IA 1065 Partnership Return of Income, 41 016 2023-2026

What is the IA 1065 Partnership Return Of Income, 41 016

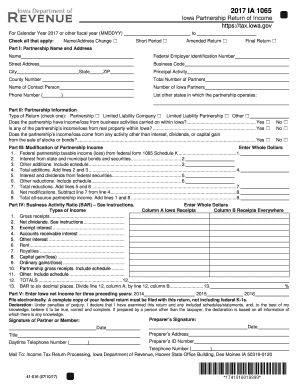

The IA 1065 Partnership Return Of Income, 41 016 is a tax form used by partnerships operating in Iowa to report income, deductions, and other relevant financial information to the state. This form is essential for partnerships to comply with Iowa tax laws and ensure accurate reporting of their financial activities. It serves as a means for the state to assess the tax obligations of partnerships, which can include various types of entities such as limited liability companies (LLCs) and general partnerships.

How to obtain the IA 1065 Partnership Return Of Income, 41 016

To obtain the IA 1065 Partnership Return Of Income, 41 016, businesses can visit the Iowa Department of Revenue's official website, where the form is available for download. Additionally, partnerships may request a physical copy by contacting the department directly. It is important to ensure that the most current version of the form is used, as tax regulations can change.

Steps to complete the IA 1065 Partnership Return Of Income, 41 016

Completing the IA 1065 Partnership Return Of Income involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions.

- Fill out the form accurately, ensuring that all income and expenses are reported correctly.

- Review the completed form for accuracy, checking for any errors or omissions.

- Sign and date the form, ensuring that all partners are in agreement with the reported information.

- Submit the form to the Iowa Department of Revenue by the designated filing deadline.

Key elements of the IA 1065 Partnership Return Of Income, 41 016

Key elements of the IA 1065 Partnership Return Of Income include sections for reporting total income, allowable deductions, and the distribution of income among partners. The form also requires information about the partnership's structure, including the names and addresses of all partners, as well as their respective shares of profit and loss. Accurate reporting of these elements is crucial for compliance with state tax laws.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the IA 1065 Partnership Return Of Income. Typically, the return is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is generally due by April 15. It is essential to file on time to avoid penalties and interest on any taxes owed.

Penalties for Non-Compliance

Failure to file the IA 1065 Partnership Return Of Income by the deadline can result in significant penalties. The Iowa Department of Revenue may impose late filing fees and interest on any unpaid taxes. Additionally, partnerships may face scrutiny during audits if they consistently fail to comply with filing requirements. It is advisable for partnerships to maintain accurate records and adhere to all filing deadlines to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct ia 1065 partnership return of income 41 016 430108159

Create this form in 5 minutes!

How to create an eSignature for the ia 1065 partnership return of income 41 016 430108159

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IA 1065 Partnership Return Of Income, 41 016?

The IA 1065 Partnership Return Of Income, 41 016 is a tax form used by partnerships in Iowa to report income, deductions, and credits. This form is essential for ensuring compliance with state tax regulations. By accurately completing the IA 1065, partnerships can avoid penalties and ensure proper tax reporting.

-

How can airSlate SignNow help with the IA 1065 Partnership Return Of Income, 41 016?

airSlate SignNow streamlines the process of preparing and submitting the IA 1065 Partnership Return Of Income, 41 016 by allowing users to eSign and send documents securely. Our platform simplifies document management, making it easier for partnerships to collaborate and ensure timely submissions. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow for the IA 1065 Partnership Return Of Income, 41 016?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the completion and eSigning of the IA 1065 Partnership Return Of Income, 41 016, ensuring you get the best value for your investment. Visit our pricing page to find the plan that suits your requirements.

-

What features does airSlate SignNow provide for managing the IA 1065 Partnership Return Of Income, 41 016?

airSlate SignNow provides a range of features designed to facilitate the management of the IA 1065 Partnership Return Of Income, 41 016. These include customizable templates, secure eSigning, and document tracking. Our user-friendly interface ensures that you can easily navigate the process and keep your documents organized.

-

Are there any benefits to using airSlate SignNow for the IA 1065 Partnership Return Of Income, 41 016?

Using airSlate SignNow for the IA 1065 Partnership Return Of Income, 41 016 offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform enhances collaboration among team members, ensuring that everyone is on the same page. Additionally, the secure eSigning feature helps protect sensitive information.

-

Can airSlate SignNow integrate with other software for the IA 1065 Partnership Return Of Income, 41 016?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the IA 1065 Partnership Return Of Income, 41 016. These integrations help streamline workflows and reduce the risk of errors during data entry. Check our integrations page for a list of compatible software.

-

Is airSlate SignNow user-friendly for completing the IA 1065 Partnership Return Of Income, 41 016?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the IA 1065 Partnership Return Of Income, 41 016. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively.

Get more for IA 1065 Partnership Return Of Income, 41 016

Find out other IA 1065 Partnership Return Of Income, 41 016

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online