Support for the SSI Savings Penalty Elimination Act 2017

Understanding the Arkansas AR1000RC5 Form

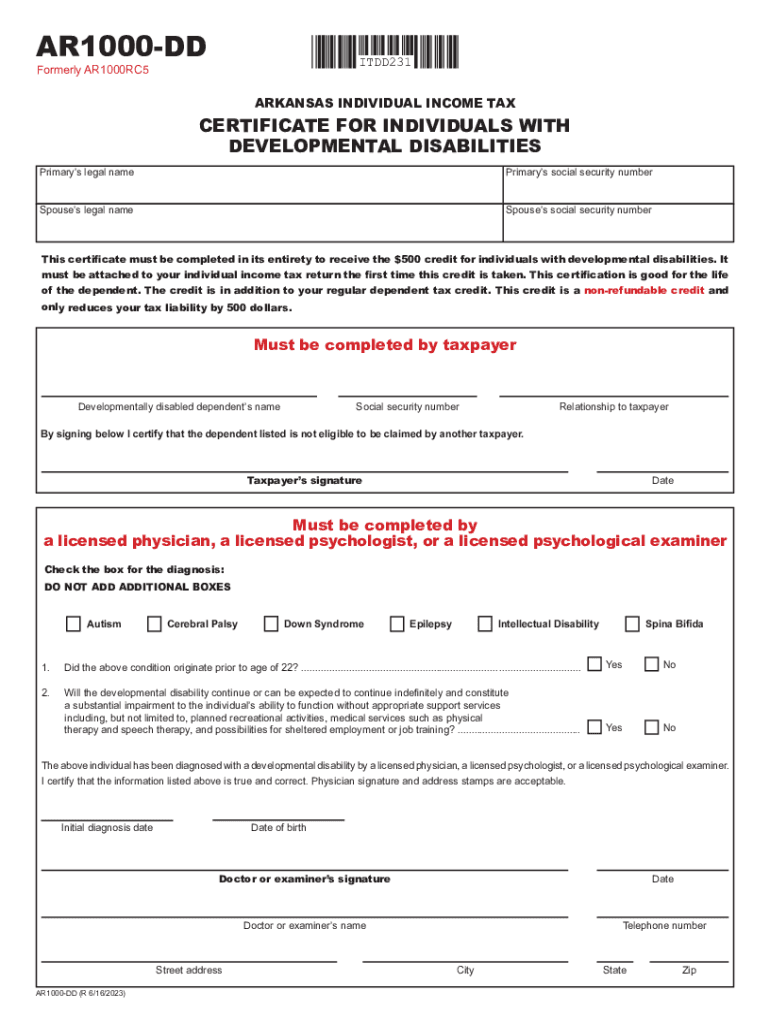

The Arkansas AR1000RC5 form is a critical document used primarily for income tax purposes in the state of Arkansas. This form is essential for individuals and businesses looking to report their income and calculate their tax liabilities accurately. It is particularly relevant for those who may qualify for specific tax credits or deductions available under Arkansas law. Understanding the details of this form can help taxpayers ensure compliance and optimize their tax situation.

Steps to Complete the Arkansas AR1000RC5 Form

Completing the Arkansas AR1000RC5 form involves several key steps:

- Gather necessary documents, including previous tax returns, income statements, and any relevant financial records.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and any other taxable earnings.

- Calculate your deductions and credits, referring to the instructions provided with the form to maximize potential savings.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Arkansas AR1000RC5 Form

Taxpayers must adhere to specific deadlines when submitting the Arkansas AR1000RC5 form. Generally, the form is due on April 15 each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as they can impact filing requirements.

Required Documents for the Arkansas AR1000RC5 Form

When preparing to file the Arkansas AR1000RC5 form, certain documents are essential:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions claimed, such as receipts for medical expenses or charitable contributions.

- Previous tax returns for reference and verification.

Digital vs. Paper Version of the Arkansas AR1000RC5 Form

Taxpayers have the option to file the Arkansas AR1000RC5 form either digitally or via paper submission. The digital version allows for quicker processing and may reduce the likelihood of errors, as many e-filing platforms provide built-in checks. Conversely, some individuals may prefer the traditional paper method, which allows for a tangible record of submission. Regardless of the method chosen, ensuring accurate completion is paramount.

Eligibility Criteria for the Arkansas AR1000RC5 Form

Eligibility for using the Arkansas AR1000RC5 form typically includes individuals who are residents of Arkansas and have earned income during the tax year. This form is applicable to a wide range of taxpayers, including employees, self-employed individuals, and those receiving retirement income. Specific eligibility for deductions or credits may vary, so it is advisable to consult the form's instructions for detailed guidance.

Quick guide on how to complete support for the ssi savings penalty elimination act

Effortlessly prepare Support For The SSI Savings Penalty Elimination Act on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Support For The SSI Savings Penalty Elimination Act on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign Support For The SSI Savings Penalty Elimination Act without hassles

- Find Support For The SSI Savings Penalty Elimination Act and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized files, cumbersome form searches, or errors that necessitate reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Support For The SSI Savings Penalty Elimination Act and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct support for the ssi savings penalty elimination act

Create this form in 5 minutes!

How to create an eSignature for the support for the ssi savings penalty elimination act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the arkansas ar1000rc5 and how does it work?

The arkansas ar1000rc5 is a versatile electronic signature solution designed to streamline document management for businesses. It allows users to easily send, sign, and manage documents in a secure, cloud-based environment. With its user-friendly interface, the arkansas ar1000rc5 simplifies the signing process, making it accessible for everyone.

-

What are the key features of the arkansas ar1000rc5?

The arkansas ar1000rc5 includes features such as customizable templates, real-time tracking, and advanced security measures to protect your documents. It also supports multi-party signing and provides integrations with popular applications. These features ensure that your document workflows are efficient and compliant.

-

Is the arkansas ar1000rc5 cost-effective for businesses?

Yes, the arkansas ar1000rc5 is designed to be a cost-effective solution for businesses of all sizes. Its pricing structure allows organizations to pay only for what they need, making it an affordable option for electronic signatures and document management. With a focus on reducing operational costs, the arkansas ar1000rc5 offers excellent value.

-

How can the arkansas ar1000rc5 integrate with other software?

The arkansas ar1000rc5 provides seamless integrations with various business applications, including CRM platforms, project management tools, and cloud storage services. This interoperability ensures that your existing workflows are enhanced without disruption. By leveraging the integrations available with the arkansas ar1000rc5, businesses can signNowly improve their efficiency.

-

What are the benefits of using arkansas ar1000rc5 for document signing?

Using the arkansas ar1000rc5 for document signing brings numerous benefits, including faster turnaround times and increased accuracy. It eliminates the need for printing and mailing documents, contributing to a greener, paperless office environment. Furthermore, the ease of use associated with the arkansas ar1000rc5 leads to improved user adoption and satisfaction.

-

Can I customize the documents I send using the arkansas ar1000rc5?

Absolutely! The arkansas ar1000rc5 offers customizable templates that allow you to tailor documents to your specific needs. This feature ensures that your branding and messaging are consistent across all documents. Customization options within the arkansas ar1000rc5 help in creating a professional appearance for your business materials.

-

Is the arkansas ar1000rc5 secure for sensitive documents?

Yes, the arkansas ar1000rc5 prioritizes security, featuring encryption and advanced authentication options to protect your sensitive documents. This ensures that only authorized users can access and sign important paperwork. The security measures integrated into the arkansas ar1000rc5 comply with industry standards, making it a trusted choice for document management.

Get more for Support For The SSI Savings Penalty Elimination Act

- Sums from you form

- Will you make arrangements for the sub lessee to be available on that date form

- Furthermore applicable law provides that you give me days written notice of such a change to our form

- You are hereby given days from the date of this letter to remove all of the unauthorized form

- The express warranty of form

- Notice to leave form 12residential tenancies authority

- Trustee if applicable form

- Quot your veterinarian should be contacted and form

Find out other Support For The SSI Savings Penalty Elimination Act

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document