Maine State Tax Information Support 2023

Key elements of the Maine State Tax Information Support

The Maine State Tax Information Support provides essential resources for taxpayers to understand their responsibilities and rights under state tax laws. Key elements include:

- Contact Information: Taxpayers can reach out to the Maine Revenue Services for assistance via phone or email.

- Online Resources: A comprehensive website offers downloadable forms, FAQs, and instructional guides.

- Workshops and Seminars: Regularly scheduled educational events help taxpayers stay informed about changes in tax laws and filing requirements.

- Personalized Assistance: Taxpayers may schedule one-on-one consultations for specific inquiries.

Steps to complete the Maine State Tax Information Support

Completing the Maine State Tax Information Support involves several straightforward steps:

- Gather Necessary Information: Collect all relevant financial documents, including income statements and previous tax returns.

- Access Online Resources: Visit the Maine Revenue Services website to find the specific information or forms needed.

- Complete Required Forms: Fill out the necessary forms accurately, ensuring all information is current and correct.

- Submit Your Forms: Choose your preferred submission method, whether online, by mail, or in person.

- Follow Up: Keep track of your submission and reach out to the tax office if you have not received confirmation of your filing.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance with Maine state tax laws. Key dates include:

- April 15: Standard deadline for individual income tax returns.

- October 15: Extended deadline for those who filed for an extension.

- Quarterly Estimated Tax Payments: Due on April 15, June 15, September 15, and January 15 of the following year.

Required Documents

To successfully complete the Maine State Tax Information Support, taxpayers need to prepare the following documents:

- W-2 Forms: For reporting wages and tax withheld.

- 1099 Forms: For reporting other income such as freelance work or interest earned.

- Previous Year’s Tax Return: For reference and to ensure consistency.

- Proof of Deductions: Receipts and documents supporting any deductions claimed.

Penalties for Non-Compliance

Failure to comply with Maine tax laws can result in various penalties, including:

- Late Filing Penalties: A percentage of the unpaid tax for each month the return is late.

- Interest Charges: Accrued on any unpaid taxes from the due date until paid in full.

- Potential Legal Action: In severe cases, the state may pursue legal remedies to collect owed taxes.

IRS Guidelines

Taxpayers in Maine should also be aware of IRS guidelines that may affect their state tax filings. Key points include:

- Federal Tax Compliance: Ensure that federal tax returns are filed accurately as they impact state tax calculations.

- Tax Credits and Deductions: Familiarize yourself with federal credits that may also apply to state taxes.

- Reporting Requirements: Understand the reporting requirements for various types of income and deductions at both federal and state levels.

Quick guide on how to complete maine state tax information support

Prepare Maine State Tax Information Support effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Maine State Tax Information Support on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related operation today.

How to alter and eSign Maine State Tax Information Support effortlessly

- Locate Maine State Tax Information Support and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or censor sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to submit your form, either via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, exhausting form searches, or errors that require new document printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Maine State Tax Information Support to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine state tax information support

Create this form in 5 minutes!

How to create an eSignature for the maine state tax information support

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

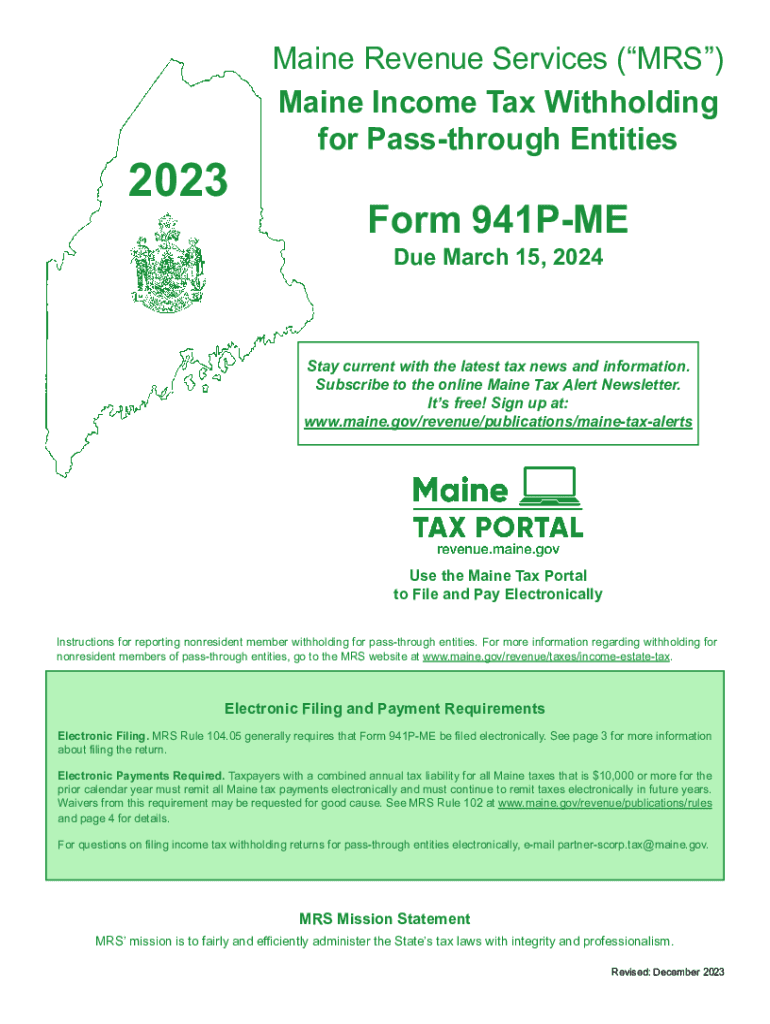

What is the form 941p me instructions 2024, and why is it important?

The form 941p me instructions 2024 provide essential guidelines for employers to report payroll taxes. Understanding these instructions is crucial to ensure compliance with federal regulations and avoid penalties. By following the form 941p me instructions 2024, businesses can accurately complete their tax filing obligations.

-

How can airSlate SignNow help with the form 941p me instructions 2024?

airSlate SignNow offers a user-friendly platform that simplifies the document signing process, including tax forms like the form 941p me instructions 2024. Our solution allows businesses to complete, sign, and store these documents securely and efficiently. By integrating SignNow into your workflow, you can streamline your tax document management.

-

What features does airSlate SignNow offer for managing the form 941p me instructions 2024?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSignature capabilities, all of which can aid in managing the form 941p me instructions 2024. You can easily create and customize your forms, ensuring all necessary information is included. This enhances efficiency and accuracy in the tax filing process.

-

Is there a cost associated with using airSlate SignNow for the form 941p me instructions 2024?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. Our plans include features that assist with the form 941p me instructions 2024 and more, making it a cost-effective choice for handling essential documentation. You can choose a plan that fits your budget while ensuring comprehensive support for your tax needs.

-

How does airSlate SignNow integrate with other software for the form 941p me instructions 2024?

airSlate SignNow integrates seamlessly with various applications, such as accounting and payroll software, to facilitate the handling of the form 941p me instructions 2024. This integration allows for easy transfer of data, reducing the chances of errors and improving overall efficiency in your tax processes. Having connected tools means you can manage your tax documentation in one centralized location.

-

Can I track the status of my submissions related to the form 941p me instructions 2024 with SignNow?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your submissions concerning the form 941p me instructions 2024. You’ll receive notifications on document status, ensuring you stay informed throughout the process. This level of visibility helps prevent any misunderstandings or delays in your tax filings.

-

What are the advantages of using airSlate SignNow over traditional methods for the form 941p me instructions 2024?

Using airSlate SignNow to manage the form 941p me instructions 2024 signNowly reduces administrative burdens associated with paper-based methods. Our digital solution enhances speed, accuracy, and accessibility for tax documentation. Additionally, the eSignature feature allows for quick approvals, eliminating delays often experienced with traditional methods.

Get more for Maine State Tax Information Support

- Pmdc registration renewal form 2021

- Health promotion officer past question papers form

- Form pd1

- Pnb life certificate form

- Query nts org pk form

- Domicile certificate pdf 2020 form

- Pld pi 002 cross complaint personal injury property damage wrongful death form

- Rein property analyzer real estate investment network form

Find out other Maine State Tax Information Support

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer