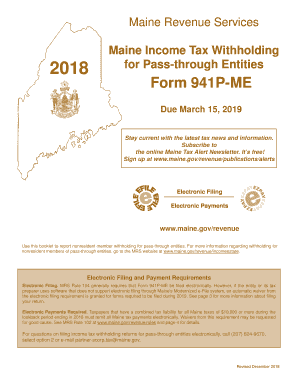

Form 941p 2018

What is the Form 941p

The Form 941p is a tax form used in the state of Maine for reporting payroll taxes. It is specifically designed for employers to report income taxes, Social Security, and Medicare taxes withheld from employee wages. This form is crucial for maintaining compliance with federal and state tax regulations. Understanding the purpose of the Form 941p helps employers fulfill their tax obligations accurately and timely.

Steps to complete the Form 941p

Completing the Form 941p involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your Employer Identification Number (EIN), the total number of employees, and the total wages paid during the reporting period. Follow these steps:

- Fill in your business information at the top of the form.

- Report the total wages, tips, and other compensation paid to employees.

- Calculate the federal income tax withheld from employee wages.

- Include the total Social Security and Medicare taxes owed.

- Sign and date the form to certify its accuracy.

Double-check all entries for accuracy before submission to avoid penalties.

Legal use of the Form 941p

The Form 941p must be used in accordance with federal and state tax laws. It serves as a legal document that verifies the employer's payroll tax obligations. To ensure legal compliance, employers should adhere to the following:

- File the form on time to avoid late fees.

- Maintain accurate records of all payroll transactions.

- Ensure that all calculations are correct to prevent discrepancies.

Failure to comply with these legal requirements can result in penalties and interest charges.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941p to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. Important dates include:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Employers should mark these dates on their calendars to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 941p can be submitted using various methods, providing flexibility for employers. Options include:

- Online submission through the IRS e-file system.

- Mailing a paper copy to the designated IRS address.

- In-person submission at local IRS offices, if needed.

Choosing the right submission method can help streamline the filing process and ensure timely delivery.

Key elements of the Form 941p

The Form 941p contains several key elements that employers must complete accurately. These include:

- Employer identification information, including the EIN.

- Details of total wages paid and taxes withheld.

- Signature of the employer or authorized representative.

Each element is vital for the form's validity and for ensuring compliance with tax regulations.

Quick guide on how to complete 99 quarter 1706200 form 941me 2018 2018 mainegov

Easily prepare Form 941p on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 941p on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The simplest way to modify and electronically sign Form 941p effortlessly

- Find Form 941p and click Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Finish button to save your adjustments.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 941p to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 99 quarter 1706200 form 941me 2018 2018 mainegov

Create this form in 5 minutes!

How to create an eSignature for the 99 quarter 1706200 form 941me 2018 2018 mainegov

How to generate an electronic signature for your 99 Quarter 1706200 Form 941me 2018 2018 Mainegov in the online mode

How to make an eSignature for your 99 Quarter 1706200 Form 941me 2018 2018 Mainegov in Chrome

How to generate an electronic signature for signing the 99 Quarter 1706200 Form 941me 2018 2018 Mainegov in Gmail

How to create an electronic signature for the 99 Quarter 1706200 Form 941me 2018 2018 Mainegov right from your smart phone

How to generate an eSignature for the 99 Quarter 1706200 Form 941me 2018 2018 Mainegov on iOS devices

How to generate an electronic signature for the 99 Quarter 1706200 Form 941me 2018 2018 Mainegov on Android OS

People also ask

-

What is the Maine Form 941P and why do I need it?

The Maine Form 941P is an essential document for employers to report income tax withheld from employees in Maine. Understanding how to prepare Maine Form 941P ME ensures compliance with state regulations and avoids potential penalties. This form helps you maintain accurate records for both your business and your employees.

-

How can airSlate SignNow assist me in preparing Maine Form 941P?

airSlate SignNow simplifies the process of preparing Maine Form 941P ME by providing easy-to-use templates and eSigning capabilities. With its intuitive interface, you can fill out the form quickly and securely send it for signatures. This saves you time and ensures that your documents are always compliant with state requirements.

-

Are there any costs associated with using airSlate SignNow for Maine Form 941P?

airSlate SignNow offers a range of pricing plans to fit various business needs, including affordable options for small businesses. Utilizing our platform to prepare Maine Form 941P ME often proves to be cost-effective by streamlining your workflow and reducing paperwork. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with my existing software?

Yes, airSlate SignNow offers seamless integrations with popular accounting and HR software, making it easy to manage documents related to Maine Form 941P ME. Whether you use QuickBooks, Salesforce, or other platforms, our integrations enhance productivity and simplify your document preparation. This flexibility allows you to work within your preferred systems.

-

What are the main features of airSlate SignNow that aid in preparing forms like Maine Form 941P?

Key features of airSlate SignNow include customizable templates, eSigning, document tracking, and security measures to ensure the integrity of your data. These tools streamline the process of preparing Maine Form 941P ME, allowing for quicker submissions and improved document management. Additionally, our platform is designed to be user-friendly, catering to all levels of technical expertise.

-

Is airSlate SignNow mobile-friendly for preparing Maine Form 941P?

Absolutely! airSlate SignNow is fully mobile-responsive, enabling you to prepare Maine Form 941P ME on-the-go. Whether on your smartphone or tablet, you can easily access your documents, make necessary edits, and obtain signatures anytime, anywhere. This flexibility ensures that you can manage your tasks efficiently, even while traveling.

-

What happens if I make a mistake on my Maine Form 941P?

If you make a mistake on your Maine Form 941P ME, airSlate SignNow allows for easy edits and corrections before submission. Our platform also keeps a history of changes, so you can revert if necessary. Should any issues arise post-submission, our support team is here to guide you through the correction process to ensure compliance.

Get more for Form 941p

- 407 state of north dakota nd form

- Local civil and criminal rules district of new jersey njd uscourts form

- Content form 71810619

- Lic 610d form

- Request for copy of aidedaccident record pdf form

- Mab 4 form

- Dws esd 61app utah department of workforce services utahgov jobs utah form

- Ifsp meeting request confirmation form date regional office nyc

Find out other Form 941p

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors