial outcomes.

-

Can airSlate SignNow integrate with other tools for Florida Dept Of Revenue Insurance Premium Tax Incentives?

Yes, airSlate SignNow offers various integrations with popular business applications, helping streamline your workflow for Florida Dept Of Revenue Insurance Premium Tax Incentives. Whether you need to connect with accounting software or customer management systems, our platform facilitates easy integration, ensuring your documents and data remain connected and organized.

-

Is airSlate SignNow secure for handling Florida Dept Of Revenue Insurance Premium Tax Incentives?

Absolutely. airSlate SignNow employs advanced security measures to protect your documents related to Florida Dept Of Revenue Insurance Premium Tax Incentives. Our platform complies with leading security standards, including SSL encryption and two-factor authentication, ensuring your sensitive information is always safeguarded against unauthorized access.

Get more for Florida Dept Of Revenue Insurance Premium Tax Incentives

- We the undersigned purchasers of the above captioned property hereby certify form

- Indiana last will ampamp testament internet legal research group form

- I a notary public in and for said county in said state hereby certify that form

- I a in and for said county in said state hereby certify that form

- In do 10a form

- In do 1a form

- Default case with written agreement california courts form

- Attorney general dissolution ingov form

Find out other Florida Dept Of Revenue Insurance Premium Tax Incentives

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template