Military Tax Issues Department of Revenue Kentucky Gov 2022

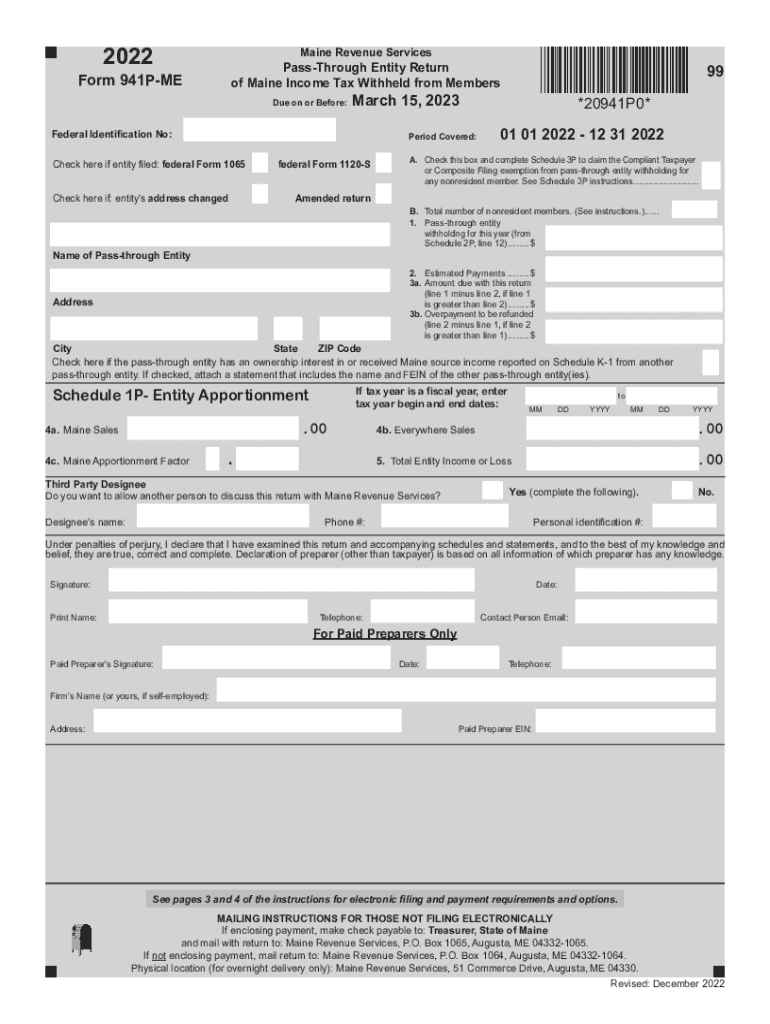

Understanding the Maine Form 941P ME

The Maine Form 941P ME is a crucial document for employers in the state, specifically designed for reporting income tax withheld from employees. This form is essential for compliance with state tax regulations and ensures that employers meet their withholding obligations. The form is typically used by businesses to report quarterly withholding amounts, making it a vital part of payroll processing.

Steps to Complete the Maine Form 941P ME

Filling out the Maine Form 941P ME involves several key steps:

- Gather Necessary Information: Collect all relevant payroll data, including total wages paid and the amount of state income tax withheld.

- Fill Out the Form: Enter the required information in the designated fields of the form. Ensure accuracy to avoid penalties.

- Review Your Entries: Double-check all figures and information for correctness before submission.

- Submit the Form: Choose your preferred method of submission, either electronically or via mail, ensuring it is sent by the deadline.

Filing Deadlines for the Maine Form 941P ME

It is essential to be aware of the filing deadlines for the Maine Form 941P ME to avoid penalties. Generally, the form must be filed quarterly, with specific due dates for each quarter:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Required Documents for Filing

When preparing to file the Maine Form 941P ME, ensure you have the following documents ready:

- Payroll records detailing employee wages and withholdings

- Previous quarter's Form 941P ME for reference

- Any relevant tax identification numbers

Digital vs. Paper Version of the Maine Form 941P ME

Employers have the option to file the Maine Form 941P ME either digitally or on paper. Filing electronically is often more efficient, allowing for quicker processing and confirmation of submission. However, some may prefer the traditional paper method for record-keeping. Regardless of the method chosen, ensure compliance with state regulations.

Penalties for Non-Compliance with the Maine Form 941P ME

Failure to file the Maine Form 941P ME on time or inaccuracies in the form can lead to penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits or further scrutiny from the state tax authorities

Quick guide on how to complete military tax issues department of revenue kentuckygov

Complete Military Tax Issues Department Of Revenue Kentucky gov effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly without delays. Handle Military Tax Issues Department Of Revenue Kentucky gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign Military Tax Issues Department Of Revenue Kentucky gov with ease

- Find Military Tax Issues Department Of Revenue Kentucky gov and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all data and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, via email, SMS, or a link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Military Tax Issues Department Of Revenue Kentucky gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct military tax issues department of revenue kentuckygov

Create this form in 5 minutes!

How to create an eSignature for the military tax issues department of revenue kentuckygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Form 941P ME Instructions 2022?

The Maine Form 941P ME Instructions 2022 provide essential guidelines for employers on how to accurately complete and submit their Payroll Tax Return. This form is critical for reporting employee wages and withholding taxes. Familiarizing yourself with the Maine Form 941P ME Instructions 2022 can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with completing the Maine Form 941P ME Instructions 2022?

airSlate SignNow streamlines the process of completing legal documents, including the Maine Form 941P ME Instructions 2022. Our platform allows you to fill out, sign, and send documents electronically, making the entire process more efficient. With user-friendly templates, you can quickly complete your forms without hassle.

-

Is there a cost associated with using airSlate SignNow for the Maine Form 941P ME Instructions 2022?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for small businesses and larger enterprises. The cost-effective solutions provided ensure that you can manage your document signing and form submissions, like the Maine Form 941P ME Instructions 2022, without breaking the bank. Visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for managing the Maine Form 941P ME Instructions 2022?

airSlate SignNow offers numerous features that make managing the Maine Form 941P ME Instructions 2022 easier, including customizable templates, cloud storage, and automated reminders. You can also integrate signature requests directly into your workflow, ensuring that all documents are processed in a timely manner. Our platform enhances your overall document management experience.

-

Can I integrate airSlate SignNow with other software to manage Maine Form 941P ME Instructions 2022?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Maine Form 941P ME Instructions 2022 along with other critical business functions. Whether you're using popular accounting software or a CRM system, our integrations simplify document workflow and boost productivity.

-

What are the benefits of using airSlate SignNow for the Maine Form 941P ME Instructions 2022?

Using airSlate SignNow for the Maine Form 941P ME Instructions 2022 offers enhanced efficiency, security, and accessibility. You can quickly sign and send documents from anywhere without dealing with paper forms. Plus, our platform ensures that your documents are securely stored and easily retrievable, giving you peace of mind.

-

How does airSlate SignNow ensure compliance with the Maine Form 941P ME Instructions 2022?

airSlate SignNow is designed to help users stay compliant with all necessary regulations, including those related to the Maine Form 941P ME Instructions 2022. Our platform provides clear templates and validation checks, reducing the risk of errors and helping you meet submission deadlines accurately. Compliance is made easier with our automated reminders and document tracking features.

Get more for Military Tax Issues Department Of Revenue Kentucky gov

- Tenant rules and regulations sample 100257060 form

- Form 18b notice of intent to defend

- How to get a replacement cdib card choctaw form

- Pltw digital electronics final exam form

- Multiple counter offer arizona form

- Opg120 form

- Texas form 651

- Disabled toll permit replacement permit request form dot state fl

Find out other Military Tax Issues Department Of Revenue Kentucky gov

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document