Nonresident Members of Pass through Entities, Go to the MRS Website at Www 2020

IRS Guidelines

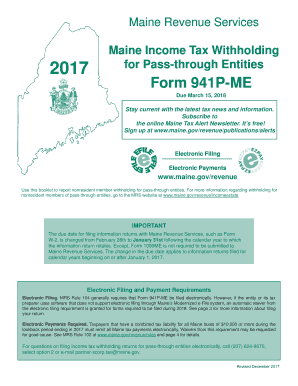

The IRS provides specific guidelines for completing the 941P ME instructions for 2021. This form is crucial for employers in Maine to report income taxes withheld and to calculate their payroll tax liabilities. It is essential to ensure that all information is accurate and complete to avoid penalties. Employers should refer to the IRS website for the most current regulations and updates regarding tax obligations and reporting requirements. Familiarizing oneself with these guidelines can help streamline the filing process and ensure compliance.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 941P ME instructions 2021 is vital for compliance. Employers must submit this form quarterly, with specific due dates for each quarter. Typically, the deadlines are as follows:

- First quarter: April 30, 2021

- Second quarter: July 31, 2021

- Third quarter: October 31, 2021

- Fourth quarter: January 31, 2022

Late submissions can result in penalties, so it is important to mark these dates on your calendar and prepare the necessary documentation in advance.

Required Documents

To complete the 941P ME instructions 2021 accurately, employers need to gather several essential documents. These may include:

- Payroll records showing employee wages and tax withholdings

- Previous quarter's 941 forms for reference

- Records of any adjustments made to payroll taxes

- Employer identification number (EIN)

Having these documents readily available will facilitate a smoother completion of the form and help ensure that all required information is included.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the 941P ME instructions 2021. These include:

- Online: Using the IRS e-file system, which is the fastest and most efficient method.

- Mail: Sending a paper form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-Person: Delivering the form to a local IRS office, if preferred.

Choosing the right submission method can impact processing times and should align with the employer's capabilities and preferences.

Penalties for Non-Compliance

Failure to comply with the 941P ME instructions 2021 can result in significant penalties. Employers may face fines for late submissions, inaccurate information, or failure to file altogether. The penalties can accumulate quickly, making it essential to adhere to the filing requirements. It is advisable to review the IRS guidelines thoroughly to understand the potential consequences and to ensure timely and accurate submissions.

Digital vs. Paper Version

Employers can choose between submitting the 941P ME instructions 2021 digitally or via paper. The digital version offers several advantages, including:

- Faster processing times

- Reduced risk of errors

- Immediate confirmation of receipt

On the other hand, some employers may prefer the traditional paper method for record-keeping purposes. It is essential to weigh the benefits of each option and select the method that best suits your business needs.

Quick guide on how to complete nonresident members of pass through entities go to the mrs website at www

Complete Nonresident Members Of Pass through Entities, Go To The MRS Website At Www effortlessly on any device

Online document management has gained signNow traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Nonresident Members Of Pass through Entities, Go To The MRS Website At Www on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and electronically sign Nonresident Members Of Pass through Entities, Go To The MRS Website At Www with ease

- Obtain Nonresident Members Of Pass through Entities, Go To The MRS Website At Www and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Nonresident Members Of Pass through Entities, Go To The MRS Website At Www to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nonresident members of pass through entities go to the mrs website at www

Create this form in 5 minutes!

How to create an eSignature for the nonresident members of pass through entities go to the mrs website at www

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What are the 941p me instructions 2021?

The 941p me instructions 2021 refer to the guidelines provided for completing the IRS Form 941, which is essential for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Following these instructions correctly ensures compliance and accurate filings, contributing to smooth business operations.

-

How can airSlate SignNow assist with the 941p me instructions 2021?

airSlate SignNow offers an intuitive platform that simplifies the process of filling and submitting forms related to the 941p me instructions 2021. With digital signatures and document management capabilities, you can efficiently prepare and send your tax forms securely, ensuring compliance and minimizing administrative hassle.

-

Are there any costs associated with using airSlate SignNow for 941p me instructions 2021?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. While there may be a cost, the investment in an efficient eSigning and document management solution typically saves time and resources in the long run, especially when dealing with critical forms like the 941p me instructions 2021.

-

What features does airSlate SignNow offer for handling 941p me instructions 2021?

airSlate SignNow provides features such as eSignatures, secure cloud storage, and document templates tailored for IRS forms, including the 941p me instructions 2021. These features streamline the document signing process, enhance security, and improve compliance, making it easier to manage essential tax paperwork.

-

Can I integrate airSlate SignNow with other tools for the 941p me instructions 2021?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, such as CRMs, accounting software, and workflow tools. This capability allows you to efficiently handle the 941p me instructions 2021 while maintaining consistency across all your business processes.

-

What are the benefits of using airSlate SignNow for the 941p me instructions 2021?

Using airSlate SignNow for the 941p me instructions 2021 offers numerous benefits, including time savings, enhanced accuracy, and reduced paper consumption. The platform's user-friendly design enables businesses to quickly navigate tax filing processes, ensuring deadlines are met without unnecessary stress.

-

Is airSlate SignNow secure for submitting 941p me instructions 2021?

Yes, airSlate SignNow prioritizes security and compliance, providing encryption and secure data storage to protect sensitive information. When submitting your 941p me instructions 2021 through airSlate SignNow, you can trust that your data is safe and handled with the utmost care.

Get more for Nonresident Members Of Pass through Entities, Go To The MRS Website At Www

Find out other Nonresident Members Of Pass through Entities, Go To The MRS Website At Www

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe