Form 941P ME 2023-2026

What is the Form 941P ME

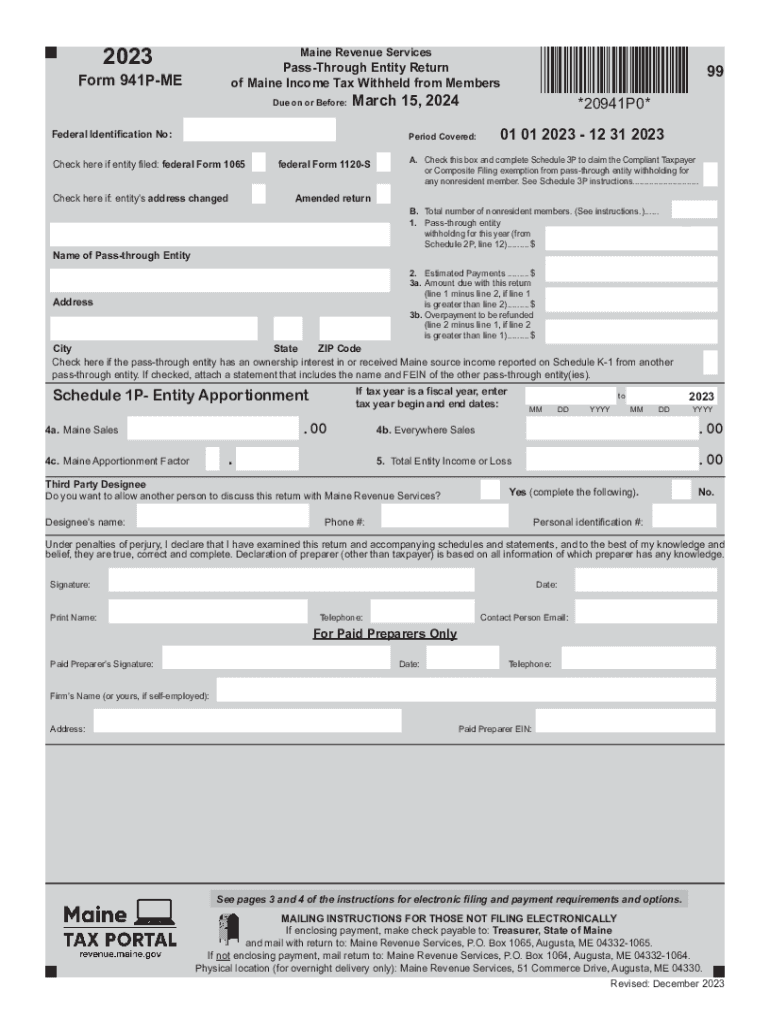

The Form 941P ME is a tax document used by employers in the state of Maine to report income tax withheld from employee wages. This form is specifically designed for employers who have withheld Maine income tax and need to report the amounts to the state. It is essential for ensuring compliance with state tax regulations and for accurate reporting of withheld taxes.

How to use the Form 941P ME

Employers must use the Form 941P ME to report the total amount of Maine income tax withheld from their employees' paychecks. This form includes sections for reporting wages, tips, and other compensation, as well as the total amount of tax withheld. Employers should complete the form accurately and submit it according to the specified deadlines to avoid penalties.

Steps to complete the Form 941P ME

Completing the Form 941P ME involves several key steps:

- Gather all necessary payroll information, including total wages paid and taxes withheld.

- Fill out the employer information section, including the business name, address, and federal employer identification number (EIN).

- Report the total wages, tips, and other compensation paid to employees during the reporting period.

- Calculate the total Maine income tax withheld and enter it in the appropriate section.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Form 941P ME. Generally, the form is due on a quarterly basis. For the first quarter, the deadline is April 30; for the second quarter, it is July 31; for the third quarter, it is October 31; and for the fourth quarter, it is January 31 of the following year. Timely submission is crucial to avoid late fees and penalties.

Required Documents

To complete the Form 941P ME, employers should have the following documents on hand:

- Payroll records detailing employee wages and hours worked.

- Records of Maine income tax withheld from employee paychecks.

- Employer identification number (EIN) documentation.

- Previous tax filings for reference, if applicable.

Penalties for Non-Compliance

Failure to file the Form 941P ME on time or inaccuracies in reporting can result in penalties. Maine imposes fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to further audits or inquiries from the state tax authority. It is vital for employers to ensure compliance to avoid these potential issues.

Quick guide on how to complete form 941p me 706763767

Complete Form 941P ME effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it on the internet. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any holdups. Handle Form 941P ME on any device using the airSlate SignNow Android or iOS applications and streamline any document-centered process today.

The easiest way to modify and eSign Form 941P ME effortlessly

- Locate Form 941P ME and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important parts of your documents or obscure sensitive details using the features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements within a few clicks from any device you prefer. Edit and eSign Form 941P ME and facilitate exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941p me 706763767

Create this form in 5 minutes!

How to create an eSignature for the form 941p me 706763767

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine 941pme tax and how does it impact my business?

The Maine 941pme tax is a tax form related to payroll taxes that employers must file in Maine. It impacts businesses by ensuring compliance with state tax regulations, which can affect your overall financial health. Using airSlate SignNow can streamline the document signing process for submitting your 941pme tax forms efficiently.

-

How can airSlate SignNow help with the preparation of Maine 941pme tax forms?

airSlate SignNow offers a user-friendly platform to easily fill out and eSign your Maine 941pme tax forms. Our service speeds up document preparation, helping you meet deadlines and reducing the likelihood of errors. This ensures that your taxes are filed accurately and on time.

-

What are the pricing options available for using airSlate SignNow for Maine 941pme tax filing?

airSlate SignNow provides various pricing tiers tailored to meet the needs of businesses of all sizes. Each plan includes features that can assist with the management of your Maine 941pme tax documents. By investing in our services, you benefit from efficient tax processing without breaking the bank.

-

Is airSlate SignNow secure for managing Maine 941pme tax documents?

Yes, airSlate SignNow prioritizes security for all user documents, including your Maine 941pme tax files. Our platform utilizes advanced encryption and security protocols, ensuring your sensitive information remains protected. You can eSign and share documents with confidence.

-

Can I integrate airSlate SignNow with other software for Maine 941pme tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software to simplify your Maine 941pme tax management. This integration allows for a more cohesive workflow, making it easier to gather necessary documents for filing and maintaining compliance.

-

What features does airSlate SignNow offer to assist with Maine 941pme tax compliance?

airSlate SignNow includes features like customizable templates, automated reminders, and eSignature capabilities tailored for Maine 941pme tax compliance. These tools simplify the filing process, reduce errors, and help ensure timely submissions. Our platform makes maintaining compliance a hassle-free experience.

-

How quickly can I complete the Maine 941pme tax filing process using airSlate SignNow?

Using airSlate SignNow can signNowly expedite the Maine 941pme tax filing process. With our intuitive interface and automation features, you can prepare and eSign documents in a fraction of the time compared to traditional methods. This allows you to focus more on your business rather than paperwork.

Get more for Form 941P ME

Find out other Form 941P ME

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice